FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't give answer & formulae in image based format.. thanku

Transcribed Image Text:The following selected transactions relate contingencies of Eastern Products Incorporated, which began operations in July 2024.

Eastern's fiscal year ends on December 31. Financial statements are published in April 2025.

1. No customer accounts have been shown to be uncollectible as yet, but Eastern estimates that 2% of credit sales will eventually

prove uncollectible. Sales were $302 million (all credit) for 2024.

2. Eastern offers a one-year warranty against manufacturer's defects for all its products. Industry experience indicates that warranty

costs will approximate 2% of sales. Actual warranty expenditures were $3.7 million in 2024 and were recorded as warranty

expense when incurred.

3. In December 2024, Eastern became aware of an engineering flaw in a product that poses a potential risk of injury. As a result, a

product recall appears inevitable. This move would likely cost the company $1.7 million.

4. In November 2024, the State of Vermont filed suit against Eastern, asking civil penalties and injunctive relief for violations of

clean water laws. Eastern reached a settlement with state authorities to pay $4.4 million in penalties on February 3, 2025.

5. Eastern is the plaintiff in a $40.2 million lawsuit filed against a customer for costs and lost profits from contracts rejected in 2024.

The lawsuit is in final appeal and attorneys advise that it is virtually certain that Eastern will be awarded $30.2 million.

Required:

Prepare the appropriate journal entries that should be recorded as a result of each of these contingencies.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in whole dollars and not in millions.

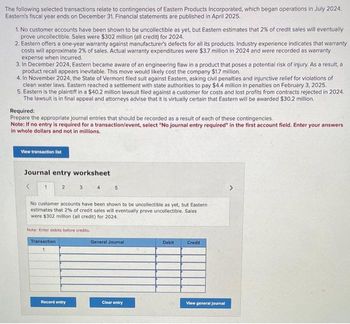

View transaction list

Journal entry worksheet

1

2

3

Note: Enter debits before credits.

Transaction

1

Record entry

4

No customer accounts have been shown to be uncollectible as yet, but Eastern

estimates that 2% of credit sales will eventually prove uncollectible. Sales

were $302 million (all credit) for 2024.

5

General Journal

Clear entry

Debit

Credit

View general Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Repost the complete question and add sub-parts to be solarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardWhat is the formula used for the questions without using excel?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education