FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

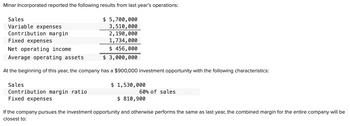

Transcribed Image Text:Minar Incorporated reported the following results from last year's operations:

$ 5,700,000

3,510,000

2,190,000

1,734,000

Fixed expenses

Net operating income

$ 456,000

Average operating assets

$ 3,000,000

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

Sales

Variable expenses

Contribution margin

Sales

Contribution margin ratio

Fixed expenses

$ 1,530,000

60% of sales

$ 810,900

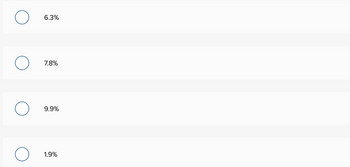

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be

closest to:

Transcribed Image Text:O

O

6.3%

7.8%

9.9%

1.9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Walsh Corporation has two divisions: East and West. Data from the most recent month appear below: East West Sales $ 330,000 $144,000 Variable expenses $ 132,000 $ 76,320 Traceable fixed expenses $ 140,000 $ 43,000 The company's common fixed expenses total $52,140, If the company operates at exactly the break even sales of the East Division and West Diveion, what would be the company's overall net operating income? Select one: O a $30,540 O b. 50 OC ($52,140) Od. ($235,140)arrow_forwardBest Sleep Company reported the following results from last year's operations: Sales $ 1,500,000 Variable expenses 650,000 Contribution margin 850,000 Fixed expenses 580,000 Net operating income $ 270,000 Average operating assets $ 1,000,000 At the beginning of this year, the company has a $160,000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 240,000 70 % of sales $ 144,000 The company's minimum required rate of return is 10%. What is the ROI related to this year's investment opportunity?arrow_forwardThe following information relates to last year's operations at the Dairy Division of Carrefour Bahrain: Minimum required rate of return Return on investment (ROI) Sales Turnover (on operating assets) 11% 14.4% $ 970,000 6 times What was the Dairy Division's net operating income last year? O $139,680 $106,700 $32,980 $23,280arrow_forward

- Required information [The following information applies to the questions displayed below.] The following information relates to a company's operations for last year. $ 1,300,000 Sales Variable expenses Contribution margin 440,000 860,000 600,000 Fixed expenses Net operating income 260,000 Average operating assets 812,500 The company's minimum required rate of return is 15%. 1. Calculate last year's return on investment (ROI). ROIarrow_forwardThe following data pertain to Turk Company's operations last year: Sales Net operating income Contribution margin Average operating assets Stockholders' equity Plant, property, & equipment Turk's return on investment for the year was: Multiple Choice O O 20% 4% 36% 15% $ 900,000 $ 36,000 $ 150,000 $ 180,000 $ 100,000 $ 120,000arrow_forwardCalculate Return on investment (ROI) using the following data: Sales $50,000 Net operating income $5,000 Contribution margin $20,000 Average operating assets $25,000 Stockholders' equity $15,000arrow_forward

- The Millard Division's operating data for the past two years are provided below: Return on investment Net operating income Turnover Margin Sales Year 1 12% Year 2 36% ? $ 480,000 ? 3 ? ? $ 3,260,000 ? Millard Division's margin in Year 2 was 150% of the margin in Year 1. The net operating income for Year 1 was: (Round your intermediate percentage calculations to the nearest whole percent.) Multiple Choice $320,000 $260,800 $391,200 $782,400arrow_forwardCold Goose Metal Works Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Cold Goose is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 70% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Cold Goose expects to pay $200,000 and $1,922,063 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Cold Goose Metal Works Inc. Income Statement for Year Ending December 31…arrow_forwardWhat is the Rate of Return on Investment (ROI) for Stevenson Corporation, given the following info: Invested Assets = $275,000 Sales $330,000 Income from Operations = $49,500 Desired minimum rate of return = 7.5% O 10.0% 18.0% 8.0% 7.5%arrow_forward

- The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 1,008,000 $ 50.40 Variable expenses 604,800 30.24 Contribution margin 403,200 20.16 Fixed expenses 323,200 16.16 Net operating income 80,000 4.00 Income taxes @ 40% 32,000 1.60 Net income $ 48,000 $ 2.40 The company had average operating assets of $499,000 during the year. Required: 5. As a result of a more intense effort by sales people, sales are increased by 10%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $18,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $178,000 of cash (received on accounts receivable) to repurchase some of its common stock.arrow_forward7arrow_forwarddavubenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education