FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:on

ance

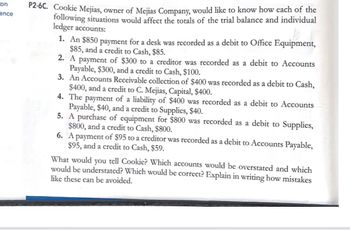

P2-6C. Cookie Mejias, owner of Mejias Company, would like to know how each of the

following situations would affect the totals of the trial balance and individual

ledger accounts:

1. An $850 payment for a desk was recorded as a debit to Office Equipment,

$85, and a credit to Cash, $85.

2. A payment of $300 to a creditor was recorded as a debit to Accounts

Payable, $300, and a credit to Cash, $100.

3.

An Accounts Receivable collection of $400 was recorded as a debit to Cash,

$400, and a credit to C. Mejias, Capital, $400.

4. The payment of a liability of $400 was recorded as a debit to Accounts

Payable, $40, and a credit to Supplies, $40.

5.

A purchase of equipment for $800 was recorded as a debit to Supplies,

$800, and a credit to Cash, $800.

6.

A payment of $95 to a creditor was recorded as a debit to Accounts Payable,

$95, and a credit to Cash, $59.

What would you tell Cookie? Which accounts would be overstated and which

would be understated? Which would be correct? Explain in writing how mistakes

like these can be avoided.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For each of the transactions, state which special journal (sales journal, cash receipts journal, cash disbursements journal, purchases journal, or general journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, or neither) would be used in recording the transaction. A. Paid utility bill B. Sold inventory on account C. Received but did not pay phone bill D. Bought inventory on account E. Borrowed money from a bank F. Sold old office furniture for cash G. Recorded depreciation H. Accrued payroll at the end of the accounting period I. Sold inventory for cash J. Paid interest on bank loanarrow_forward5. Jack's lawn care used the direct write-off method for accounting for uncollectible accounts. The company writes off $500 on Jane Doe's account. The journal entry to record this will include a debit of $500 to which account?arrow_forwardP2-6C. Cookie Mejias, owner of Mejias Company, would like to know how each of the following situations would affect the totals of the trial balance and individual ledger accounts: 1. An $850 payment for a desk was recorded as a debit to Office Equipment, $85, and a credit to Cash, $85. 2. A payment of $300 to a creditor was recorded as a debit to Accounts Payable, $300, and a credit to Cash, $100. 3. An Accounts Receivable collection of $400 was recorded as a debit to Cash, $400, and a credit to C. Mejias, Capital, $400. 4. The payment of a liability of $400 was recorded as a debit to Accounts Payable, $40, and a credit to Supplies, $40. 5. A purchase of equipment for $800 was recorded as a debit to Supplies, $800, and a credit to Cash, $800. Situation 1. 2. 3. 4. 5. 6. 6. A payment of $95 to a creditor was recorded as a debit to Accounts Payable, $95, and a credit to Cash, $59. What would you tell Cookie? Which accounts would be overstated and which would be understated? Which would…arrow_forward

- 2. Add two new expense accounts to the chart of accounts you prepared. Assign each account numbers based on where they would be placed in the chart of accounts. Miscellaneous Expense Utilities Expense Answer: Type answer here. 3. Prepare a T account for each transaction. Label the account title for each account affected. Use the chart for accounts you created in question 1. Write the debit and credit amounts for each T account to show how the accounts are affected. The first one is done. c. Received cash from owner, Roger Fisher, as an investment, $10,000.00 d. Paid cash for insurance, $ 2, 400.00 e. Bought supplies on a account to Salmon Slayers, $600.00 Paid cash for fuel, $500.00 Paid cash to owner, Roger Fisher, for personal use, $1,250.00arrow_forward19) Intercom, Inc. paid one of its creditors $678 on their balance due. The journal entry would require a: A) credit to Cash and a debit to Accounts Receivable. B) debit to Cash and a credit to Accounts Receivable. C) debit to Cash and a credit to Accounts Payable. Di debit to Accounts Payable and credit to Cash.arrow_forwardYour new company paid the invoice for their account with Alli's Broom Supply Company. What would your journal entry look like when you record this transaction? a) Debit Cash; Credit Accounts Payable b) Debit Cash; Credit Supplies Expense c) Debit Accounts Receivable; Credit Cash d) Debit Accounts Payable; Credit Casharrow_forward

- For each of the following, indicate if the statement reflects an input component, output component, or storage component of an accounting information system. 1. A credit card scanner at a grocery store is a(n) [ Select] component. 2. A report of patients who missed appointments at a doctor's office is a(n) [ Select] component. 3. Electronic files containing a list of current customers is aln) [ Select ] component. 4. A list of the day's cash and credit sales is aln) [ Select] component. 5. A purchase order for 1,000 bottles of windshield washing fluid to be used as inventory by an auto parts store is a(n) [ Select ] component.arrow_forwardRandomly listed below are the steps for preparing a trial balance: (1) Verify that the total of the Debit column equals the total of the Credit column. (2) List the accounts from the ledger and enter their debit or credit balance in the Debit or Credit column of the trial balance. (3) List the name of the company, the title of the trial balance, and the date the trial balance is prepared. (4) Total the Debit and Credit columns of the trial balance. a.(2), (3), (4), (1) b.(4), (3), (2), (1) c.(3), (2), (4), (1) d.(3), (2), (1), (4)arrow_forwardIf a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forward

- An employee working on her first trial balance discovers that the Equipment account has a credit balance of $2500 and a customer's A/R account has a credit balance of $25. Based on the knowledge you have gained in this course and how account balances are recorded and increase/decrease, has the accountant made a mistake in her records or are these situations possible?arrow_forwardSuppose a co-worker has recorded a cash disbursement twice (Supplies Expense was debited twice for $100 and Cash was credited twice for $100) and wants you to record a correcting entry that will reverse the mistake. The correcting entry will record a debit to the Cash account and a credit to the Supplies account. Would you make this correcting entry? What should you investigate before making a decision about the correcting entry? Are there any other steps you would take to address this issue?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education