FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

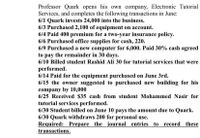

Transcribed Image Text:Professor Quark opens his own company, Electronic Tutorial

Services, and completes the following transactions in June:

6/1 Quark invests 24,000 into the business.

6/3 Purchased 2,100 of equipment on account.

6/4 Paid 400 premium for a two-year insurance policy.

6/6 Purchased office supplies for cash, 220.

6/9 Purchased a new computer for 6,000. Paid 30% cash agreed

to pay the remainder in 30 days.

6/10 Billed student Rashid Ali 30 for tutorial services that were

performed.

6/14 Paid for the equipment purchased on June 3rd.

6/15 the owner suggested to purchased new building for his

company by 10,000

6/25 Received $35 cash from student Mohammed Nasir for

tutorial services performed.

6/30 Student billed on June 10 pays the amount due to Quark.

6/30 Quark withdraws 200 for personal use.

Required: Prepare the _journal entries to

transactions.

record

these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject - account Please help me. Thankyou.arrow_forwardA potential employer needs Katie's permission to review her credit report. True False Previous Page #3 D C 54 $ L % 5 Next Page t acer 6 A 6 y & 7 Ö u *00 8 O ( 9 A O 0 3 L' Р Page 1 baarrow_forwardPurchase InvoiceFrom Repair Experts, $875 plus HST, for maintenance and repairs to the company’s equipment. what is journal?arrow_forward

- Need help with this questiin please. Thank youarrow_forwardHow do i record stationery taken by the owner for personal use amounting to R300 when physical stock shows R200arrow_forwardquestion is attached in the ss blow thanks for help thlatpatphat ha arepoacited it top4ipt4op 4itp 4iyp4 o o4i yarrow_forward

- Need a worksheet in excel form add interest expense - of 167.00 please.arrow_forwardtle=pccertified-professional-in-financial-accounting 5e33e716ef363&c=9&p=1 O New Tab 6 Currency Conversion O Silberline Intranet S.. @ https://www.comm... A SAP Health Declara. I Silberline Home ( Previous al Question 1/50 O 117 min 15 secs 2% 89% Done In October 2015 Utland sold some goods on sale or return terms for $2,500. Their cost to Utland was $1,500. The transaction has been treated as a credit sale in Utland's financial statements for the year ended 31 October 2015. In November 2015 the customer accepted half of the goods and returned the other half in good condition. What adjustments, if any, should be made to the financial statements? A. Sales and receivables should be reduced by $2,500, with no adjustment to closing inventory B. ) Sales and receivables should be reduced by $2,500, and closing inventory increased by $1,500. C. Sales and receivables should be reduced by $1,250, and closing inventory increased by $750 D. No adjustment is necessary Next O Mark For Review @…arrow_forwardM Inbox (909) - camillejeunei @gm i General (BSA 1-1: FAR 2) | Micro O FAR 2 LONG QUIZ /Pages/ResponsePage.aspx?id3DcYWpTercOUiPsQvdXclp-WXyu19p0dpLjDbGCXgjKqpURFVGNzZDSzZDWUhSWkRNTUoxTjBXNzhF The net income from January 1 to September 30, 2019 is P44,000. Also, on this date, cash and liabilities are P40,000 and P90,000, respectively. For Romans to receive P55,200 in full settlement of his interest in the firm, how much must be realized from the sale of the firm's non-cash assets? * Corinthians and Galatians decide to dissolve the partnership on September 30, 2021. neir capital balances and profit ratio on this date, follow: Capital Balances Profit Ratio Romans P50,000 40% Corinthians 60,000 Galatians 20,000 30% P196,000 P177,000 P193,000 国 INarrow_forward

- * 00 T 4. File Edit View History Bookmarks Window Help A ezto.mheducation.com Bb Welcome, Aury - Blackb... Close reading assignmen... t Center FEnglish essay - Google D... M MyOpenMath - Gradebook M Question 4 - Chapter 5-.. chapter 5 i Saved Help Save Lopez Company reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 480 units-160 from each of the last three purchases. 1 Beginning inventory 260 units @ $4.40 = $ 1,144 2,940 5,880 5,616 3,640 $ 19,220 Jan. Mar. 7 Purchase oints 560 units @ $5.25 1,200 units @ $4.90 = 1,080 units @ $5.20 = 560 units @ $6.50 = %3D July 28 Purchase Oct. 3 Purchase Skipped %3D Dec. 19 Purchase %3D Totals 3,660 units eBook Hint Determine the cost assigned to ending inventory and to cost of goods sold for the following. (Do not round intermediate calculations and round your answers to 2 decimal places.) Print References Ending Inventory Cost of Goods Sold (a)…arrow_forwardAccounting Homeworkarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education