Lancer, Inc. (a U.S.-based company), establishes a subsidiary in Croatia on January 1, 2019. The following account balances for the year ending December 31, 2020, are stated in kuna (K), the local currency:

| Sales | K | 200,000 |

| Inventory (bought on 3/1/20) | 100,000 | |

| Equipment (bought on 1/1/19) | 80,000 | |

| Rent expense | 10,000 | |

| Dividends (declared on 10/1/20) | 20,000 | |

| Notes receivable (to be collected in 2023) | 30,000 | |

| 24,000 | ||

| Salary payable | 5,000 | |

| Depreciation expense | 8,000 | |

The following U.S. $ per kuna exchange rates are applicable:

| January 1, 2019 | $0.13 |

| Average for 2019 | 0.14 |

| January 1, 2020 | 0.18 |

| March 1, 2020 | 0.19 |

| October 1, 2020 | 0.21 |

| December 31, 2020 | 0.22 |

| Average for 2020 | 0.20 |

Lancer is preparing account balances to produce consolidated financial statements.

-

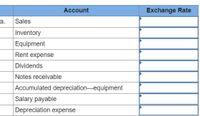

Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in U.S. dollar consolidated financial statements?

-

Assuming that the U.S. dollar is the functional currency, what exchange rate would be used to report each of these accounts in U.S. dollar consolidated financial statements?

(For all requirements, round your answers to 2 decimal places.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s): Cash Inventory Land Building Accumulated depreciation 2011 2013 August 1, 2019 December 31, 2019 February 1, 2020 May 1, 2020 June 1, 2020 August 1, 2020 September 1, 2020 NGN 16,790 Notes payable Common stock Retained. 11,900 earnings The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: October 1, 2020 November 1, 2020 December 1, 2020 December 31, 2020 Average for 2020 4,190 41,900 (20,950) NGN 53,830 2020 Feb. 1 Paid 8,190,000 NGN on the note payable. May 1 Sold entire inventory for 17,900,000 NGN on account. June 1 Sold land for 6,190,000 NGN cash. Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,190,000 NGN…arrow_forwardGodoarrow_forwardCompany X is a U.S.-based IT company with operations and earnings in a number of foreign countries. The company's profits by subsidiary, in local currency (in millions), are shown in the following table for 2019 and 2020. Net Income Japanese Subsidiary Britih Subsidiary 2019 JPY 200 GBP 100.00 2020 JPY 1,480 GBP 108.40 The average exchange rate for each year, by currency pairs, is the following. Exchange Rate USD = 1 GBP JPY = 1 USD 2019 97.57 1.5646 2020 90.88 1.6473 Use the above data, Students answer the following questions. a. What is Company X's consolidated profits in U.S. dollars in 2019 and 2020? b. If the same exchange rates are used for both years, what is the change in corporate earnings on a "constant currency" basis? c. Using the results of the constant currency analysis in part b, is it possible to separate Company X's growth in earnings between local currency earnings and foreign exchange rate impacts on a consolidated basis?arrow_forward

- On January 1, 2019, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid of 52,000,000 British pounds (£), which was equal to fair value. The excess of fair value over book value is attributable to land (part of property, plant, and equipment) and is not subject to depreciation. Parker accounts for its investment in Suffolk at cost. On January 1, 2019, Suffolk reported the following balance sheet: Cash Accounts receivable $ 2,000,000 Accounts payable 3,000,000 Long-term debt 14,000,000 Common stock 40,000,000 Retained earnings $59,000,000 $ 1,000,000 $,000,000 44,000,000 6,000,000 Inventory Property, plant, and equipment (net) $59,000,000 Suffolk's 2019 income was recorded at £2,000,000. It declared and paid no dividends in 2019. On December 31, 2020, two years after the date of acquisition, Suffolk submitted the following trial balance to Parker for consolidation: Page 537 Cash $ 1,500,000 Accounts Receivable 5,200,000…arrow_forwardASSUME THAT THE U.S. DOLLAR IS THE FUNCTIONAL CURRENCY. Ruthie Inc. had a debit adjustment of $7900 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Ruthie had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Ruthie's balance sheet at $124200. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $122200. In Ruthie's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardOn January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of this inventory remained unsold on December 31, while 30 percent of the account payable had not yet been paid. The U.S. $ per LCU exchange rates were as follows: January 1 . . . . . . . . . . . . . . . $0.60 April 1 . . . . . . . . . . . . . . . . . . 0.58 Average for the current year . . 0.56 December 31 . . . . . . . . ........ . . 0.54 At what amounts should the December 31 balances in inventory and accounts payable be translated into U.S. dollars using the current rate method?arrow_forward

- Subject: accountingarrow_forwardA US company, acquired an interest in Kamins Co, a foreign company in March 2017, when 1 FC equaled $1.52. Kamins is a foreign company whose functional currency is the FC. The condensed preclosing comparative trial balance for Kamins for the year ended December 31, 2019, is a follows:arrow_forwardHaresharrow_forward

- Nonearrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria, where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash NGN 16,000 Notes payable NGN 20,000 Inventory 10,000 Common stock 20,000 Land 4,000 Retained earnings 10,000 Building 40,000 Accumulated depreciation (20,000 ) NGN 50,000 NGN 50,000 The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: 2020 Feb. 1 Paid 8,000,000 NGN on the note payable. May 1 Sold entire inventory for 16,000,000 NGN on account. June 1 Sold land for 6,000,000 NGN cash. Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,000,000 NGN cash. Oct. 1 Bought inventory for 20,000,000 NGN cash. Nov. 1…arrow_forwardA company located in the USA, which has the dollar as its functional currency, purchased inventory on February 1 in Vietnam for 10,000,000 dongs with a payment date of April 1. One dong can be exchanged for $0.01 on February 1, and one dong can be exchanged for $0.12 on April 1. On April 1, the company pays off the 10,000,000-dong debt from the purchase of inventory. When the US company presents its financial statements, which of the following statements is false? The business should file with the statement a gross profit of $110,000. No profit is recognized related to inventory A loss of $20,000 is reported as a result of accounts payable Cost of goods sold is reported at $120,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education