FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

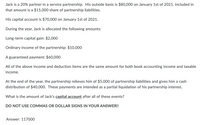

Transcribed Image Text:Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2021. Included in

that amount is a $15,000 share of partnership liabilities.

His capital account is $70,000 on January 1st of 2021.

During the year, Jack is allocated the following amounts:

Long-term capital gain: $2,000

Ordinary income of the partnership: $10,000

A guaranteed payment: $60,000

All of the above income and deduction items are the same amount for both book accounting income and taxable

income.

At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash

distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest.

What is the amount of Jack's capital account after all of these events?

DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Answer: 117000

Transcribed Image Text:Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2021. Included in

that amount is a $15,000 share of partnership liabilities.

During the year, Jack is allocated the following amounts:

Long-term capital gain: $2,000

Ordinary income of the partnership: $10,000

A guaranteed payment: $60,000

At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash

distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest.

What is the amount of Jack's outside basis after all of these events?

DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Answer: 99000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ann, Beth, Chris and Dan are equal partners in the ABCD. They have agreed that all items of partnership income, gain, loss and deduction will be split equally between them. In addition, since Ann is expected to be rendering the majority of the services on behalf of the partnership, the partners have agreed that she will receive $3,000 per month in addition to her 25% distributive share. For the year 2020, the partnership had short-term capital loss of $28,000, long-term capital gain of $54,000 and bottom line ordinary income (before considering the additional payments to Ann) of $21,000. What is the amount and character of partnership income and loss that Ann, Beth, Chris and Dan must include from the ABCD partnership on their 2020 income tax returns?arrow_forwardIn the current year, the POD Partnership received revenues of $200,000 and paid the following amounts: $50,000 in rent and utilities, and $20,000 as a distribution to partner Olivia. In addition, the partnership earned $6,000 of long-term capital gains during the year. Partner Donald owns a 50% interest in the partnership. How much income must Donald report for the tax year? a $68,000 ordinary income. b $78,000 ordinary income. $65,000 ordinary income; $3,000 of long-term capital gains. d $75,000 ordinary income; $3,000 of long-term capital gains. e None of the above.arrow_forwardJackie is a 50% partner in The Lunch Box. She is to receive a guaranteed payment of $30,000. If the partnership's ordinary income before deducting the guaranteed payment is $70,000, what is Jackie's distributive share? $15,000 $20,000 $30,000 $35,000arrow_forward

- Mary is a 25% partner. She is to receive 25% of the partnership income, but no less than $10,000. If the net income of the partnership is %50,000, what amount can the partnership deduct as a guaranteed payment to Mary? (a) $0, (b) $2,500, (c) $10,000, (d) $12,500arrow_forwardThis answer is wrong . please give me the right answer.arrow_forwardJenna began the year with a tax basis of $22,000 in her partnership interest. Her share of partnership liabilities consists of $3,000 of recourse liabilities and $12,000 of nonrecourse liabilities at the beginning of the year and $3,000 of recourse liabilities and $14,000 of nonrecourse liabilities at the end of the year. During the year, she was allocated $36,000 of partnership ordinary business loss. Jenna does not materially participate in this partnership, and she has $5,000 of passive income from other sources. b. How much of Jenna’s loss is limited by her at-risk amount?arrow_forward

- Lilac Designs is a partnership with a tax year that ends November 30, 2018. During that year, William, a partner, received $4,000 per month as a guaranteed payment and his share of partnership income after guaranteed payments was $20,000. For December of 2018, William received a guaranteed payment of $10,000. Calculate the amount of income from the partnership that William should report for his tax year ended December 31, 2018.arrow_forwardArtemis is a 30% partner in the CAR Partnership. At the beginning of the tax year, Artemis' basis in the partnership interest was $60,000, including a share of partnership liabilities. During the current year, CAR reported net ordinary income of $40,000. In addition, CAR distributed $5,000 to each of the partners ($15,000 total). At the end of the year, Artemis' share of partnership liabilities increased by $20,000. Artemis' basis in the partnership interest at the end of the year is: a. $87,000. b. $75,000. c. $82,000. d. $120,000. e. $60,000.arrow_forwardOn January 1, 2021 David contributed $25,000 cash and building with a basis of $100,000 and a FMV of $165,000 in exchange for 50% interest in partnership XYZ LLC. XYZ had the following activty for 2021: Ordinary Income: $140,000 Operating expenses: $60,000 Interest Income: $10,000 Nondeductible Expenses: 5,000 What is David's outside basis in XYZ LLC on December 31, 2021? 232,500 170,000 167,500 210,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education