Concept explainers

Please solve this question Week 3

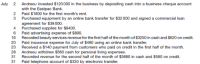

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST).

Use the following account titles and numbers: Cash at Bank, 100;

a) Prepare the general

b)

format) and enter the posting references in the general journal.

c) Prepare a

Step by stepSolved in 2 steps with 5 images

- For each of the following, indicate if the statement reflects an input component, output component, or storage component of the accounting information system for a bank. A. Online customer check ordering system. B. Approved loan applications. C. Report of customers with savings accounts over $5,000. D. Desktop hard drive on computer used by bank presidents administrative assistant. E. List of the amount of money withdrawn from all of the banks ATMs on a given day.arrow_forward**General Journal needed** Review uploaded images Rick Hall owns a card shop: Hall’s Cards. The following cash information is available for the month of August Year 1. As of August 31, the bank statement shows a balance of $13,250. The August 31 unadjusted balance in the Cash account of Hall’s Cards is $9,564. A review of the bank statement revealed the following information: A deposit of $1,250 on August 31, Year 1, does not appear on the August bank statement. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $1,750 but was recorded on the books as $2,650. When checks written during the month were compared with those paid by the bank, three checks amounting to $4,095 were found to be outstanding. A debit memo for $59 was included in the bank statement for the purchase of a new supply of checks.arrow_forwardHelp Save A company's Cash account shows a balance of $3,410 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($60), an NSF check from a customer ($330), a customer's note receivable collected by the bank $(1,500), and interest earned $(190). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list А Record the entries that increase cash. Record the entries that decrease cash. Credit Note : = journal entry has been entered %3D Record entry Clear entry View general journal EX:arrow_forward

- Haytechcc.blackboard.co gement,. H https://outlook.offi.. FES Protection Plan System 7- North C. work Exercises Saved After returning from a three-day business trip, the accountant for Southeast Sales, Johanna Estrada, checked bank activity in the company's checking account online. The activity for the last three days follows. Business Checking Account #123456-987 Date Туpe Description Online Transfer to CM XX0XX Deposit ID number 8888 Check #1554 (view) Online payment Check #1553 (view) Check #1551 (view) Edwards UK AP payment ATM withdrawal Additions Payments Balance 09/24/20X1 09/24/20X1 Deposit 09/23/20X1 Loan payment $5,100.00 $17,275.06 $22,375.06 $5,100.00 $19,945.46 52.05 $25,845.46 $ 400.00 $25,097.51 $1,910.00 $25,497.51 $27,407.51 $ 400.00 $16,907.51 $ 2,429.60 Check Bill payment 09/23/20X1 09/22/20X1 09/22/20X1 Check Check ACH credit ATM $10,500.00 09/22/20x1 09/22/20X1 After matching these transactions to the company's Cash account in the general ledger, Johanna noted the…arrow_forwardPlease see below. Be sure to include the appropriate mathematical formula and cell referencing for this. Those were needed.arrow_forwardCatherines Cookies has a beginning balance in the Accounts Receivable control total account of $8,200. $15,700 was credited to Accounts Receivable during the month. In the sales journal, the Accounts Receivable debit column shows a total of $12,000. What is the ending balance of the Accounts Receivable account in the general ledger?arrow_forward

- Jul 13 The owner, Jen Beck, withdrew $2,000 cash for personal use, Check No. 78. Memorize the transaction for payments every two weeks. Next payment is July 27, 2022. Just tell me in quickbooks where do i record this transaction? bill (enter bills window) credit (enter bills window) bill pmt - check (pay bills window) check (write checks window) invoice (create invoices window) payment (receive payments window) sales receipt (enter sales receipts window) deposit (make deposit window) general journal (make general journal entries window) inventory adjust (adjust quantity/value on hand window) sales tax payment (pay sales tax window) paycheck (pay employees window) liability check (pay payroll liabilities window) transfer (transfer funds between accounts window) credit card charge (enter credit card charges window) credit memo (create credit memos/refunds window) discounts (receive payments window)arrow_forwardEllie Harrod, owner of Harrod’s Dry Cleaners, makes bank deposits in the night depository at the close of each business day. The following information for the last four days of July is available. July 28 29 30 31 Cash register tape $895.20 $977.40 $884.50 $1,027.25 Cash count 993.50 1,075.80 986.60 1,124.40 Required: In general journal form, record the cash deposit for each day, assuming that there is a $100 Change Fund.arrow_forwardhrd.3arrow_forward

- **** I want to know in what im wrong and what im missing, Thank you**** Balance Sheet Easy Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 20Y7, the end of the fiscal year, the balances of selected accounts from the ledger of Easy Weight Loss are as follows: Line Item Description Amount Accounts Payable $10,160 Accounts Receivable 24,490 Accumulated Depreciation - Equipment 30,580 Cash ? Common Stock 180,000 Equipment 88,390 Land 118,000 Prepaid Insurance 5,690 Prepaid Rent 3,560 Retained Earnings 23,810 Salaries Payable 3,960 Supplies 610 Unearned Fees 2,950arrow_forwardHardevarrow_forwardAwnser in graph format please please provide the 4 graphsarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning