FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

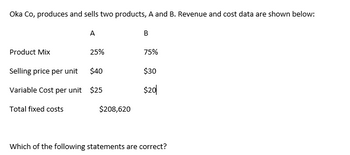

Transcribed Image Text:Oka Co, produces and sells two products, A and B. Revenue and cost data are shown below:

A

B

Product Mix

25%

75%

Selling price per unit

$40

$30

Variable Cost per unit $25

$20

Total fixed costs

$208,620

Which of the following statements are correct?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The single-column CVP income statements shown below are available for Wildhorse Company and Blossom Company, Sales Variable costs Contribution margin Fixed costs Net income Wildhorse Wildhorse Co. Blossom $495,000 239,000 256,000 1000 156,000 $100,000 Blossom Co. Degree of Operating Leverage $495,000 (a1) Compute the degree of operating leverage for each company. (Round answers to 2 decimal places, e.g. 1.15.) $ 51,000 444,000 344,000 $100,000 (b) Assuming that sales revenue increases by 10% (due to a 10% increase in the number of units sold), prepare a single-plumn CVP income statement for each company. Wildhorse Company $ tA $ Blossom Companyarrow_forwardsarrow_forwardThe following income statements illustrate different cost structures for two competing companies: Income Statements Company Name Perez Munoz Number of customers (a) 81 81 Sales revenue (a × $250) $ 20,250 $ 20,250 Variable cost (a × $175) N/A (14,175 ) Variable cost (a × $0) 0 N/A Contribution margin 20,250 6,075 Fixed cost (14,175 ) 0 Net income $ 6,075 $ 6,075 Required Reconstruct Perez’s income statement, assuming that it serves 162 customers when it lures 81 customers away from Munoz by lowering the sales price to $150 per customer. Reconstruct Munoz’s income statement, assuming that it serves 162 customers when it lures 81 customers away from Perez by lowering the sales price to $150 per customer.arrow_forward

- Required information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,600 units at $225 each) Variable costs (11,600 units at $180 each) Contribution margin Fixed costs Income $ 2,610,000 2,088,000 522,000 315,000 $ 207,000 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forwardJenna Corporation sells a single product. Management has provided the following data for two levels of monthly sales volume. The company sells the product for $172.50 per unit. Sales Volume in Units 4,000 5,000 Cost of Sales (COS) $307,600 $384,500 Selling, General & Administrative Costs (SG&A) $321,200 $337,000 Selling Price Per Unit $173 Total costs for these cost categories and may include both Fixed and Variable costs. HINT: See high-low analysis. 1. Calculate the total contribution margin when 4,300 units are sold. 2. What is the breakeven point in Sales dollars if Advertising (a fixed SG&A cost) is increased by $40,000? Please show calculations.arrow_forwardjagdisharrow_forward

- The following income statements illustrate different cost structures for two competing companies: Income Statements Number of customers (a) Sales revenue (a $200) Variable cost (ax $140) Contribution margin Fixed cost Net income Company Name Hill 200 $40,000 N/A 40,000 (28,000) $12,000 Creek 200 $40,000 (28,000) 12,000 0 $12,000 Required a. Reconstruct Hill's income statement, assuming that it serves 400 customers when it lures 200 customers away from Creek by lowering the sales price to $120 per customer. b. Reconstruct Creek's income statement, assuming that it serves 400 customers when it lures 200 customers away from Hill by lowering the sales price to $120 per customer. Complete this question by entering your answers in the tabs below.arrow_forwardYancey, Inc reports the following information Units produced Units sold Sales poce Direct materials Direct labor 520 units 520 units $150 per unit $40 per unit $30 per unit Variable manufacturing overhead Fixed manufacturing overhead $20 per unit $24,000 per year $15 per unit Variable selling and administrative costs Fixed selling and administrative costs $25,000 per year What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent) OA. $76 15 OB 5136 15 OC. $116 15 OD $80.00arrow_forwardSheridan Optics manufactures two products: microscopes and telescopes. Information for each product is as follows. Microscopes Telescopes Sales price $ 34 53 Sales volume 406,565 178,500 Variable cost per unit 15 20 Annual traceable fixed expenses $ 3,003,300 $ 3,505,100 Annual allocated common fixed expenses $ 2,009,500 $ 2,006,700 Prepare a segment margin income statement for Sheridan Optics that provides detail on both the product lines and the company as a whole. (If the amount is negative then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125).) Microscopes Telescopes Total LA $ LA $ LA LAarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education