FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

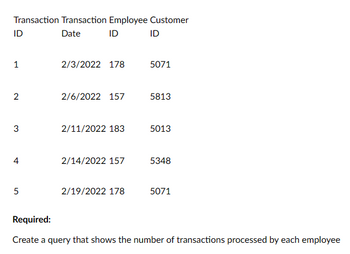

Transcribed Image Text:Transaction Transaction Employee Customer

ID

Date

ID

ID

1

2/3/2022 178

5071

2

2/6/2022 157

5813

3

2/11/2022 183

5013

4

2/14/2022 157

5348

5

2/19/2022 178

5071

Required:

Create a query that shows the number of transactions processed by each employee

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Instructions The following equity investment transactions were completed by Romero Company during a recent year. Apr. July Sept. 10 Purchased 4,700 shares of Dixon Company for a price of $49 per share plus a brokerage commission of $120. 8 Received a quarterly dividend of $0.70 per share on the Dixon Company investment. 10 Sold 1,900 shares for a price of $41 per share less a brokerage commission of $75. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers the nearest dollar.arrow_forwardThe General Ledger How does posting journal entries work in a computerized accounting system? What does it mean when posting is done automatically? Explain.arrow_forwardView History Bookmarks Window Help A education.wiley Exam 1 WP NWP Assessment Player UI Application Question 20 of 42 View Policies Current Attempt in Progress The usual sequence of steps in the transaction recording process is: journal ledger → analyze. analyze journal ledger. journal analyze ledger. ledger journal → analyze. Save for Laterarrow_forward

- On January 1, 2020, Blue Company has the following defined benefit pension plan balances. Projected benefit obligation $4,506,000 Fair value of plan assets 4,220,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $508,000 are created. Other data related to the pension plan are as follows. 2020 2021 Service cost $152,000 $179,000 Prior service cost amortization 0 91,000 Contributions (funding) to the plan 237,000 281,000 Benefits paid 202,000 284,000 Actual return on plan assets 253,200 262,000 Expected rate of return on assets 6 % 8 %arrow_forwardME7The process of initially recording a business transaction is called: a) Slidingb) Postingc) Journalizingd) Transposingarrow_forwardWhich of the following items is considered an original source document? Select one: a. accounts receivable b. company expense account c. purchase order d. general ledgerarrow_forward

- eNOWy2 | Online teachin x * Cengage Learning G 8000x2% - Google Search + eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress-false w. The following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a perpetual inventory system. July Purchased merchandise from Sabol Imports Co., $20,500, terms FOB destination, n/30. 1 3 Purchased merchandise from Saxon Co., $12,000, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $75 was added to the invoice. 5. Purchased merchandise from Schnee Co., $8.000, terms FOB destination, 2/10, n/30. 6. Issued debit memo to Schnee Co. for merchandise with an invoice amount of $1,500 returned from purchase on July 5. 13 Paid Saxon Co. for invoice of July 3. 14 Paid Schnee Co. for invoice of July 5, less debit memo of July 6. 19 Purchased merchandise from Southmont Co., $18.900, terms FOB shipping point, n/eom. 19 Paid freight of $140 on July 19…arrow_forwardQuestion 6 of 20: Select the best answer for the question. 6. To determine the effects of an entire accounting transaction, you would consult the accounting record called the A. journal O B. register. C. T-account O D. ledger Mark for review (Will be highlighted on the review page) << Previous Question Next Questionarrow_forwardRequired information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security uses a job order costing system. Overhead is applied using a predetermined overhead rate of 5 labor cost. Beginning of period $ 45,000 9,600 68,000 End of Period $ 45,000 19,000 33,500 Inventories Raw materials Work in process Finished goods Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used Indirect labor used Other overhead costs $ 178,000 250,000 9,000 57,500 115,500 Exercise 15-15 (Algo) Recording actual and applied overhead LO P3 1. Incurred other actual overhead costs (all paid in Cash). 2. Applied overhead to work in process. Prepare journal entries for the above transactions for the period. View transaction list Journal entry worksheet A В Record the entry for other actual…arrow_forward

- Question 4 of 20: Select the best answer for the question 4. The process of entering journal page numbers of transactions in the ledger and then entering the account numbers in the journal is referred to as OA. balancing OB. journalizing OC. cross-adding. D. cross-referencing Mark for review (Will be highlighted on the review page) Previous Question Next Questionarrow_forwardAnswered: The fo x b Details | bartleby x b My Questions |b x Post Altendee -2 x FA Midterm Exan X -> File | C:/Users/Wendy/Downloads/FA%20Midterm%20Exam.pdf ME6 Which of the following entries records the payment of an account payable? a) Debit Accounts Payable, credit Cash b) Debit Cash, credit Accounts Payable c) Debit Expense, credit Cash d) Debit Cash, credit Expense ME7 The process of initially recording a business transaction is called: a) Sliding b) Posting c) Journalizing d) Transposing ME8 Which of the following entries for goods sold by cash is correct? a) Cash Dr, AR Cr b) AR Dr, Revenue Cr c) Fees Earned, debit; Cash credit d) Cash, debit; Bank Cr ME9 The verification that the sum of the debits and the sum of the credits in the ledger are equal is called: a) A journal b) A ledger c) Posting Type here to searcharrow_forwardProfiles Tab Window Help A CengageNOWv2 | Online teach x K Counseling eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false MLA Citation Gen. Spinbot.com - Arti. Plagiarism Checke.. edunav cenage Inflaor 围 eBook Show Me How Retained earnings statement Instructions Labels and Amount Descriptions Retained Earnings Statement Instructions Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November $160,000 Cash dividends paid during November 23,500 Retained earnings, November 1, 2018 371,000 1. Prepare a retained earnings statement for the month ended November 30, 2018. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. 2. Why is the retained earnings statement…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education