Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

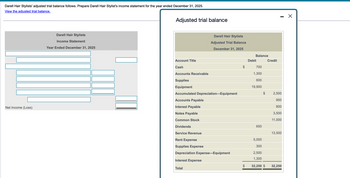

Transcribed Image Text:Darell Hair Stylists' adjusted trial balance follows. Prepare Darell Hair Stylist's income statement for the year ended December 31, 2025.

View the adjusted trial balance.

Net Income (Loss)

Darell Hair Stylists

Income Statement

Year Ended December 31, 2025

Adjusted trial balance

Darell Hair Stylists

Adjusted Trial Balance

December 31, 2025

Account Title

Cash

Accounts Receivable

Supplies

Equipment

Accumulated Depreciation Equipment

Accounts Payable

Interest Payable

Notes Payable

Common Stock

Dividends

Service Revenue

Rent Expense

Supplies Expense

Depreciation Expense-Equipment

Interest Expense

Total

Balance

Debit

700

1,300

600

19,900

650

5,000

300

2,500

1,300

32,250 $

Credit

-

2,500

950

800

3,500

11,000

13,500

32,250

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please solve this question Financial data for Safety Hire as of 30 June 2019 are: Data Prepare an income statement for the month of June and a balance sheet in account format for Safety Hire as at 30 June 2019. Data available in the image thnkxarrow_forwardBalance sheet Optimum Weight Loss Co. offers personal weight reduction consultingservices to individuals. After all the accounts have been closed on November 30, 2019, the end of the fiscal year, the balances of selectedaccounts from the ledger of Optimum Weight Loss Co. are as follows: Prepare a classified balance sheet that includes the correct balance forCasharrow_forwardGuidelines: Construct a statement of comprehensive income for the years 2019 and 2020. Given is the 2-period Adjusted Trial Balancearrow_forward

- Beacon Signals Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Beacon Signals Company prepared the following end-ofperiod spreadsheet at December 31, 2019, the end of the fiscal year:Beacon Signals CompanyEnd-of-Period SpreadsheetFor the Year Ended December 31, 2019Unadjusted Trial Balance Adjustments Adjusted Trial BalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.Cash 13,000.00 13,000.00Accounts Receivable 40,500.00 (a) 12,500.00 53,000.00Prepaid Insurance 4,200.00 (b) 3,000.00 1,200.00Supplies 3,000.00 (c) 2,250.00 750.00Land 98,000.00 98,000.00Building 500,000.00 500,000.00Accumulated Depreciation-Building 255,300.00 (d) 9,000.00 264,300.00Equipment 121,900.00 121,900.00Accumulated Depreciation-Equipment 100,100.00 (e) 4,500.00 104,600.00Accounts Payable 15,700.00 15,700.00Salaries and Wages Payable (f) 4,900.00 4,900.00Unearned Rent 2,100.00 (g) 1,300.00 800.00Sarah Colin, Capital 238,100.00…arrow_forwardBeacon Signals Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Beacon Signals Company prepared the following end-ofperiod spreadsheet at December 31, 2019, the end of the fiscal year:Beacon Signals CompanyEnd-of-Period SpreadsheetFor the Year Ended December 31, 2019Unadjusted Trial Balance Adjustments Adjusted Trial BalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.Cash 13,000.00 13,000.00Accounts Receivable 40,500.00 (a) 12,500.00 53,000.00Prepaid Insurance 4,200.00 (b) 3,000.00 1,200.00Supplies 3,000.00 (c) 2,250.00 750.00Land 98,000.00 98,000.00Building 500,000.00 500,000.00Accumulated Depreciation-Building 255,300.00 (d) 9,000.00 264,300.00Equipment 121,900.00 121,900.00Accumulated Depreciation-Equipment 100,100.00 (e) 4,500.00 104,600.00Accounts Payable 15,700.00 15,700.00Salaries and Wages Payable (f) 4,900.00 4,900.00Unearned Rent 2,100.00 (g) 1,300.00 800.00Sarah Colin, Capital 238,100.00 238,100.00Sarah Colin, Drawing 10,000.00…arrow_forwardBeacon Signals Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Beacon Signals Company prepared the following end-ofperiod spreadsheet at December 31, 2019, the end of the fiscal year:Beacon Signals CompanyEnd-of-Period SpreadsheetFor the Year Ended December 31, 2019Unadjusted Trial Balance Adjustments Adjusted Trial BalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.Cash 13,000.00 13,000.00Accounts Receivable 40,500.00 (a) 12,500.00 53,000.00Prepaid Insurance 4,200.00 (b) 3,000.00 1,200.00Supplies 3,000.00 (c) 2,250.00 750.00Land 98,000.00 98,000.00Building 500,000.00 500,000.00Accumulated Depreciation-Building 255,300.00 (d) 9,000.00 264,300.00Equipment 121,900.00 121,900.00Accumulated Depreciation-Equipment 100,100.00 (e) 4,500.00 104,600.00Accounts Payable 15,700.00 15,700.00Salaries and Wages Payable (f) 4,900.00 4,900.00Unearned Rent 2,100.00 (g) 1,300.00 800.00Sarah Colin, Capital 238,100.00 238,100.00Sarah Colin, Drawing 10,000.00…arrow_forward

- Required: Prepare the necessary adjusting journal entries on June 30, 2020. [Narrations are not required] Prepare the Adjusted Trial balance for the period ending June 30, 2020.arrow_forwardBeacon Signals Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Beacon Signals Company prepared the following end-ofperiod spreadsheet at December 31, 2019, the end of the fiscal year:arrow_forwardComprehensive ProblemPrepare adjusting entries, post to ledger accounts, and prepare adjusted trial balance.Ben and Jerry started his own consulting firm, on June 1, 2021. The trial balance at June 30 is asfollows. Ben & Jerry ConsultantsTrial BalanceJune 30, 2021 Debit Credit Cash $ 6,850Accounts Receivable 7,000Supplies 2,000Prepaid Insurance 2,880Equipment 15,000Accounts Payable $ 4,230Unearned Service Revenue 5,200Common Stock 22,000Service Revenue 8,300Salaries and Wages Expense 4,000Rent Expense 2,000 $39,730 $39,730 1.Supplies on hand at June 30 total $720.2.A utility bill for $180 has not been recorded and will not be paid until next month.3.The insurance policy is for a year.4.Services were performed for $4,100 of unearned service revenue by the end of themonth.5.Salaries of $1,250 are accrued at June 30.6.The equipment has a 5-year life with no salvage value and is being depreciated at $250per month for 60 months.7.Invoices representing $3,900 of services performed during…arrow_forward

- Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2020: December 31, 2020 $3,500,000 Defined benefit obligation Fair value of plan assets 1,750,000 For 2020, the service cost is $210,000 and past service cost (effective Jan 1, 2020) is $100,000. During 2020, Pumpkin contributed $595,000 to the plan, and paid 89,000 to the retirees throughout the year. The actual return of the plan assets is $90,000. The company was also informed by the consulting firm that an actuarial gain of $750 should be reported. Pumpkin uses discount rates of 6%. Pumpkin uses the immediate recognition approach under IFRS. Instructions Please calculate Pumpkin's DBO and Plan Assets ending balance and net defined pension asset/liability by completing the following worksheet. No separate journal entry necessary.arrow_forwardC) Using the Adjusted trial balance, generate the statements requested by MNB, i.e. *A Multiple-step income statement & a Statement of owner’s equity for the year ended June 30, 2020 d) A Classified balance sheet, in report format, at June 30, 2020.arrow_forwardThe adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200$412 340 $412 340Profit for the periodRequired:a) Complete the worksheet.b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of theentity’s accounting period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College