FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

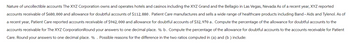

Transcribed Image Text:Nature of uncollectible accounts The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada As of a recent year, XYZ reported

accounts receivable of $680,000 and allowance for doubtful accounts of $112,880. Patient Care manufactures and sells a wide range of healthcare products including Band-Aids and Tylenol. As of

a recent year, Patient Care reported accounts receivable of $942,000 and allowance for doubtful accounts of $32,970 a. Compute the percentage of the allowance for doubtful accounts to the

accounts receivable for The XYZ Corporation Round your answers to one decimal place. % b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient

Care. Round your answers to one decimal place. %. Possible reasons for the difference in the two ratios computed in (a) and (b) include:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,353,500 of merchandise on credit (that had cost $979,500), terms n/30. b. Wrote off $18,100 of uncollectible accounts receivable. c. Received $671,300 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible. Year 2 e. Sold $1,556,800 of merchandise (that had cost $1,295,500) on credit, terms n/30. f. Wrote off $26,000 of uncollectible accounts receivable. g. Received $1,394,400 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized…arrow_forwardUpton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton's balance sheet as of December 31, 2019, is shown here (millions of dollars): Cash Receivables Inventories 5 Total current assets. Net fixed assets million % $3.5 26.0 58.0 $87.5 35.0 Accounts payable Notes payable Line of credit Accruals Total current liabilities. Mortgage loan Common stock Retained earnings Total assets $122.5 Total liabilities and equity Sales for 2019 were $375 million and net income for the year was $11.25 million, so the firm's profit margin was 3.0%. Upton paid dividends of $4.5 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. Do…arrow_forwardRequired information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 280,000 $ 700,000 In addition, its unadjusted trial balance includes the following items. $ 210,000 debit $ 2,500 debit Accounts receivable Allowance for doubtful accounts 2. Bad debts are estimated to be 2% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet. Current assets: $ 0arrow_forward

- Ivanhoe Company provides for doubtful accounts based on 4.0% of credit sales. The following data are available for 2020: Credit sales during 2020 $3,020,000 Allowance for doubtful accounts 1/1/20 37,700 Collection of accounts written off in prior years (customer credit was re-established) 15,500 Customer accounts written off as uncollectible during 2020 36,100 What is the balance in Allowance for Doubtful Accounts at December 31, 2020? Allowance for doubtful accounts 12/31/20 $Enter your answer in accordance to the question statementarrow_forwardPlease do part d as the first 3 sub part have been answe Complete the acounting for the following Journal Entries: #2:Bigger corp has nurnerous clients they sell to on account. At 12/31/18, Bigger’s accounts receivable balance is $500,000and their balance in their Allowance for Bad Debt account is a credit balance of $15,000Based on past experience and other factors, the corp estimates that 8% of its account receivable is uncollectable after preparing an Aging of their A/Rec They determine this to be a material amount and therefore use the Allowance Methoda) prepare the accounting for estimating Bad Debt Exp under the Allowance Method b) show the Corp’s Net Realizable Value after (a) abovec) After accounting for their Allowance, on 7/1/1~ Bigger identifies Customer F to be written off. F owes then, $20,000 show the accounting for Cust F’s write-off under the Allowance Methodd) show the Corp’s Net Realizable Value after writing off Customer Farrow_forwardThis question uses the same facts as the previous question and is repeated for your convenience. The following information relates to Hanover Foods, Inc. for the year 20X1: Accounts receivable (January 1, 20X1) Credit sales during 20X1 Collections from credit customers during 20X1 Customer account written off as uncollectible during 20X1 Allowance for Doubtful (Uncollectible) Accounts $334,000 850,000 725,000 12,000 (this balance is given after writing-off uncollectible accounts and has a credit balance) Estimated uncollectible accounts based on aging analysis If the aging approach is used to estimate bad debts, what amount should be recorded as bad debts expense for 20X1? 1,700 13,200arrow_forward

- Williamson Distributors separates its accounts receivable into three age groups for purposes of estimating the percentage of uncollectible accounts. Accounts not yet due = $29,000; estimated uncollectible = 5%. Accounts 1 to 30 days past due = $9,900; estimated uncollectible = 15%. Accounts more than 30 days past due = $3,900; estimated uncollectible = 25%. Compute the total estimated uncollectible accounts.arrow_forwardThe Manda Panda Company uses the allowance method to account for bad debts. At the beginning of 2018, theallowance account had a credit balance of $75,000. Credit sales for 2018 totaled $2,400,000 and the year-endaccounts receivable balance was $490,000. During this year, $73,000 in receivables were determined to be uncollectible. Manda Panda anticipates that 3% of all credit sales will ultimately become uncollectible. The fiscal yearends on December 31.Required:1. Does this situation describe a loss contingency? Explain.2. What is the bad debt expense that Manda Panda should report in its 2018 income statement?3. Prepare the appropriate journal entry to record the contingency.4. What is the net accounts receivable value Manda Panda should report in its 2018 balance sheet?arrow_forwardograms Plus is a retail firm that sells computer programs for home and business use. Programs Plus operates in a state with no sales tax. On December 31, 20X1, its general ledger contained the accounts and balances shown below: ACCOUNTS BALANCES Cash $ 18,280 Dr. Accounts Receivable 29,600 Dr. Allowance for Doubtful Accounts 110 Cr. Merchandise Inventory 65,375 Dr. Supplies 7,040 Dr. Prepaid Insurance 2,980 Dr. Equipment 37,000 Dr. Accumulated Depreciation—Equipment 11,600 Cr. Notes Payable 7,564 Cr. Accounts Payable 7,100 Cr. Social Security Tax Payable 710 Cr. Medicare Tax Payable 160 Cr. Yasser Tousson, Capital 96,620 Cr. Yasser Tousson, Drawing 50,000 Dr. Sales 520,980 Cr. Sales Returns and Allowances 10,800 Dr. Purchases 320,330 Dr. Freight In 3,900 Dr. Purchases Returns and Allowances 7,745 Cr. Purchases Discounts 15,330 Cr. Rent Expense 17,500 Dr. Telephone Expense 2,314 Dr. Salaries…arrow_forward

- The December 31, 20X7 statement of financial position of Howson Limited showed Trade Accounts Receivable of $450, 000 and a credit balance in Allowance for Doubtful Accounts of $ 45,000. During 20X8, the following transactions occurred: service revenue billed on account, $1,500,000; collections from customers, $1,300,000; accounts written off $37,000; previously written off accounts of $4,000 were collected. Required: (a) Record the 20X8 transactions. (b) If the company uses the percentage of receivables basis to estimate bad debts expense and determines that uncollectible accounts are expected to be 5% of trade accounts receivable, what is the adjusting entry at December 31, 20X8?arrow_forwardFlorence Company had a debit balance of $1,500 in the Allowance for Doubtful Accounts account and a debit balance of $500,000 in the Accounts Receivable account with Credit Sales of $1,500,000 for the year. Management estimates 1.5% of credit sales will become uncollectible. What is the amount of estimated bad debts expense?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education