FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

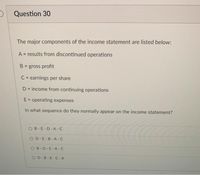

Transcribed Image Text:O Question 30

The major components of the income statement are listed below:

A = results from discontinued operations

B = gross profit

C= earnings per share

D= income from continuing operations

%3D

E = operating expenses

In what sequence do they normally appear on the income statement?

OB-E-D-A -C

OD-E-B-A -C

OB-D-E-A-C

OD-B-E-C -A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 9arrow_forward15- If you would like to measure the effectiveness of asset management of a company, which of the following ratios would be the least useful? Average days in inventory Times interest earned ratio Average collection period Inventory turnover ratio Days sales outstandingarrow_forwardThe following events were experienced by Sequoia, Inc.: 1. Issued cumulative preferred stock for cash. 2. Issued common stock for cash. 3. Issued noncumulative preferred stock for cash. 4. Paid cash to purchase treasury stock. 5. Sold treasury stock for an amount of cash that was more than the cost of the treasury stock. 6. Declared a cash dividend. 7. Declared a 2-for-1 stock split on the common stock. 8. Distributed a stock dividend. 9. Appropriated retained earnings. 10. Paid a cash dividend that was previously declared. Required Show the effect of each event on the elements of the financial statements using a horizontal statements model. Use + for increase, for decrease, and leave the cell blank if there is no effect. In the Cash Flow column indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. The first transaction is entered as an example.arrow_forward

- Exercise 17-4 (Algo) Computing and interpreting common-size percents LO P2 Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) Sales Cost of goods sold Gross profit Operating expenses Net income GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % 780,000 $ 560,000 220,000 130,400 89,600 $ Income Statement Prior Year $ $ $ 660,000 295,400 364,600 251,600 113,000 Prior Year % Reason for Decline in Net Income >arrow_forwardX Print Item Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Sales Cost of goods sold Gross margin Income Statement Operating expenses Interest expense Net income a. 2.8% b. 1.4% c. 11.3% d. 5.6% $67,366 89,760 79,299 63,350 $299,775 $93,016 37,206 $55,810 (21,965) (4,651) $29,194 Number of shares of common stock outstanding Market price of common stock Total dividends paid Cash provided by operations What is the return on total assets for Diane Company? 6,335 $26 $9,000 $30,000 All work saved. MacBookarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education