FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

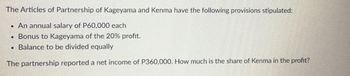

Transcribed Image Text:The Articles of Partnership of Kageyama and Kenma have the following provisions stipulated:

An annual salary of P60,000 each

Bonus to Kageyama of the 20% profit.

• Balance to be divided equally

The partnership reported a net income of P360,000. How much is the share of Kenma in the profit?

.

·

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information [The following information applies to the questions displayed below.] As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,600 cash during the year. $ 11,600 10,600 7,600 6,600 14,200 17,600 22,200 14,600 36,200 25,200 21,600 13,600 9,600 Cash Accounts receivable Supplies Equipment Accounts payable Armani, Capital, December 31, prior year Armani, Capital, December 31, current year Armani, Withdrawals Consulting revenue Rental revenue Salaries expense Rent expense Selling and administrative expenses Required: Prepare the statement of owner's equity for Armani Company for the current year ended December 31. ARMANI COMPANY Statement of Owner's Equity For Current Year Ended December 31 Armani, Capital, December 31, prior year Armani, Capital, December 31, current year $arrow_forwardRequired information [The following information applies to the questions displayed below.] Ramer and Knox began a partnership by investing $88,000 and $132,000, respectively. During its first year, the partnership earned $255,000. Prepare calculations showing how the $255,000 income is allocated under each separate plan for sharing income and loss. 3. The partners agreed to share income by giving a $69,000 per year salary allowance to Ramer, a $43,000 per year salary allowance to Knox, 10% interest on their initial capital investments, and the remaining balance shared equally. Net income is $255,000. Note: Enter all allowances as positive values. Enter losses as negative values. Net Income Salary allowances Interest allowances Total salary and interest Balance of income Balance allocated equally Balance of income Shares of the partners Ramer Saved Knox Totalarrow_forwardA partnership agreement states that following: the partners shall participate in profits: partner 1 - 70%, partner 2 - 25% and partner 3 - 5%. if the partnership had net income for the year of $135,000, what would be partner's 2 share of the income? a. $33,750. b. $94,500. c. $100,000. d. $6,750.arrow_forward

- Emerson and Dakota formed a partnership dividing income as follows: 1. Annual salary allowance to Emerson of $34,000 2. Interest of 10% on each partner's capital balance on January 1 3. Any remaining net income divided equally. Emerson and Dakota had $34,000 and $142,000, respectively, in their January 1 capital balances. Net income for the year was $230,800. How much net income should be distributed to Dakota?arrow_forwardXavier and Yolanda have original investments of $55,000 and $90,300, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $28,000 and $30,500, respectively; and the remainder to be divided equally. How much of the net income of $118,500 is allocated to Xavier? O a. $39,000 O b. $28,000 O c. $54,470 O d. $65,364arrow_forwardXavier and Yolanda have original investments of $54,200 and $107,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $26,000 and $32,000, respectively; and the remainder to be divided equally. How much of the net income of $108,500 is allocated to Yolanda? a. $75,036 Ob. $62,530 c. $53,400 Od. $21,400arrow_forward

- Assume the partnership income-sharing agreement calls for income to be divided with a salary of $41,000 to Coburn and $36,000 to Webb, interest of 10% on beginning capital, and the remainder divided 50%-50%. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Income Summary Coburn, Capital Webb, Capital Debit 68000 Credit 33850 32150arrow_forwardXavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000, respectively; and the remainder to be divided equally. How much of the net income of $77,000 is allocated to Yolanda? Oa. $77,000 Ob. $36,000 Oc. $44,000 Od. $38,000arrow_forwardPlease solve this questionarrow_forward

- A and B are equal partners. Assume that the partnership net income in the current year is 340800. The partnership agreement states as follows: Partners are entitle to Salary of: A - $45,000; B - $38,000 Interest on Capital: A - $7,000; B - $6,000 Interest charged on drawings: A - $2,500; B - $1,800 The Partners share profits and losses as follows: A: 60%; B: 40% Complete the multiple spaces below to calculate the Taxable Income of each partner. Just state the figure without any commas, full stops or dollar signs. If the figure is a negative, show it in brackets, eg (3000)arrow_forwardThe partnership of Hendrick, Mitchum, and Redding has the following account balances: Cash Noncash assets a Maximum amount b Distributed $ 51,000 136,000 This partnership is being liquidated. Hendrick and Mitchum are each entitled to 30 percent of all profits and losses with the remaining 40 percent going to Redding. Hendrick Mitchum Liabilities Hendrick, capital Mitchum, capital Redding, capital a. What is the maximum amount that Redding might have to contribute to this partnership because of the deficit capital balance? b. How should the $10,000 cash that is presently available in excess of liabilities be distributed? c. If the noncash assets are sold for a total of $51,000, what is the minimum amount of cash that Hendrick could receive? (Do not round intermediate calculations.) Redding C Minimum amount $ 41,000 91,000 71,000 (16,000)arrow_forwardXavier and Yolanda have original investments of $51,500 and $100,100, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $27,200 and $29,600, respectively; and the remainder to be divided equally. How much of the net income of $114, 400 is allocated to Xavier? a. $37,500 b. $61, 368 с. $51,140 d. $27,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education