FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

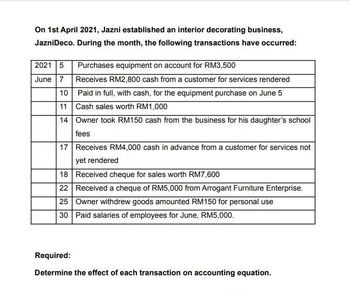

Transcribed Image Text:On 1st April 2021, Jazni established an interior decorating business,

JazniDeco. During the month, the following transactions have occurred:

2021 5

Purchases equipment on account for RM3,500

June 7 Receives RM2,800 cash from a customer for services rendered

Paid in full, with cash, for the equipment purchase on June 5

11 Cash sales worth RM1,000

10

14 Owner took RM150 cash from the business for his daughter's school

fees

17 Receives RM4,000 cash in advance from a customer for services not

yet rendered

18 Received cheque for sales worth RM7,600

22 Received a cheque of RM5,000 from Arrogant Furniture Enterprise.

25 Owner withdrew goods amounted RM150 for personal use

30 Paid salaries of employees for June, RM5,000.

Required:

Determine the effect of each transaction on accounting equation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2019: Gross receipts $ 203,000 Business mileage: 27,000 (miles incurred ratably throughout the year) 35,000 miles total during the year 2019 Van (over 6,000 lbs) placed in service 1/01/19, cost 27,000 Postage (500 ) Wages (26,000 ) Payroll taxes (1,950 ) Supplies (12,500 ) Phone (1,250 ) Internet service (600 ) Rent (2,400 ) Insurance (2,800 ) Van expenses (4,500 ) Business assets Date Purchased Cost Computer 1 5/18/19 $ 2,200 Computer 2 6/01/19 2,700 Printer 3/01/18 900 Copier 3/02/18 2,100 Furniture 3/01/18 6,000 Required: Determine Cassi’s self-employment income and QBI deduction. Prepare Schedule C and Schedule SE. § 179 expense is elected on all eligible assets (§ 179 was not taken on assets…arrow_forwardDuring the current year, Paul, the vice president of a bank, made gifts in the following amounts. To Sarah (Paul's personal assistant) at Christmas $39 To Darryl (a key client)-$3 was for gift wrapping 42 To Darryl's wife (a homemaker) on her birthday 14 To Veronica (Paul's boss) at Christmas 75 In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $50. Presuming that Paul has adequate substantiation and is not reimbursed, how much can he deduct? Do not round intermediate computations. If required, round your final answer to the nearest cent.arrow_forwardMelissa recently paid $875 for round trip airfare to San Francisco to attend a business conference for 3 days. Melissa also paid the following expenses: $280 fee to register for the conference, $435 per night for 3 night's lodging, $275 for meals in restaurants and $235 for cab fare. What amount of these costs can Melissa deduct as a business expensearrow_forward

- Taxation Naga Tiddug applied and was hired as a cashier in Bagsakan Corporation. After saving enough money, he enrolled in the University of Saint Louis as an accountancy student. For 2021, he earned and incurred the following Salaries, net of: 162,000 SSS premium contribution -3600 Philhealth premium contribution -2400 Pag-ibig premium contribution- 3k Health and hospitalization premium contribution -2k Union dues- 3k Creditable withholding taxes-6k SSS loan- 10k Productivity bonus-12k Achievement award-cash -12k 13th month pay- 16k Christmas bonus- 16k Expense incurred: Tuition fee, board and lodging and other living expenses- 40k Medical expenses 10k Required A. How much is the non-taxable income of Naga? B. How much should be Naga's deductible expenses? C. How much is the taxable income of Naga? D. How much is the tax still payable (or refundable) of Naga?arrow_forwardPlease help mearrow_forwardYolanda is a cash basis taxpayer with the following tranasctions during the year: Cash received from sales of products $70,000 Cash paid for expenses (except rent and interest) $40,000 Rent prepaid on a leased building for 18 monts beginning December 1 $48,600 Prepaid interest on a bank loan, paid on December 31 for the next 3 months 5,000 Calculate Yolanda's income from her business for this calendar year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education