Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

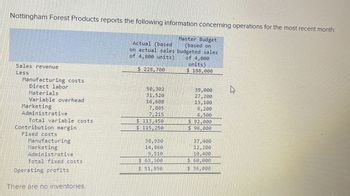

Transcribed Image Text:Nottingham Forest Products reports the following information concerning operations for the most recent month:

Actual (based

Master Budget

(based on

on actual sales budgeted sales

of 4,800 units)

$ 228,700

of 4,000

units)

$ 188,000

Sales revenue

Less

Manufacturing costs.

Direct labor

50,302

39,000

31,520

27,200

16,608

13,100

7,805

6,200

6,500

Materials

Variable overhead

Marketing

Administrative

Total variable costs

$ 113,450

Contribution margin

$ 115,250

Fixed costs

Manufacturing

Marketing

Administrative

7,215

38,930

14,860

9,510

$ 92,000

$ 96,000

37,400

12,200

10,400

$ 60,000

Total fixed costs

$ 63,300

$ 51,950

$ 36,000

Operating profits

There are no inventories.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A report for a company's Assembly Department for the month of March follows: Assembly Department Cost Report For the Month Ended March 31 Machine-hours Variable costs: Supplies Scrap Indirect materials Fixed costs: Wages and salaries Equipment depreciation Total cost Actual Results 15,000 Master Budget Variances 20,000 $ 10,800 39,200 $ 11,400 42,000 $ 600 F 2,800 F 111,800 133,500 21,700 F 83,500 108,000 78,000 108,000 5,500 U 0 $ 353,300 $ 372,900 $ 19,600 F Required: Prepare a flexible budget performance report for the month of March.arrow_forwardThe following information was drawn from the accounting records of Ashton Company. Budgeted Actual Sales $ 10,000 $ 13,000 Cost of Goods Sold (5,000 ) (6,600 ) Gross Margin 5,000 6,400 Variable Cost (2,000 ) (2,700 ) Fixed Cost (2,500 ) (1,900 ) Net Income $ 500 $ 1,800 Based on this information Ashton Company has a Multiple Choice $1,300 favorable sales variance $1,300 unfavorable sales variance $3,000 favorable sales variance $3,000 unfavorable sales variancearrow_forwardThe following information is available for Brownstone Products Company for the month of July: Master Actual Budget 4, eee $ 60,000 16, e00 Units Sales revenue Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses 3,8ee $ 53,600 19,400 14,300 8,100 9,see 13, 30e 8, e00 9,400 Required: 1. What was the master budget varidnce for July? Was this variance favorable or unfavorable? 2. Compute the July sales volume variance and the flexible-budget variance for the month, both in terms of contribution margin and in terms of operating income. 4. Prepare pro-forma budgets for activities within its relevant range of operations. Prepare a flexible budiget for each of the following two output levels: a. 3,790 units. b. 4,190 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 4 .. Nextarrow_forward

- Please do not give solution in image format thankuarrow_forwardThe following information relates to Steele Manufacturing's overhead costs for the month: Static budget variable overhead $35,900 Static budget fixed overhead $15,600 Static budget direct labor hours 15,400 hours Static budget number of units 5,500 units Steele allocates variable manufacturing overhead to production based on standard direct labor hours. Steele reported the following actual results for last month: actual variable overhead, $35,400;actual fixed overhead, $15,400; actual production of 5,400 units at 2.4 direct labor hours per unit. The standard direct labor time is 2.8 direct labor hours per unit. Compute the variable overhead efficiency variance. (Round the answer to the nearest dollar.) A. $4,474 U B. $5,033 U C. $4,474 F D. $5,033 Farrow_forwardA report for a company's Assembly Department for the month of March follows: Assembly Department Cost Report For the Month Ended March 31 Machine-hours Variable costs: Supplies Scrap Indirect materials Fixed costs: Actual Master Budget Results 15,000 Variances 20,000 $ 10,800 39,200 111,800 $ 11,400 42,000 133,500 $ 600 F 2,800 F 21,700 F 83,500 108,000 78,000 108,000 5,500 U e $ 353,300 $ 372,900 $ 19,600 F Wages and salaries Equipment depreciation Total cost Required: Prepare a flexible budget performance report for the month of March.arrow_forward

- Performance Report Based on Budgeted and Actual Levelsof ProductionBowling Company budgeted the following amounts:Variable costs of production:Direct materials 3 pounds @ $0.60 per poundDirect labor 0.5 hr. @ $16.00 per hourVOH 0.5 hr. @ $2.20FOH:Materials handling $6,200Depreciation $2,600 At the end of the year, Bowling had the following actual costs for production of 3,800 units:Direct materials $ 6,800Direct labor 30,500VOH 4,200FOH:Materials handling 6,300Depreciation 2,600Required:1. Calculate the budgeted amounts for each cost category listed above for the 4,000budgeted units.2. Prepare a performance report using a budget based on expected production of 4,000units.3. Prepare a performance report using a budget based on the actual level of production of3,800 units.arrow_forwardX Company's 2021 budgeted cost function for fixed overhead was C=$211,800. Its budgeted cost function for variable overhead was C=$11.8ox, where X the number of units produced. The following information is also available for 2021: Master Actual Budget Results Production 10,100 units 11,500 units Total variable costs $119,180 $134,185 Total fixed costs $211,800 $213,544 1. What was the total overhead master (static) budget for 2021? 2. What was the total overhead flexible budget for 2021?arrow_forwardHarlow Parts produces a single product at its Superior Plant. The master budget for July follows: Harlow Parts Superior Plant Master Budget (For July) Quantity Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 8,200 $ 1,558,000 590,400 98,400 $ 869,200 212,000 370,000 $ 287,200 The following operating income statement shows the actual results for July: Harlow Parts Superior Plant Operating Results (For July) Quantity (units) Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit Required: 9,600 $ 1,760,800 780,394 111,040 $ 869,366 223,040 380,000 $ 266,326 Prepare a profit variance analysis for the Superior Plant for July. (Do not round intermediate calculations. Indicate the effect of each variance by…arrow_forward

- 8. Sweet Tooth Company budgeted the following costs for anticipated production for August: Advertising expenses $273,290 Manufacturing supplies 14,980 Power and light 44,670 Sales commissions 302,050 Factory insurance 26,010 Production supervisor wages 131,390 Production control wages 34,160 Executive officer salaries 278,550 Materials management wages 37,580 Factory depreciation 21,290 Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs.arrow_forwardPartially completed budget performance reports for Delmar Company, a manufacturer of light duty motors, follow: Delmar Company Plant Eastern Region Central Region Western Region Department Chip Fabrication Electronic Assembly Final Assembly Budget Performance Report-Vice President, Production For the Month Ended June 30 Cost Factory wages Materials Power and light a. S b. Maintenance c. S d. s e. S f. S Actual $402,500 286,900 (g) $(1) Actual $(a) 86,710 135,860 $(d) Delmar Company Budget Performance Report-Manager, Western Region Plant For the Month Ended June 30 Over Budget Budget $402,500 289,800 Actual $25,680 73,390 4,460 8,050 (h) $(k) Budget $(b) 85,600 136,960 $(e) i. $ (1) $(1) 9. $ h. $ Over Budget s(c) 1,110 Delmar Company Budget Performance Report-Supervisor, Chip Fabrication For the Month Ended June 30 Over Budget Budget $24,000 $1,680 73,910 3,750 7,350 j. s k. $ 1. S $(f) (Under) Budget $0 (2,900) 710 700 $111,580 $109,010 $3,090 $(520) a. Complete the budget performance…arrow_forwardThe following are the budgeted and actual income statements for Tucan Ltd, a manufacturing business, for the month of January: Budget Output (production and sales) Sales revenue Raw materials Labour Fixed overheads Operating profit Output (production and sales) Sales revenue Raw materials Labour Fixed overheads 5,000 units Flexed budget £ 500,000 200,000 150,000 70,000 80,000 £ units Actual 6,000 units £ 630,000 270,000 150,000 78,000 132,000 Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education