FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Net income and

Four different corporations, Amber, Blue, Coral, and Daffodil, show the same

| Total Asset | Total Liabilities | |

| Beginning of the year | $ 1,220,000 | $ 990,000 |

| End of the year | 1,730,000 | 1,150,000 |

On the basis of the preceding data and the following additional information for the year,

determine the net income (or loss) of each company for the year. (Hint: first determine the amount of increase or decrease in stockholders’ equity during the year.)

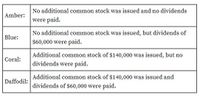

Transcribed Image Text:No additional common stock was issued and no dividends

were paid.

Amber:

No additional common stock was issued, but dividends of

Blue:

$60,000 were paid.

Additional common stock of $140,000 was issued, but no

dividends were paid.

Coral:

Additional common stock of $140,000 was issued and

dividends of $60,000 were paid.

Daffodil:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ssarrow_forwardShep Company's records show the following information for the current year. Beginning of year $ 50,800 $ 22,400 Total assets Total liabilities. End of year $ 81,000 $ 35,400 Determine net income (loss) for each of the following separate situations. Note: For all requirements, losses should be entered with a minus sign. a. Additional common stock of $3,400 was issued and dividends of $7,400 were paid during the current year. b. Additional common stock of $15,100 was issued and no dividends were paid during the current year. c. No additional common stock was issued and dividends of $12,400 were paid during the current year. a. Net income (loss) b. Net income (loss) c. Net income (loss)arrow_forwardA corporation has $91,000 in total assets, $30, 500 in total liabilities, and a $18,600 credit balance in retained earnings. What is the balance in the contributed capital accounts? Multiple Choice $79, 100 $49, 100 $60,500 $41,900arrow_forward

- Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Joel de Paris, Incorporated Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 111,000 200,000 1. Average operating assets 2. Margin 2. Turnover 2. ROI 3. Residual income $ 340,000 1,021,000 1,209,000 Total liabilities and stockholders' equity $ 2,494,000 $ 2,570,000 Beginning Balance $ 132,000 343,000 577,000 788,000 405,000 249,000 $ 2,494,000 $ 5,208,000 4,322,640 885,360 311,000 $ 574,360 % % $ 380,000 1,021,000 1,093,000 Ending Balance The company paid dividends of $458,360 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of…arrow_forwardFor Year 1, the Sacramento Corporation had beginning and ending Retained Earnings balances of $157,900 and $210,400 respectively. Also during Year 1, the corporation declared and paid cash dividends of $24,800 and issued stock dividends valued at $15,000. Total expenses were $40,416. Based on this information, what was the amount of total revenue for Year 1? Multiple Choice $145,184 $117,716 $132,716 $133,100arrow_forwardOwearrow_forward

- Please help mearrow_forwardProvide answer this questionarrow_forwardAssume the following data for Cable Corporation and Multi-Media Incorporated. Multi-Media Incorporated Cable Corporation $ 39,800 352,000 409,000 $ 190,000 2,170,000 966,000 234,000 545,000 175,000 421,000 Net income Sales Total assets Total debt Stockholders' equity a. 1. Compute return on stockholders' equity for both firms. Note: Input your answers as a percent rounded to 2 decimal places. Cable Corporation Multi-Media, Incorporated 2. Which firm has the higher return? Return on Stockholders' Equity % %arrow_forward

- The comparative financial statements prepared at December 31, Year 2, for Goldfish Company showed the following summarized data: Statement of Earnings Sales revenue Cost of sales Gross profit Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Current liabilities (no interest) Long-term debt (interest rate: 10%) Common shares (6,000 shares) Retained earningst Year 2 Year 1 $367,950 $310,000 312,178 262,000 55,780 48,000 37,410 33,400 18,370 6,310 14,600 4,800 $ 12,060 $ 9,800 $ 4,270 $ 8,400 16,830 48,350 29,810 $ 99,260 $ 11,820 40,480 24,000 22,960 20,000 42,000 25,000 $ 95,400 $14,200 39,200 24,000 18,000 Required: 1 Complete the following columns for each item in the comparative financial statements (Negative answers should be indicated by a minus sign. Round percentage answers to 2 decimal places, Le., 0.1243 should be…arrow_forwardWhat is the most likely consequence of unethical behaviours by management accountants? Satisfied suppliers Customers paying less for products Resource allocation from the budgeting process in organisations being done inequitably Employees experiencing higher job satisfactionarrow_forwardThe balance sheet for the Capella Corporation is as follows: Assets Liabilities and Shareholders' Equity Current assets $ 300 Current liabilities $ 110 Net fixed assets 1, 200 Long-term debt 500 Shareholders' equity 890 Total assets $ 1,500 Total liabilities and shareholders' equity $ 1, 500 What is the Net Working Capital for Capella Corporation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education