FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate the amount that J&J’s retirement fund obligations are underfunded as of each year-end. How much of the underfunding is reported on the company’s

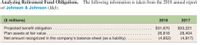

Transcribed Image Text:Analyzing Retirement Fund Obligations. The following information is taken from the 2018 annual report

of Johnson & Johnson (J&J):

($ millions)

2018

2017

Projected benefit obligation

$31,670

$33,221

Plan assets at fair value.

26,818

28,404

Net amount recognized in the company's balance sheet (as a liability).

(4,852)

(4,817)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information relates to the pension plan for the employees of Cullumber Co.: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) O $665200 gain. O $282200 loss. 1/1/20 $110600 gain. $272400 gain. $8140000 8665000 7825000 -0- $ 12/31/20 8560000 9358000 9820000 (1402000 ) 11% 8% 12/31/21 $ 11500000 12907000 10954000 (1570000 ) 11% Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $1213000 in 2021 and benefits paid were $877000. The unexpected gain or loss on plan assets in 2021 is 7%arrow_forwardCullumber Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2025 in which no benefits were paid. 1. 2. 3. 4. The actuarial present value of future benefits earned by employees for services rendered in 2025 amounted to $55,700. The company's funding policy requires a contribution to the pension trustee amounting to $144,323 for 2025. As of January 1, 2025, the company had a projected benefit obligation of $894,700, an accumulated benefit obligation of $792,500, and a debit balance of $402,000 in accumulated OCI (PSC). The fair value of pension plan assets amounted to $601,400 at the beginning of the year. The actual and expected return on plan assets was $54,300. The settlement rate was 9%. No gains or losses occurred in 2025 and no benefits were paid. Amortization of prior service cost was $49,800 in 2025. Amortization of net gain or loss was not required in 2025.arrow_forwardThe following Incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions) Debit (Credit) Beginning balance Service cost Interest cost Expected return on assets Gain/loss on assets Amortization of: Prior service cost Net gain/loss Loss on PBO Contributions to fund Retiree benefits paid Ending balance What was the actuary's Interest (discount) rate? Multiple Choice O 17% PBO (300) (12) Prior Plan Service Net Pension Net Pension Assets Cost (Gain)/Loss Expense Cash (Liability)/Asset 43 (185) 83 (88) 866 (11) (5) 6 (96) 77 51 (60)arrow_forward

- Based upon this information, how would I make the following journal entries? Record annual pension expense. Record the change in plan assets. Record the change in the PBO. Record the cash contribution to plan assets. Record the retiree benefits paid.arrow_forwardA company that sponsors a defined benefit plan records an entry to debit OCI-Pension Gain/Loss for $5,000 and credit Plan Assets. The company uses the corridor approach to amortize Accumulated OCI-Pension Gain/Loss. This entry indicates that Select one: O a. The expected return on plan assets exceeded actual return on plan assets. O b. The actual return on plan assets exceeded the expected return on plan assets. O c. The beginning balance in Accumulated OCI-Pension Gain/Loss exceeded the corridor. O d. The beginning balance in Accumulated OCI-Pension Gain/Loss did not exceed the corridor. e. a and c f. b and d OOarrow_forward2arrow_forward

- What is the fair value of the plan assets at December 31?arrow_forwardWarrick Boards calculated pension expense for its underfunded pension plan as follows: ($ in millions) Service cost $ 224 Interest cost 150 Expected return on the plan assets ($100 actual, less $10 gain) (90 ) Amortization of prior service cost 8 Amortization of net loss 2 Pension expense $ 294 Required: Which elements of Warrick’s balance sheet are affected by the components of pension expense? What are the specific changes in these accounts?arrow_forwardWhat amount should Webb Company contribute in order to report an accrued liability for retirement benefit cost of P200,000 in its December 31, 2005 balance sheet? Webb Company implemented a defined benefit plan for its employees on January 1, 2002. During 2002 and 2003, Webb's contributions fully funded the plan. The following data are provided for 2004 and 2005: 2005 estimated 2004 actual Projected benefit obligation, 12/31 Accumulated benefit obligation, 12/31 Plan assets at fair value Projected benefit obligation in excess of plan assets Retirement benefit expense Employer's contribution P7,500,000 5,200,000 6,750,000 P7,000,000 5,000,000 6,000,000 750,000 900,000 ? 1,000,000 800,000 500,000 (a) P1,000,000 (b) P700,000 (c) P600,000 O (d) P500,000arrow_forward

- The interest on the defined benefit obligation component of defined benefit expense reflects the incremental borrowing rate of the employer. is the current market rate. may be stated implicitly or explicitly when reported. is the same as the expected return on plan assets.arrow_forwardPkease Do not Give image format Note .Prepare a partial income statement and balance sheet for the pension expense. *The pension expense on the Income statement is not $133,470.arrow_forwardWhat is the net periodic pension cost for the year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education