FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

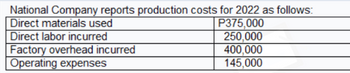

National Company’s period costs for 2022 amount to:

Transcribed Image Text:National Company reports production costs for 2022 as follows:

P375,000

Direct materials used

Direct labor incurred

250,000

400,000

Factory overhead incurred

Operating expenses

145,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- . Minimum amortization of the actuarial loss?arrow_forwardPlease do not give solution in image format thankuarrow_forwardThe Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 3,960 kayaks during 2020. Each kayak will require 56 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). The polyethylene powder used in these kayaks costs $1.00 per pound, and the finishing kits cost $150 each. Each kayak will use two kinds of labor-2 hours of type I labor from people who run the oven and trim the plastic, and 3 hours of work from type II workers who attach the hatches and seat and other hardware. The type I employees are paid $19 per hour, and the type II are paid $16 per hour. Manufacturing overhead is budgeted at $381,520 for 2020, broken down as follows. Variable costs Indirect materials Manufacturing supplies Maintenance and utilities Fixed costs Supervision Insurance Depreciation Total Polyethylene powder Finishing kits Type I labor Type II labor Indirect materials Manufacturing supplies Maintenance…arrow_forward

- Statler Corporation wants to find an equation to estimate some of their monthly operating costs for the operating budget for 2021. The following cost and other data were gathered for 2020: (Click the icon to view the cost and other data) Read the requirements. Requirement 1. Which of the preceding costs is variable? Fixed? Mixed? Explain. Cost function Mixed Fixed Variable Cost Maintenance Health insurance Shipping costs Requirement 2. Using the high-low method, determine the cost function for each cost. Begin by selecting the general formula that represents the linear cost function for each cost. y = a +bX y = a y = bX Maintenance Health insurance Shipping costs Now determine the cost function for each cost. (Enter all values in the same format as the general linear formula. If an input field is not used in the Cost function Maintenance Explanation The cost neither remains constant in total nor remains constant per unit. Although the cost driver varies from month to month, the total…arrow_forwardThe cost data for Evencoat Paint for the year 2019 is as follows: Month Gallons ofPaintProduced EquipmentMaintenanceExpenses January 110,000 $70,700 February 68,000 66,800 March 71,000 67,000 April 77,000 68,100 May 95,000 69,200 June 101,000 70,300 July 125,000 70,400 August 95,000 68,900 September 95,000 69,500 October 89,000 68,600 November 128,000 72,800 December 122,000 71,450 A. Using the high-low method, express the company’s maintenance costs as an equation where x represents the gallons of paint produced. Then estimate the fixed and variable costs. Fixed cost $fill in the blank 1 Variable cost $fill in the blank 2 B. Predict the maintenance costs if 90,000 gallons of paint are produced. Maintenance cost $fill in the blank 3 C. Predict the maintenance costs if 81,000 gallons of paint are produced. Maintenance cost $fill in the…arrow_forward#14Stefan company provided the following information in relation to a defined benefit plan for thecurrent year:January 1 December 31Fair value of plan assets 1,300,000 1,500,000Projected benefit obligation 1,000,000 1,050,000Prepaid/accrued benefit cost-surplus 300,000 450,000Asset ceiling 100,000 150,000Effect of asset ceiling 200,000 300,000Current service cost 50,000Contribution to the plan 175,000Benefits paid 75,000Discount rate 10%What is the net remeasurement loss for the current year? 85,000 pls provide solution for this answerarrow_forward

- Shown below are the totals from 2025 period budgets. Revenue budget $100,000 Materials usage from production budget 15,000 Labor cost budget 20,000 Manufacturing overhead budget 20,000 General and administrative budget 30,000 Capital expenditure budget 20,000 Work in Progress Inventories Beginning of 2002 10,000 End of 2002 5,000 Finished Goods Inventory Beginning of 2002 15,000 End of 2002…arrow_forwardBlossom Inc. has beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. Projected Benefit Obligation Plan Assets Value 2024 $1,080,000 $972,000 2025 1,350,000 1,188,000 2026 1,728,000 1,566,000 2027 2,268,000 2,160,000 The average remaining service life per employee in 2024 and 2025 is 8 years and in 2026 and 2027 is 11 years. The net gain or loss that occurred during each year is as follows: 2024, $178,200 gain; 2025, $43,200 gain; 2026, $32,400 loss; and 2027, $16,200 loss. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.) Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the 4 years, setting up an appropriate schedule. (Round answers to O decimal places, e.g. 22,500.)arrow_forwardManno Corporation has the following information available concerning its postretirement benefit plan for 2017. Service cost $40,000 Interest cost 47,400 Actual and expected return on plan assets 26,900 Compute Manno’s 2017 postretirement expense.arrow_forward

- (Application of the Corridor Approach) Kenseth Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets Check the below image for beginning-of-the-year present values. The average remaining service life per employee in 2016 and 2017 is 10 years and in 2018 and 2019 is 12 years. The net gain or loss that occurred during each year is as follows: 2016, $280,000 loss; 2017, $90,000 loss; 2018, $11,000 loss; and 2019, $25,000 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)InstructionsUsing the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.arrow_forwardHi, please help :) Use the appropriate mixed cell references and relative references to reflect the percentages in range A22:B27 to determine the projected expenses for each of the Budgeted Selling and Budgeted Administrative Expenses for the year of 2022.arrow_forwardthe warren groups pension expense is 78 million. the amount includes a 46 million service cost, a 60 million interest cost, a 34 million reduction for the expected return on plan assets, and a 6 million amoritization of a prior service cost. prepare the journal entry to record the pension expense?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education