FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

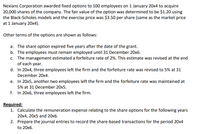

Transcribed Image Text:Nexians Corporation awarded fixed options to 100 employees on 1 January 20x4 to acquire

20,000 shares of the company. The fair value of the option was determined to be $1.20 using

the Black-Scholes models and the exercise price was $3.50 per share (same as the market price

at 1 January 20x4).

Other terms of the options are shown as follows:

a. The share option expired five years after the date of the grant.

b. The employees must remain employed until 31 December 20x6.

c. The management estimated a forfeiture rate of 2%. This estimate was revised at the end

of each year.

d. In 20x4, three employees left the firm and the forfeiture rate was revised to 5% at 31

December 20x4.

e. In 20x5, another two employees left the firm and the forfeiture rate was maintained at

5% at 31 December 20x5.

f. In 20x6, three employees left the firm.

Required:

1. Calculate the remuneration expense relating to the share options for the following years

20x4, 20x5 and 20x6.

2. Prepare the journal entries to record the share-based transactions for the period 20x4

to 20x6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nexians Corporation awarded fixed options to 100 employees on 1 January 20x4 to acquire 20,000 shares of the company. The fair value of the option was determined to be $1.20 using the Black-Scholes models and the exercise price was $3.50 per share (same as the market price at 1 January 20x4). Other terms of the options are shown as follows:a. The share option expired five years after the date of the grant.b. The employees must remain employed until 31 December 20x6.c. The management estimated a forfeiture rate of 2%. This estimate was revised at the end of each year.d. In 20x4, three employees left the firm and the forfeiture rate was revised to 5% at 31 December 20x4.e. In 20x5, another two employees left the firm and the forfeiture rate was maintained at 5% at 31 December 20x5.f. In 20x6, three employees left the firm. Required:1. Calculate the remuneration expense relating to the share options for the following years 20x4, 20x5 and 20x6.2. Prepare the journal entries to record the…arrow_forwardOn 1 May 20X4 XYZ invests in 18456 call options for Fantasy Travel Limited shares. The options have an exercise price of $100 per share, and will expire on 30 April 20X6. Price premium for each option is $25. Fantasy Travel Limited's shares price on 1 May 20X4 is $132. The balance sheet date for XYZ Ltd is 30 June. XYZ Ltd accounts for its financial instruments using fair value through profit and loss. Other data: Date 30 June 20X4 30 June 20X5 30 April 20X6 Share Price 146 131 150 Option price 34 24 43 What is the value of the options at the time when XYZ Ltd exercises the options on 30 April 20X6? PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS WITH NO COMMAS OR DOLLAR SIGNS (EG $1,000,000 SHOULD BE SHOWN AS 1000000; -$1,000,000 SHOULD BE SHOWN AS -1000000).arrow_forwardOn March 1, 2025, Ferguson Corp. purchased a put option on shares of SST stock. The contract was for 100 shares at a strike price of $120 per share, with an expiration date of May 31, 2025. Ferguson settled the option on May 5 (assume cash settlement). Additional information pertaining to the option is provided below. March 1 March 31 May 5 Price of SST stock: $120 $110 $115 Time value of option: $30 $20 $10 Required: 1. Compute the cost of the option paid by Ferguson Corp. on March 1, 2025. 2. Compute the balance of the option account on date of settlement.arrow_forward

- On January 1 of Year 1, Holiday Inc. offered a stock option incentive plan to a top executive. The plan provided the executive 300 stock options for Holiday Inc. $1 par value, common stock at an option price of $15 per share through the expiration date of January 1 of Year 7. The fair value of the options based upon an option-pricing model on January 1 of Year 1, is $9,000. The market price at year-end of Holiday Inc. stock is $15 per share on January 1 of Year 1, and $18 on December 31 of Year 1. The requisite service period is 3 years. The options were not exercised due to the stock price remaining below $15 per share after the vesting period. Record the entry on January 1 of Year 7 for the expiration of the stock options. Note: If a line in a journal entry isn't required for the transaction, select "N/A—debit" and "N/A—credit" as the account names and leave the Dr. and Cr. answers blank (zero).arrow_forwardCullumber Imited purchased 45, 100 call options during the year. The options give the company the right to buy its own common shares for $9 each. The average market price during the year was $11 per share. Assume that Cullumber also wrote pur options that allow the holder to sell 45, 100 of culumbet's shares to cullumber at $13 per sharearrow_forwardABC Corporation acquired an option to buy 5,000 shares of XYZ Corp. at a strike price of P300 on a later date. ABC paid a premium of P4,000. On the last day of the option, an XYZ Corp. stock is selling at P280 each. If ABC will be acquiring the XYZ stocks, how much should it pay?arrow_forward

- Under its executive stock option plan, National Corporation granted 12 million options on January 1, 2018, thatpermit executives to purchase 12 million of the company’s $1 par common shares within the next six years, butnot before December 31, 2020 (the vesting date). The exercise price is the market price of the shares on the dateof grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 peroption. No forfeitures are anticipated. Ignoring taxes, what is the total compensation cost pertaining to the stockoptions? What is the effect on earnings in the year after the options are granted to executives?arrow_forwardUnder its executive stock option plan, Mining Co. granted options on January 1, 2021, that permit executives to purchase 15 million of the company's $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $22 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. The options are exercised on April 2, 2024, when the market price is $21 per share. By what amount will the shareholders' equity increase when 100% of those options are exercised? O $60 million $270 million O $315 million. O $330 millionarrow_forwardAylmer Inc paid $230 for a call to purchase 800 shares of Belmont Inc on April 1, Y3. The strike price was $28.50 per share and could be exercised anytime in the next 6 months. On April 1, Y3, the market price for one share of Belmont Inc. was $29.30. Belmont's stock price rose. On June 30, Y3, the price for Belmont stock was $36.10 per share. The fair value of the option on June 30, Y3 was $8,340. REQUIRED Prepare the appropriate entries under two different scenarios: 1) Aylmer exercised the option 2) Aylmer did not exercise the option (just the June 30th entry)arrow_forward

- On May 1, 2020, Sunco Limited purchased a call option from Moonco Corporation. The option gave Sunco the right to purchase shares in a third company, Galaxy Company. Sunco settled the options in cash on June 16, 2020. Following are additional details pertaining to the option: Number of shares that can be purchased with the call option 7,400 Call option exercise price per share $ 10.03 Market price per share of Galaxy Company on May 1, 2020 $ 10.03 Price paid by Sunco to purchase the option $ 1,800 Market price per share of Galaxy Company on May 31, 2020 $ 11.24 Fair value of call option on May 31, 2020 $ 9,200 Market price per share of Galaxy Company on June 16, 2020 $ 11.29 Fair value of call option on June 16, 2020 $ 8,800 Sunco has a year end of May 31. Required: Prepare the journal entries required on the books of Sunco Limited on each of the…arrow_forwardCompany A has issued stock options to an employee that vest based on only continued service in installments. The employee was granted 300 options, 100 vest if the employee continues in service for one year, a further 100 vest after two years and the final 100 vest after three years. The fair value of the options is $9 per share. The company has determined that the service period for purposes of attributing the expense to the period of service is three years. What would be the amortization expense in the second year of the arrangement under IFRS? a. $900 b $1,650 c. $1,800 d. $750arrow_forwardIvanhoe Corp. purchased a put option on Mykia common shares on July 7, 2020, for $468. The put option is for 350 shares, and the strike price is $50. The option expires on January 31, 2021. The following data are available with respect to the put option: Fair Value Market Price Date of Option of Mykia Shares Sept. 30, 2020 $230 $58 per share Dec. 31, 2020 $97 $60 per share Jan. 31, 2021 $0 $64 per share Prepare the journal entries for Miller Co. for the following dates. (a) July 7, 2020—Investment in call option on Wade shares. (b) September 30, 2020—Miller prepares financial statements. (c) December 31, 2020—Miller prepares financial statements. (d) January 4, 2021—Miller settles the call option on the Wade sharesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education