FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

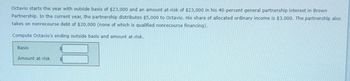

Transcribed Image Text:Octavio starts the year with outside basis of $23,000 and an amount at-risk of $23,000 in his 40-percent general partnership interest in Brown

Partnership. In the current year, the partnership distributes $5,000 to Octavio. His share of allocated ordinary income is $3,000. The partnership also

takes on nonrecourse debt of $20,000 (none of which is qualified nonrecourse financing).

Compute Octavio's ending outside basis and amount at-risk.

Basis

Amount at-risk

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nelson Ellis and Hank Tollis are partners who share profits and losses in the ratio of 40 to 60 percent, respectively. The balances of their capital accounts on December 31, 20X0, are Ellis, $210,000, and Tollis, $230,000. With Tollis's agreement, Ellis sells one-half of his interest in the partnership to Kate Cantu for $160,000 on January 1, 20X1. Required: What will the capital account balances for each of the three partners be after this sale? New Capital Account Balances Beginning balance Transfer of capital New balances Ellis Tollis Cantuarrow_forwardJenna began the year with a tax basis of $22,000 in her partnership interest. Her share of partnership liabilities consists of $3,000 of recourse liabilities and $12,000 of nonrecourse liabilities at the beginning of the year and $3,000 of recourse liabilities and $14,000 of nonrecourse liabilities at the end of the year. During the year, she was allocated $36,000 of partnership ordinary business loss. Jenna does not materially participate in this partnership, and she has $5,000 of passive income from other sources. b. How much of Jenna’s loss is limited by her at-risk amount?arrow_forwardMilton has a basis in his partnership of $300,000, including his $80,000 share of partnership liabilities. At the end of the current year the partnership pays off the liabilities and makes a proportionate current distribution to its partners. Milton receives a parcel of land (partnership basis of $120,000 and FMV of $135,000) and inventory (partnership basis of $160,000 and FMV of $180,000). Following the distribution what is Milton's basis in the inventory? I'm not sure if it's 160,000 or notarrow_forward

- Kent contributed $50,000 in exchange for a 40% interest in a partnership at the beginning of the year. The partnership has no liabilities in place at the time of Kent's contribution. At the end of the year, the partnership correctly allocates $30,000 ordinary loss and a $50,000 long term capital loss to Kent. In addition, during the year, the partnership borrowed $100,000. $40,000 of this liability is allocable to Kent. At the end of the year, Kent's outside basis equals ____ and his capital account equals _______.arrow_forwardZoey contributed land with a tax basis of $45,000 and a fair market value of $100,000 in exchange for a 20% percent interest in the new formed ZAT Partnership. All other partners contributed cash and ZAT partnership has no liabilities. What is Zoey’s basis in her partnership interest in ZAT Partnership?arrow_forwardArtemis is a 30% partner in the CAR Partnership. At the beginning of the tax year, Artemis' basis in the partnership interest was $60,000, including a share of partnership liabilities. During the current year, CAR reported net ordinary income of $40,000. In addition, CAR distributed $5,000 to each of the partners ($15,000 total). At the end of the year, Artemis' share of partnership liabilities increased by $20,000. Artemis' basis in the partnership interest at the end of the year is: a. $87,000. b. $75,000. c. $82,000. d. $120,000. e. $60,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education