Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

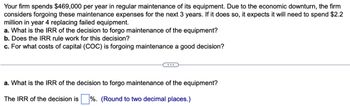

Transcribed Image Text:Your firm spends $469,000 per year in regular maintenance of its equipment. Due to the economic downturn, the firm

considers forgoing these maintenance expenses for the next 3 years. If it does so, it expects it will need to spend $2.2

million in year 4 replacing failed equipment.

a. What is the IRR of the decision to forgo maintenance of the equipment?

b. Does the IRR rule work for this decision?

c. For what costs of capital (COC) is forgoing maintenance a good decision?

a. What is the IRR of the decision to forgo maintenance of the equipment?

The IRR of the decision is ☐ %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Vijayarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward(Ignore income taxes in this problem.) Your Company purchased a van to use in orders directly to customers. The auto was purchased for $28,000 and will have a 6-year useful life and a $7,000 salvage value. Delivering fees should increase gross revenues by at least $6,350 per year. Depreciation on the van will be $3,500 per year. In what year will the payback for the van occur? please solve and show work.arrow_forward

- Green Moose Industries is a company that produces iGadgets, among several other products. Suppose that Green Moose Industries considers replacing its old machine used to make iGadgets with a more efficient one, which would cost $1,800 and require $250 annually in operating costs except depreciation. After-tax salvage value of the old machine is $600, while its annual operating costs except depreciation are $1,100. Assume that, regardless of the age of the equipment, Green Moose Industries's sales revenues are fixed at $3,500 and depreciation on the old machine is $600. Assume also that the tax rate is 40% and the project's risk-adjusted cost of capital, r, is the same as weighted average cost of capital (WACC) and equals 10%. Based on the data, net cash flows (NCFs) before replacement are $1,680 and they are constant over four years. Although Green Moose Industries's NCFs before replacement are the same over the 4-year period, its NCFs after replacement vary annually. The following…arrow_forwardBlooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $20 million. The system will last 5 years. Do-It-Right sells a sturdier but more expensive system for $21 million; it will last for 6 years. Both systems entail $1 million in operating costs; both will be depreciated straight- line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 30%, and the discount rate is 13%. a. What is the equivalent annual cost of investing in the cheap system? Note: Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places. b. What is the equivalent annual cost of investing in the more expensive system? Note: Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places. c. Which system…arrow_forwardAt times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $9,000,000, and it is eligible for 100% bonus depreciation so it will be fully depreciated at t = 0. • The old machine was purchased before the new tax law, so it is being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education