ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

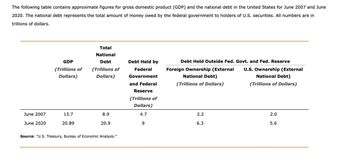

Transcribed Image Text:Net public debt is the portion of the national debt that is held outside the federal government and the Federal Reserve System. In June 2007, the net

public debt as a percentage of total national debt was

In June 2007, the percentage of the U.S. national debt held by foreigners (external national debt) was

The fraction of the national debt held by foreigners will eventually need to be repaid to foreigners, thereby reducing the collective purchasing power of

Americans. Between 2007 and 2020, the fraction of the national debt held by foreigners

The absolute level of the debt does not necessarily provide a clear indication of a nation's debt burden. Thus, economists often look at relative

measures of the national debt. One possible relative measure of the national debt is the federal debt held by the public (outside the federal

government and the Federal Reserve) as a percentage of GDP. In 2007, publicly held debt was

of GDP. Between 2007 and 2020, publicly

held debt as a percentage of GDP

Transcribed Image Text:The following table contains approximate figures for gross domestic product (GDP) and the national debt in the United States for June 2007 and June

2020. The national debt represents the total amount of money owed by the federal government to holders of U.S. securities. All numbers are in

trillions of dollars.

June 2007

June 2020

GDP

(Trillions of (Trillions of

Dollars)

Dollars)

13.7

Total

National

Debt

20.89

8.9

20.9

Source: "U.S. Treasury, Bureau of Economic Analysis."

Debt Held by

Federal

Government

and Federal

Reserve

(Trillions of

Dollars)

4.7

9

Debt Held Outside Fed. Govt. and Fed. Reserve

Foreign Ownership (External U.S. Ownership (External

National Debt)

National Debt)

(Trillions of Dollars)

(Trillions of Dollars)

2.2

6.3

2.0

5.6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using the figures provided in Table 2, calculate the national debt as a percentage of GDP for 2008. 10.14% 59.86% 68.48% $28,333 $47,333 Table 2: Macroeconomic Summary 2008 2009 GROSS DOMESTIC PRODUCT $14,200,000,000,000 $13,800,000,000,000 EMPLOYED BUDGET SURPLUS/DEFICIT NATIONAL DEBT POPULATION POTENTIAL LABOR FORCE LABOR FORCE UNEMPLOYED $450,000,000,000 $1,400,000,000,000 $8,500,000,000,000 $9,450,000,000,000 300,000,000 305,000,000 250,000,000 255,000,000 157,000,000 154,500,000 148,000,000 140,000,000 9,000,000 14,500,000arrow_forwardThe following describes some key variables regarding public debt in the UK. Debt to output is 95%, the growth rate of output is 1.2%, and the interest rate on debt is 1.5%. a) What is the primary surplus the government has to run as a percentage of output to ensure a stable debt to output ratio if there is no seigniorage from printing money? b) How would your answer change if you know that the increase in real money balances as a percentage of output is 0.8% per year? c) Assuming, again, no seigniorage what is the primary surplus the government needs to run to ensure that the level of government debt is constant? d) Explain briefly what the concept of "cyclically adjusted budget deficit" is and why is it relevant?arrow_forwardThis is from a practice worksheet. Please help mearrow_forward

- In discussing debt growth the article Debt - What Is and Should Never Be, found that by each seceding decade from 1950 the ratio of increase in Debt and increase in GDP: a) Was fairly constant over the time discussed b) Increased in each succeeding decade Oc) There was no relationship of the growth in debt to the growth in GDP ratio over time d) The Debt to GDP ratio fellarrow_forwardSuppose that the amount of taxes in the US is equal to $1800. Suppose that the government expenditures is equal to $1800. In addition, you know that the current level of debt in the US is equal to $380000 (all numbers in billions of domestic currency). Given this data, what is the new level of the US's debt? $ Hint ow Transcribed Text $ Suppose that the amount of taxes in Slovenia is equal to 1300. Suppose that the government expenditures are equal to 1700 (All numbers in billions of domestic currency) Given this data, what can you say about Slovenia's budget? What is the size of Slovenia's deficit? Hint ow Transcribed Text 4 3 Consider the following statistics for banking sector in Mexico displayed in the table below (all numbers in billions of domestic currency). Coins and Currency in Circulation Checkable Deposits Traveler's Checks Hint 1400 1 1900 Savings Accounts 8600 Money Market Mutual Funds 500 Time Deposits 600 Using the data above, calculate M2 for Mexico. Use the new…arrow_forwardConsider the government debt at the beginning of the year 2010 equals $2 000, the annual interest rate on the government debt – 8%. Government expenditures over the current year 2010 equal $1 500, government transfers - 20% of output. Government income is 40% of output. Calculate the government debt burden (government debt to total output) at the end of the current year 2010 if the output equals $5 000.arrow_forward

- U.S. budget deficit widens In the fiscal year 2019, the projected U.S. federal government deficit totaled $960 billion, which is 23.2 percent higher than a year earlier. Source: Congressional Budget Office, August 21, 2019 Given the information in the news clip, what was the total change in U.S. national debt during the fiscal years 2018 and 2019? The budget deficit in 2018 was $ 779 billion. ... During Fiscal 2018 and Fiscal 2019, the national debt by $ billion.arrow_forwardThe following table shows the approximate value of exports and imports for the United States from 2006 through 2010. Complete the table by calculating the surplus or deficit both in absolute (dollar) terms and as a percentage of GDP. If necessary, round your answers to the nearest hundredth. Year GDP Exports Imports Exports – Imports Exports – Imports (Billions of dollars) (Billions of dollars) (Billions of dollars) (Billions of dollars) (Billions of Dollars) (Percentage of GDP) 2006 13,399.00 1,471.00 2,240.30 -769.30 -5.74 2007 14,062.00 1,661.70 2,375.70 -714.00 -5.08 2008 14,369.00 1,843.40 2,553.80 -710.40 -4.94 2009 14,119.00 1,578.40 1,964.70 -386.30 -2.74 2010 14,660.00 1,837.50 2,353.90 -516.40 -3.52 Step 3 In 2006, Net Exports = $1471.0 - $2240.30 = -$769.30. Net Exports as percentage of GDP = -769.30 / 13399 * 100 = - 5.74% Similarly has been calculated for other years Between 2007 and 2008, the _____________ in dollar terms and…arrow_forwardFor each of the descriptions below, decide whether it applies to a deficit, a surplus or the public debt. Deficit Surplus Public Debt Is calculated using factors The amount by which annual including treasury bills, notes, government revenues exceed expenditure. and bonds. Experienced by the U.S. federal government between 1998-2001, but rarely occurs in the modern American economy. Occurs when the cost of additional government programs exceed additional government income. The amount that government spending exceeds tax revenue.arrow_forward

- Now suppose that the gross national debt initially is equal to $2.5 trillion and the federal government then runs a deficit of $100 billion. What is the new level of gross national debt? If 100 percent of this deficit is financed by the sale of securities to the public, what happens to the level of debt held by the public? What happens to the level of gross debarrow_forwardEconomicsarrow_forwardCompare GDP, Debt per GDP and number of employed people for the largest nation on each continent (except Antarctica). Comment on the differences - estimate the national debt per capita in each nation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education