ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

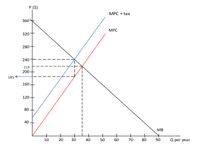

Now suppose that the government has to intervene in the production of the good (rice) for there is a reason to believe (as community clamors it) that the production is causing pollution in the community. With the intervention, the local government decided to impose a tax (Pigouvian tax) on the polluters (a tax per unit of the good produced). Use the figure below to answer the following:

A. What is the value of the tax?

B. Calculate Pigouvian tax revenue as a result of this tax levied on producers.

Transcribed Image Text:P ($)

MPC + tax

360

MPC

320

280

240

216

200

185

160-

120-

80

40

MB

+

10

20

30

40

50

60

70

80

90

Q per year

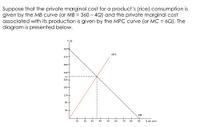

Transcribed Image Text:Suppose that the private marginal cost for a product's (rice) consumption is

given by the MB curve (or MB = 360 – 4Q) and the private marginal cost

associated with its production is given by the MPC curve (or MC = 6Q). The

diagram is presented below.

P ($)

360

MPC

320+

280+

240-

216

200+

160-

120+

80-

40+

MB

10

20

30

40

50

60

70

80

90

Q per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- This is an end-of-chapter problem that I'm struggling with! thanks!arrow_forwardWhat happens in the market for a good that pollutes the air when it is manufactured if government decides to tax its production? Will this reduce the amount of air pollution?arrow_forwardB. Let’s consider the market for flour in a different town. Assume that it is efficient (i.e. that there are not external costs to producing flour, and no external benefits from consuming it). Price ($/lb) Quantity Supplied (thousands of lbs per day) Quantity Demanded (thousands of lbs per day) 1.5 8 14 2 9 13 2.5 10 12 3 11 11 3.5 12 10 4 13 9 What is the price and quantity of flour sold without government intervention. Graph this equilibrium. XXXX 2. Suppose that, alarmed by the inability of many poorer consumers to buy flour, the government institutes a $2/lb price ceiling. How much flour will suppliers wish to sell, and how much will buyers demand? How much flour will actually be sold? Show this outcome on the same graph you drew for question 1. XXXX 3. Describe, in one sentence each, three problems that this policy might create? Please do not simply copy down phrases from the textbook, but instead describe ways that…arrow_forward

- What is externality. Explain its both types negative and positive too.arrow_forwardParks confer many external benefits on society: open space, trees that reduce pollution, and so on. Therefore, the market equilibrium quantity of parks is not equal to the socially optimal quantity. The following graph shows the demand for parks (their private value), the supply of parks (the private cost of producing them), and the social value of parks, including both the private value and external benefits. Use the black point (plus symbol) to indicate the market equilibrium quantity. Next, use the purple point (diamond symbol) to indicate the socially optimal quantity.arrow_forwardWhen does a subsidy that benefits consumers result in a more efficient allocation of a resource? A when the good being produced or consumed is not scarce B when the good being produced or consumed generates a negative externality when the good being produced or consumed generates a positive externality D when the equilibrium price of the good is one that consumers don't likearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education