FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

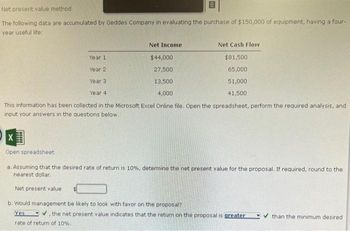

Transcribed Image Text:Net present value method

The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of equipment, having a four-

year useful life:

Year 1

Year 2

DO

Net Income

Net present value

$44,000

27,500

Year 3.

13,500

Year 4

4,000

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and

input your answers in the questions below.

Net Cash Flow

$81,500

65,000

51,000

41,500

X

Open spreadsheet

a. Assuming that the desired rate of return is 10%, determine the net present value for the proposal. If required, round to the

nearest dollar.

b. Would management be likely to look with favor on the proposal?

Yes

✔, the net present value indicates that the return on the proposal is greater

rate of return of 10%.

than the minimum desired

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data are accumulated by Geddes Company in evaluating the purchase of $120,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $49,500 $79,500 Year 2 29,000 59,000 Year 3 16,500 46,500 Year 4 6,500 36,500 This information has been collected in the Microsaft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. K) Open spreadsheet a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollac. Net present value b. Would management be likely to look with favor on the propesal? the net present value indicates that the return on the proposal is than the minimum desired rate of retum of 15%arrow_forwardHaresharrow_forwardCurrie Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift.would be leased on an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Currie would sell it at the end of the fifth year of its useful life. The expected cash inflows and outflows follow: Nature of Item Purchase price Cash Outflow $99,000 Year Cash Inflow Year 1 Year 1 $40,000 40,000 29,000 Revenue Year 2 Revenue Year 3 Revenue Major overhaul Revenue 10,000 Year 3 Year 4 Year 5 Year 5 26,000 24,000 8,800 es Revenue Salvage value Required a.&b. Determine the payback period using the accumulated and average cash flows approaches. (Round your answers to 1 decimal place.) a. Payback period (accumulated cash flows) b. Payback period (average cash flows) years yearsarrow_forward

- Give correct solutionarrow_forwardKnowledge Check A purchase of a backhoe with an 8-year life requires an initial investment of $88,300, has positive cash flows of $10,000 per year, and has an estimated salvage value of $21,700. Indicate the inputs to be entered into the financial calculator keys. What is the return of the investment? (Round internal rate of return to two decimal places (e.g., 52.75%).) Inputs Calculator Keys IRR N 8 -2.143 % ? | PV 88300 i PMT 10000 FVarrow_forwardNet present value method The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $40,000 $77,500 Year 2 30,000 67,500 Year 3 16,500 54,000 Year 4 2,000 39,500 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value $ Would management be likely to look with favor on the proposal? , the net present value indicates that the return on the proposal is than the minimum desired rate of return of 15%.arrow_forward

- You have been assigned to check the valuation of InfoSystems, a software firm, done by a colleague of you. Infosystems has an expected life 5 years, constant cash flows over this period, and zero salvage value. The income statement of the Infosystems is given as follows: Revenues - Operating Expenses EBIT - Interest expenses Taxable Income - Taxes Net Income Years 1-5 €1,000 €550 €450 €85 €365 €146 €219 Infosystems has no capital expenditures, depreciation or working capital needs, i.e. the earnings are the cash flows to the firm. The cost of capital is 10% i. Estimate the value of Infosystems. ii. Assume that the value derived in (i) is the one also estimated by your colleague. How would you change your calculations if you are given that the cash flows are real cash flows and the cost of capital is the nominal cost of capital. The expected inflation rate is 2% annually. Comment on your answer.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardhslarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education