SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

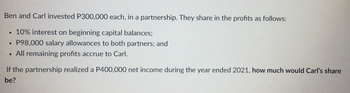

Transcribed Image Text:Ben and Carl invested P300,000 each, in a partnership. They share in the profits as follows:

●

10% interest on beginning capital balances;

●

P98,000 salary allowances to both partners; and

●

All remaining profits accrue to Carl.

If the partnership realized a P400,000 net income during the year ended 2021, how much would Carl's share

be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partners, C and D, share profits 3:2. However, C is to receive a yearly bonus of 20% of the profits, in addition to his profit share. The partnership made a net income for the year of P960,000 before the bonus.Assuming C’s bonus is computed on profit after deducting said bonus, how much profit share will D receive? Choices: P160,000 P307,200 P640,000 P320,000arrow_forwardA and B formed a partnership. The partnership agreement stipulates the following: • Annual salary allowances of P80,000 for A and P40,000 for B. • The partners share in profits and losses equally. The partnership earned profit of P100,000. How much is the share of B? 30,000 48,000 52,000 70,000arrow_forwardWhat is the average capital balance of A during 2020? How much is the bonus given to B during 2020? How much is the share of A in the partnership profit for the year ended 2020? What is the capital balance of C on December 31, 2020?arrow_forward

- The partnership agreement of Kray, Lamb, and Mann provides for the division of net income as follows: 1. Lamb who manages the partnership, is to receive a salary of P550,000 per year. 2. Each partner is to be allowed interest at 10% on beginning capital. 3. Remaining profits are to be divided equally. During 2020, Kray invested additional P200,000 in the partnership. Lamb withdrew P250,000, and Mann withdrew P200,000. No other investments or withdrawals were made during 2020. On January 1, 2020 the capital. balances of Kray, P3,250,00, Lamb P3,750,000, and Mann P3,500,000. Total capital at year end was PP12,600,000. Required: Prepare a statement of partners' capital for the year ended December 31, 2020.arrow_forwardElisa Diaz and Ma. Concepcion Manalo formed a partnership, investing P330,000 and P110,000, respectively. Determine the partners' participation in the 2019 profit of P420,000 under each of the following independent assumptions: a.) No agreement concerning division of profit. b.) Divided in the ratio of original capital investment. c.) Interest at the rate of 8% allowed on original investments and the remainder divided in the ratio of 2:3. d.) Salary allowances of P50,000 and P70,000, respectively, and the balance to be divided equally. e.) Allowance of interest at the rate of 8% on original investments, salary allowances of P50,000 and P70,000, respectively, and the remainder to be divided equally.arrow_forwardG, E and N are partners with average capital balances during 2020 of P400,000, P200,000 and P150,000respectively. Partners receive 10% interest on their average capital balances. After deducting salaries ofP100,000 to G and P50,000 to E the residual profit and loss is divided equally. In 2020 the partnershipsustained a P99,000 loss after interest and salaries to partners.By what amount should G's capital account change?A. 107,000 C. 32,000B. 67,000 D. 17,000arrow_forward

- What is the correct answer to the question?arrow_forward4. Rubio and Bisana established a trading partnership. They share profits equally after allowing salaries of P40,000 per year for Rubio and interest on partner's capital at 5% per year. On Jan. 1, 2019, their capital balances are as follows: Rubio, P200,000 and Bisana, P100,000. ratio On July 1, 2019, Bisana invested an additional P100,000 and Rubio's salary was The partnership profit for the year ended Dec. 31, 2019 was alary ear- 00B discontinued. of P337,500. What was Rubio's total profit share for the year ended Dec. 31, 2019? P182,500 а. b. P178,750 P180,000 С. d. P190,000arrow_forward14. The income summary of Cabatu and Dacua Partnership for the year ended December 31, 2020 show a net income of P140,000. The capital accounts of the partners for 2020 show the following: 1. Cabatu began the year with a capital balance of P70,000. 2. Dacua began the year with a capital balance of P175,000. 3. On April 1, Cabatu invested additional P26,250 into the partnership. 4. On August 1, Dacua invested additional P52,500 into the partnership. 5. Throughout 2020, each partner withdrew P700 per week in anticipation of partnership net income. The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distribution. Cabatu and Dacua have agreed to distribute partnership net income according to the following plan: Cabatu Dacua Interest on average capital balances Bonuses on net income before salaries, but after 10% 10% 25% None interest and bonuses Salaries P43,750 P52,500 Residual (if positive) Residual (if…arrow_forward

- Assuming that an interest of 20% per annum is given on average capital and 10. On January 1, 2020, Lim and Pan decided to form a partnership. At the end of the year, the partnership made a net income of P630,000. The capital accounts of the partnership show the following transactions. Lim, Capital Pan, Capital Debit Credit Debit Credit January 1 April 1 210,000 131,250 26,250 June 1 52,500 August 1 September 1 52,500 15,750 26,250 21,000 October 1 5,250 December 1 26,250 the balance of the profits is allocated equally, the allocation of profits should be: a. Lim, P315,000; Pan, P311,850 b. Lim, P321,300; Pan, P308,700 c. Lim, P352,800; Pan, P277,200 d. Lim, P361,200; Pan, P268,800arrow_forwardP, A and L formed a partnership and have average capital balances of P195,000, 246,000 and 294,000 each respectively for 2018. Their articles of co-partnership provide that the operating income be shared among the partners as follows: as salary, P20,000 for P, P22,000 for A, and P15,000 for L; interest of 10% on the average capital during 2018 for the three partners; a 10% bonus to A; and the remainder in the ratio 2:4:4, respectively. The operating income for the year ending December 31, 2018 after partners’ salaries and bonus amount to P105,000. The partnership agreement also states that L should receive a minimum of P60,000 as his share in partnerhsip operations. What is the net income for the year and the share of P in the net income? A. 22,300 C. 44,800 B. 25,800 D. 45,800arrow_forward. A and B share equally in partnership profits and losses. During the year, A's capital account has a net increase of P50,000. Partner A made contributions of P10,000 and capital withdrawals of P60,000 during the year. How much was the partnership profit for the year? a. 180,000 b. 200,000 c. 210,000 d. 480,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT