ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

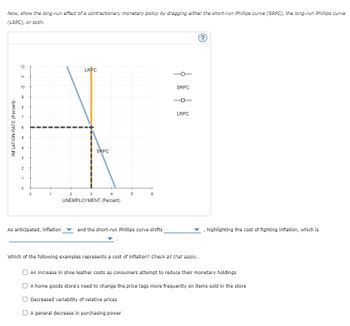

Transcribed Image Text:Now, show the long-run effect of a contractionary monetary policy by dragging either the short-run Phillips curve (SRPC), the long-run Phillips curve

(LRPC), or both.

INFLATION RATE (Percent)

12

11

10

9

co

80

3

2

1

0

0

1

As anticipated, inflation

2

LRPC

3

4

UNEMPLOYMENT (Percent)

SRPC

5

6

and the short-run Phillips curve shifts

SRPC

LRPC

Which of the following examples represents a cost of inflation? Check all that apply.

(?)

highlighting the cost of fighting inflation, which is

An increase in shoe leather costs as consumers attempt to reduce their monetary holdings

A home goods store's need to change the price tags more frequently on items sold in the store

Decreased variability of relative prices

A general decrease in purchasing power

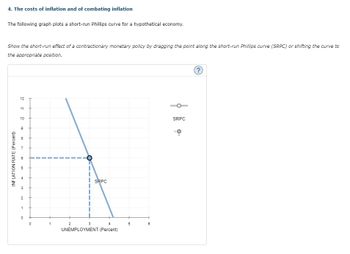

Transcribed Image Text:4. The costs of inflation and of combating inflation

The following graph plots a short-run Phillips curve for a hypothetical economy.

Show the short-run effect of a contractionary monetary policy by dragging the point along the short-run Phillips curve (SRPC) or shifting the curve to

the appropriate position.

INFLATION RATE (Percent)

12

11

10

9

m

10

3

2

1

0

0

1

O

2

4

UNEMPLOYMENT (Percent)

SRPC

3

5

m

SRPC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Describe macroeconomic analysis

VIEW Step 2: Show the short run effect on the Phillips curve

VIEW Step 3: Show the long run effect on the Phillips curve

VIEW Step 4: Explain the scenario of a falling inflation expectations

VIEW Step 5: Explain the correct and the incorrect options

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give proper explanation and solve all parts will definitely upvote. Hand written solution is not allowed.arrow_forwardQuestion 52, 13.2 Questio Suppose the central bank in a hypothetical country Corearea uses "core" inflation for inflation targeting purpos K O A. makes inflation targeting harder because it is closely related to excess demand in the economy. O B. is irrelevant for inflation targeting because the central bank does not include the price of food in its targ O C. makes inflation targeting easier because it makes these problems less relevant. OD. is closely related to changes in core inflation, so the central bank uses it for targeting inflation. O E. would be offset by an increase in the Corearian dollar, making this price change irrelevant. Q RechercherQuestion 52, 13.2 Questio Suppose the central bank in a hypothetical country Corearea uses "core" inflation for inflation targeting purpos K O A. makes inflation targeting harder because it is closely related to excess demand in the economy. O B. is irrelevant for inflation targeting because the central bank does not include the price of…arrow_forwardAccording to the St. Louis Federal Reserve the natural unemployment rate is 4.44 percent (Q2 2022 B) and the U.S. Bureau of Labor Statistics (BLS) estimates the U.S. unemployment rate (U3, March 2022 ) to be 3.6 percent. If you expect unemployment to continue to fall the short-run Phillips curve would predict: O A decrease in the inflation rate. An increase in the inflation rate. A decrease in the unemployment rate. An increase in the unemployment rate.arrow_forward

- 2. Analyze the effects of the following developments on both the short-run and the long-run Phillips curves. Use the graphs and explain in detail: a) a rise in the natural rate of unemployment b) a substantial increase in the price of energyarrow_forwardD Question 1 The short-run Phillips curve is a curve that shows the relationship, other things being constant, between and O the inflation rate; the unemployment rate O the inflation rate; the nominal interest rate O the unemployment rate; real GDP 0.1 pts O potential GDP; the natural unemployment rate O the inflation rate; the expected inflation rate .arrow_forwardThe long-run Phillips Curve describes: The relationship between unemployment and inflation after expectations of inflation have had time to adjust to experience. O An increase in expected inflation will cause nominal wages to rise, shifting both SRAS and the Phillips Curve up. That there is a predictable negative relationship between the output gap and the unemployment rate but it is not one to one. The negative short-run relationship between the unemployment rate and the inflation rate.arrow_forward

- Do the expected inflation rate and natural unemployment rate remain constant along the short-run Phillips curve? Along the short-run Phillips curve, _______. A. the expected inflation rate rises as the natural unemployment rate rises B. the expected inflation rate is constant and the natural unemployment rate varies C. the expected inflation rate and the natural unemployment rate are constant D. the expected inflation rate rises as the natural unemployment rate falls thank ssarrow_forward3. Explain any three costs associated with inflation? Also, provide a real-world example of hyperinflation that happened in the past.arrow_forwardFrom 2008-2009 the Federal Reserve created a very large increase in the money supply. According to the short-run Phillips curve this policy should have raised inflation and unemployment. Oraised inflation and reduced unemployment. O reduced inflation and raised unemployment. O reduced inflation and unemployment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education