FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

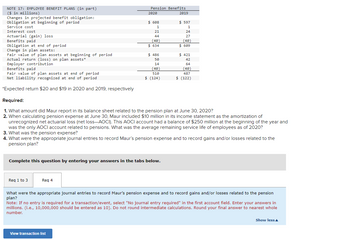

Transcribed Image Text:NOTE 17: EMPLOYEE BENEFIT PLANS (in part)

($ in millions)

Changes in projected benefit obligation:

Obligation at beginning of period

Service cost

Interest cost

Actuarial (gain) loss

Benefits paid

Obligation at end of period

Change in plan assets:

Fair value of plan assets at beginning of period

Actual return (loss) on plan assets*

Employer contribution

Benefits paid

Fair value of plan assets at end of period

Net liability recognized at end of period

*Expected return $20 and $19 in 2020 and 2019, respectively

Req 1 to 3

Pension Benefits

2020

Req 4

$ 608

1

21

44

(40)

$634

Complete this question by entering your answers in the tabs below.

$ 486

50

14

(40)

510

$ (124)

View transaction list

2019

$ 597

1

24

Required:

1. What amount did Maur report in its balance sheet related to the pension plan at June 30, 2020?

2. When calculating pension expense at June 30, Maur included $10 million in its income statement as the amortization of

unrecognized net actuarial loss (net loss-AOCI). This AOCI account had a balance of $250 million at the beginning of the year and

was the only AOCI account related to pensions. What was the average remaining service life of employees as of 2020?

3. What was the pension expense?

4. What were the appropriate journal entries to record Maur's pension expense and to record gains and/or losses related to the

pension plan?

27

(40)

$ 609

$421

42

64

(40)

487

$ (122)

What were the appropriate journal entries to record Maur's pension expense and to record gains and/or losses related to the pension

plan?

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in

millions. (i.e., 10,000,000 should be entered as 10). Do not round intermediate calculations. Round your final answer to nearest whole

number.

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- nkt.2arrow_forwardCalculate the amount that J&J’s retirement fund obligations are underfunded as of each year-end. How much of the underfunding is reported on the company’s balance sheet?arrow_forwardIvanhoe Corp. provides the following information about its post-retirement health-care benefit plan for the year 2020: Current service cost Contribution to the plan Actual return on plan assets Benefits paid Plan assets at January 1, 2020 Defined post-retirement benefit obligation at January 1, 2020 Discount rate (a) $204,500 Post-retirement benefit expense $ 47,750 141,950 91,000 1,597,600 1,823,100 11% Assuming Opsco follows IFRS, calculate the post-retirement benefit expense for 2020.arrow_forward

- On January 1, 2021, Pharoah Co. has the following balances: Projected benefit obligation Fair value of plan assets Service cost The settlement rate is 11%. Other data related to the pension plan for 2021 are: $3700000 Benefits paid Actual return on plan assets Amortization of net gain 3200000 Amortization of prior service costs due to increase in benefits Contributions O $3644000. O $3890000. O $4115000. O $3700000. The fair value of plan assets at December 31, 2021 is $320000 108000 520000 245000 415000 34000arrow_forwardHaresharrow_forwardEmployee benefitsarrow_forward

- Determining Pension Expense The following information pertains to Qdobe Corporation’s defined benefit pension plan for 2020. Service cost $512,000 Actual and expected gain on plan assets 112,000 Actuarial loss on PBO incurred during 2020 128,000 Amortization of unrecognized prior service cost 16,000 Annual interest on pension obligation 160,000 What amount should Qdobe report as pension expense in its 2020 income statement? Assume no beginning balance in Accumulated OCI—Pension Gain/Loss. Pension expense, 2020arrow_forwardA-1arrow_forwardThe following information relates to the defined benefit pension plan of Nelson, Inc. Projected benefit obligation Fair value of plan assets Accumulated OCI-net actuarial gain Settlement rate (for year) Expected rate of return (for year) The interest cost for 2020 is $158,640 $211,520 12/31/19 2,644,000 3,118,000 432,000 O $240,120 O $280,140 O None of the above 6% 8% 12/31/20 4,002,000 3,328,000 480,000 For 2020, Nelson estimates that the average remaining service life of its current employees is 8 years. Nelson's contribution to the plan was $364,000 in 2020 and benefits paid to retirees were $276,000, 6% 7%arrow_forward

- Pension data for Sterling Properties include the following: Service cost, 2024 Projected benefit obligation, January 1, 2024 Plan assets (fair value), January 1, 2024 Prior service cost-AOCI (2024 amortization, $8) Net loss-AOCI (2024 amortization, $2) Interest rate, 5% Expected return on plan assets, 9% Actual return on plan assets, 10% Required: ($ in thousands) $ 125 660 700 90 111 Assume Sterling Properties prepares its financial statements according to International Financial Reporting Standards (IFRS). The interest rate on high-grade corporate bonds is 5%. Determine the net pension cost. Note: Enter your answer in thousands (i.e., 10,000 should be entered as 10). Answer is complete but not entirely correct. Net pension cost $ 105 thousand Assessment Tool iFramearrow_forwardThe following information relates to the pension plan for the employees of Blossom Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) 1/1/25 $7940000 8465000 7625000 O $26250. O $17456. O $20238. O $14188. 0 12/31/25 $8360000 9158000 9620000 (1382000) 11% 8% 12/31/26 $11300000 12707000 10754000 (1550000) 11% 7% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1323000 in 2026 and benefits paid were $987000. The amount of AOCI (net gain) amortized in 2026 isarrow_forwardOnly typed solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education