Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

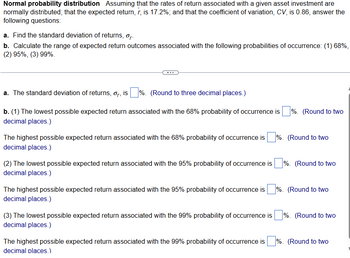

Transcribed Image Text:Normal probability distribution Assuming that the rates of return associated with a given asset investment are

normally distributed; that the expected return, r, is 17.2%; and that the coefficient of variation, CV, is 0.86, answer the

following questions:

a. Find the standard deviation of returns, or.

b. Calculate the range of expected return outcomes associated with the following probabilities of occurrence: (1) 68%,

(2) 95%, (3) 99%.

a. The standard deviation of returns, or, is

%. (Round to three decimal places.)

b. (1) The lowest possible expected return associated with the 68% probability of occurrence is %. (Round to two

decimal places.)

The highest possible expected return associated with the 68% probability of occurrence is

decimal places.)

(2) The lowest possible expected return associated with the 95% probability of occurrence is

decimal places.)

%. (Round to two

%. (Round to two

The highest possible expected return associated with the 95% probability of occurrence is

decimal places.)

%. (Round to two

(3) The lowest possible expected return associated with the 99% probability of occurrence is

decimal places.)

%. (Round to two

The highest possible expected return associated with the 99% probability of occurrence is

decimal places.)

%. (Round to two

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assuming that the rates of return associated with a given asset investment are normally distributed; that the expected return, r, is 18.7%; and that the coefficient of variation, CV, is 1.88, answer the following questions: a. Find the standard deviation of returns, sigma Subscript rσr. b. Calculate the range of expected return outcomes associated with the following probabilities of occurrence: (1) 68%, (2) 95%, (3) 99%.arrow_forwardSupposing the return from an investment has the following probability distribution Return Probability R (%) 8 0.2 10 0.2 12 0.5 14 0.1 Required: What is the expected return of the investment? What is the risk as measured by the standard deviation of expected returns?arrow_forwardThe expected rate of return of an investment ________. a. equals one of the possible rates of return for that investment b. equals the required rate of return for the investment c. is the mean value of the probability distribution of possible returns d. is the median value of the probability distribution of possible returns e. is the mode value of the probability distribution of possible returnsarrow_forward

- The probability distributions of expected returns for the assets are shown in the following table: Asset A Prob Return 0.2 -5% 0.4 10% 0.4 15% a) Calculate the expected return for asset A. b) Calculate the standard deviation for asset A.arrow_forwardAssuming the following returns and corresponding probabilities for Asset D: Rate of Return Probability 10% 30% 15% 40% 20% 30% Compute for: a. Expected rate of return b. The standard deviation c. The coefficient of variationarrow_forwardAn asset has normally-distributed returns, with mean of 10.6% and standard deviation of 14.8%. What is the 2% VaR (value at risk) return? Enter answer in percents.arrow_forward

- Calculate the (a) expected return, (b) standard deviation, and (c) coefficient of variation for an investment with the following probability distribution: Probability Payoff 0.45 32.0% 0.35 -4.0% 0.20 -20.0%arrow_forwardPlease answer all parts (a-d) with explanations thx.arrow_forwardSuppose the average return on Asset A is 6.6 percent and the standard deviation is 8.6 percent and the average return and standard deviation on Asset B are 3.8 percent and 3.2 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.25 percent. How likely is it that such a low return will recur at some point in the future? (Do…arrow_forward

- The expected value, standard deviation of returns, and coefficient o below.) \table[[Asset A],[Possible Outcomes,Probability,Returns (%)arrow_forwarduppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forwardWhat are the (a) expected return, (b) standard deviation, and (c) coefficient of variation for an investment with the following probability distribution? Probability Payoff 0.2 19.0% 0.7 9.0 0.1 4.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education