FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

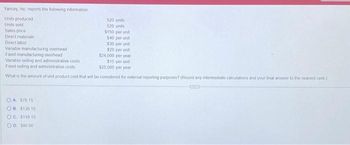

Transcribed Image Text:### Yancey, Inc. Product Cost Information

**Yancey, Inc. reports the following information:**

- **Units produced:** 520 units

- **Units sold:** 520 units

- **Sales price:** $150 per unit

- **Direct materials:** $40 per unit

- **Direct labor:** $30 per unit

- **Variable manufacturing overhead:** $20 per unit

- **Fixed manufacturing overhead:** $24,000 per year

- **Variable selling and administrative costs:** $15 per unit

- **Fixed selling and administrative costs:** $25,000 per year

**Question:**

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent.)

**Answer choices:**

- (A) $76.15

- (B) $136.15

- (C) $116.15

- (D) $80.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress In Robert's manufacturing plant, the estimated monthly overhead cost function is provided in the Y = m(X) + b format: Total monthly overhead costs = $1.15(number of machine hours) + $6,500. Given this cost function, specify (a) the variable cost, (b) the fixed cost, (c) the cost driver, and (d) whether these monthly overhead costs are considered variable, fixed, or mixed in total. (Round variable cost to 2 decimal places, e.g. 15.25.) Variable cost Fixed cost Cost driver Cost type $ $arrow_forward! Required information [The following information applies to the questions displayed below.] Acacia Manufacturing has compiled the following information from the accounting system for the one product it sells: Sales price Fixed costs (for the month) Marketing and administrative Manufacturing overhead Variable costs (per unit) Marketing and administrative Direct materials Manufacturing overhead Direct labor Units produced and sold (for the month) Required: a. Calculate the product costs per unit. Note: Round your answer to 2 decimal places. b. Calculate the period costs for the period. Product costs per unit b. Period costs $80 per unit $ 23,800 $ 9,100 $9 $20 $ 10 $16 21,000arrow_forwardA known manufacturing company has estimated the ff. Component for a new product. Fixed cost= 50,000 Material cost per unit= 2.15 Labor cost per unit = 2 Revenue per unit= 7.50 Vary the production volume from 0 to 100,000 in increments of 10,000. The five different material costs are 1.50,1.95,2.15,2.85 and 3.25. Using the spreadsheet model, what will be the resulting profit if the company decides to make 70,000 units of the new product. Choices: A.623,018 B.176,400 C.45,705 D.No choice given E.138,430arrow_forward

- Jamison Company uses the total cost method of applying the cost-plus approach to product pricing. Jamison produces and sells Product X at a total cost of $800 per unit, of which $540 is product cost and $260 is selling and administrative expenses. In addition, the total cost of $800 is made up of $460 variable cost and $340 fixed cost. The desired profit is $168 per unit. Determine the markup percentage on total cost. %arrow_forwardRequired information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Total variable cost 2 5. If 8,000 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? (Do not round intermediate calculations.) W S X H # 3 E D C $ 4 - 2023-01...0.40 PM 2023-01...2.52 PM 2022-12...6.4. - 9 M AO < K -0 ) O O V H I' P A commandarrow_forwardThe Miramichi Company uses the high-low method to estimate its cost function. The information for the current year is provided below: Highest observation of cost driver Lowest observation of cost driver $12,500 Machine-hours a. O b. $0 O C. $25,000 O d. $125,000 O e. $225,000 2,000 1,000 What is the constant for the estimating cost equation? Costs $225,000 $125,000arrow_forward

- Adams, Inc. has the following cost data for Product X, and unit product cost using absorption costing when production is 2,000 units, 2,500 units, and 5,000 units. (Click on the icon to view the cost data.) (Click on the icon to view the unit product cost data.) Product X sells for $175 per unit. Assume no beginning inventories. Read the requirements. Data table Begin by selecting the labels and computing the gross profit for scenario a. and then compute the gross profit for scenario b. and c. Absorption costing a. b. C. Gross Profit Reference 2,000 units 2,500 units 5,000 units 42 $ 42 52 52 11 11 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit product cost Print $ $ 42 S 52 11 10 115 $ Done 8 113 $ 4 109 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Print Done $42 per unit 52 per unit 11 per unit 20,000 per yeararrow_forwardProvide correct solution for this questionarrow_forwardDengerarrow_forward

- Required information. Cost Classifications (Algo) [The following information applies to the questions displayed below] Kubin Company's relevant range of production is 26,000 to 35,500 units. When it produces and sells 30,750 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $8.50 $5.60 $ 3.10 1. Total amount of product cost 2. Total amount of period cost 3. Total amount of product cost 4 Total amount of period cost $6.60 $5.10 $.4.10 $2.00 $2.10 Exercise 1-8 (Algo) Product Costs and Period Costs; Variable and Fixed Costs [LO1-3, LO1-4] Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 30,750 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 30,750 units? 3. For…arrow_forwardSubject-Acountingarrow_forwardBoth the image are from the same question please helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education