Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

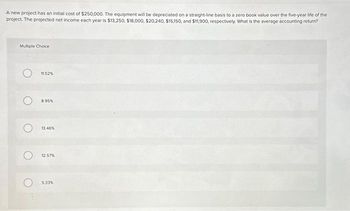

Transcribed Image Text:A new project has an initial cost of $250,000. The equipment will be depreciated on a straight-line basis to a zero book value over the five-year life of the

project. The projected net income each year is $13,250, $18,000, $20,240, $15,150, and $11,900, respectively. What is the average accounting return?

Multiple Choice

11.52%

8.95%

13.46%

12.57%

5.33%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forward1. An analyst offers three investment alternatives with the initial investment of A= $200,000; B= $300,000 and C= $100,000. The net annual income for these alternatives over the next 10 years includes $40,000; $55,000 and $19,000 respectively. Use IRR to choose the best alternative. MARR= 10% and no salvage values after 10 years.arrow_forwardA tunnel to transport water initially cost $1,000,000 and has expected maintenance costs that will occur in a 6-year cycle as shown below, assume MARR is 5% per year. End of Year: 2 4 6. Maintenance: $35,000 $35,000 $35,000 $45,000 $45,000 $60,000 Compute the Equivalent Annual Cost of the maintenance. Hint: Don't insert the negative sign Compute the Capitalized Cost? Hint: Don't insert the negative signarrow_forward

- [The following information applies to the questions displayed below.} Project Y requires a $313,500 investment for new machinery with a four-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Project Y $ 380,000 170, 240 78, 375 27,000 $ 104,385 3. Compute Project Y's accounting rate of return. Project Y Numerator: Accounting Rate of Return Denominator: Accounting Rate of Return 0arrow_forwardUsing the table in Exercise 10, calculate the net present value for each project shown below at the end of six years and determine which would be the better decision for Mike’s Camping Supply. Assume that Project 1 can be sold for $15,000 at the end of the sixth year. Project 1 Project Cost $160,000 Cost $150,000 Minimum desired rate of return 12% Minimum desired rate of return 12% Expected useful life 7 years Expected useful life 6 years Yearly cash flows to be received: Yearly cash flows to be received: Year 1…arrow_forwardA project that cost $72000 has a useful life of 5 years and a salvage value of $3000. The internal rate of return is 12% and the annual rate of return is 18%. The annual net income isarrow_forward

- Engineering economy - ENGR 3322 A new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the internal rate of return of the project a. 7% b. 8% c. 9% d. None of the choicesarrow_forwardRequired information [The following information applies to the questions displayed below.] Project Y requires a $331,500 investment for new machinery with a five-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1. EV of $1. PVA of $1. and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Annual Amounts Sales of new product Expenses Project Y Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income 3. Compute Project Y's accounting rate of return. Numerator: Accounting Rate of Return Denominator: Project Y $ 400,000 179,200 66,300 29,000 $ 125,500 Accounting Rate of Returnarrow_forwardNonearrow_forward

- A project will produce an operating cash flow of $18,000 a year for 8 years. The initial fixed asset investment in the project will be $75,000. The net aftertax salvage value is estimated at $11,250 and will be received during the last year of the project's life. What is the IRR? A. 18.57% B. 16.71% C. 17.08% D. 18.94% E. 17.83%arrow_forwardI need help solving this problemarrow_forwardThree mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At the conclusion of the useful life, the investment will be sold. A decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation using the PW method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education