FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

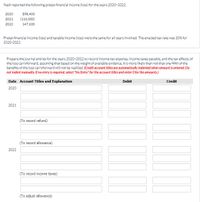

Transcribed Image Text:Nash reported the following pretax financial income (loss) for the years 2020-2022.

2020

$98,400

2021

(116,000)

2022

147,600

Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 20% for

2020-2022.

Prepare the journal entries for the years 2020-2022 to record income tax expense, income taxes payable, and the tax effects of

the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-fifth of the

benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do

not indent manualy. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

Debit

Credit

2020

2021

(To record refund)

(To record allowance)

2022

(To record income taxes)

(To adjust allowance)

Transcribed Image Text:Prepare the income tax section of the 2021 income statement beginning with the line "Income (loss) before income taxes.".

(Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45).)

Nash

Income Statement (Partial)

%24

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe pretax financial income (or Loss) figures for Limerick co. are as follows: 2017 83,000 2018 (53,000) 2019 (36,000) 2020 115,000 2021 104,000 Pretax financial income( or loss) and taxable income(loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years. Prepare the journal entires for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforward. All income and losses relate to normal operations (in recording the benefits of a loss carryforward assume that no valuation account is deemed necessary.arrow_forwardJenkins Corporation had $675,000 of taxable income for 2018 and $575,000 for 2019. What is the minimum amount that it must submit for each estimated quarterly tax payment to avoid any penalty for underpayment?arrow_forward

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses Pretax accounting income (income statement) Taxable income (tax return) 760 800 $ 128 $ 116 $ 180 $ 200 Tax rate: 25% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint View this as two temporary differences-one reversing in 2021; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing…arrow_forwardDuring 2020, Sheffield Co.'s first year of operations, the company reports pretax financial income at $252,300. Sheffield's enacted tax rate is 45% for 2020 and 20% for all later years. Sheffield expects to have taxable income in each of the next 5 years. The effects on future tax returns of temporary differences existing at December 31, 2020, are summarized as follows. Future Years 2021 2022 2023 2024 2025 Total Future taxable (deductible) amounts: Installment sales Depreciation Unearned rent $31,300 5,800 (48,500) (48,500) $31,300 $31,300 5,800 $5,800 $5,800 $93,900 29,000 (97,000) 5,800 Complete the schedule below to compute deferred taxes at December 31, 2020. (Negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Deferred Tax Future Taxable Temporary Difference (Deductible) Amounts Tax Rate (Asset) Liability $ Installment sales $93,900 1% Depreciation 29,000 1% Unearned rent (97,000) % Totals THAarrow_forwardGive me correct answer with explanation..jarrow_forward

- Now assume that Syer does account for its NOL under the CARES Act. Prepare the appropriate journal entry to record Syer’s 2020 income taxes, and indicate Syer’s 2020 net income(loss). Syer Company reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in millions): 2016 2017 2018 2019 2020 $ 330) $ 130 $ 0 $0 $ (660) Syer’s 2020 NOL is driven by an unfortunate obsolescence of its primary product. Given great uncertainty in Syer’s future profitability, Syer’s management does not believe it is more likely than not that it will be able to realize deferred tax assets in future years. Syer’s federal tax rate decreased from 35% to 21% starting in 2018.arrow_forwardIMPORTANT: PLEASE ANSWER CORRECTLY AND ILL LIKE THE QUESTION. Exercise 19-04 (Part Level Submission) Kingbird Company reports pretax financial income of $73,500 for 2020. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by $17,600. 2. Rent collected on the tax return is greater than rent recognized on the income statement by $19,900. 3. Fines for pollution appear as an expense of $10,500 on the income statement. Kingbird’s tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2020.arrow_forwardArndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues. Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $888 760 $128 $116 a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2024 for $60 million. The cost is tax deductible in 2024. Answer is complete but not entirely correct. Deferred tax amounts ($ in millions) Classification Net noncurrent deferred tax asset ✔ $ Net noncurrent deferred tax liability X $ 2025 $980 800 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $33 million and $35 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $25 million ($10 million collected in 2023 but not recognized as revenue until 2024) and $33 million,…arrow_forward

- The following information has been obtained for Sheridan Corporation. 1. Prior to 2020, taxable income and pretax financial income were identical. 2. Pretax financial income is $1,634,000 in 2020 and $1,359,000 in 2021. On January 1, 2020, equipment costing $1,260,000 is purchased. It is to be depreciated on a straight-line basis over 5 years for tax purposes and over 8 years for financial reporting purposes. (Hint: Use the half-year convention for tax purposes, as discussed in Appendix 11A.) 3. 4. Interest of $57,000 was earned on tax-exempt municipal obligations in 2021. 5. Included in 2021 pretax financial income is a gain on discontinued operations of $195,000, which is fully taxable. 6. The tax rate is 20% for all periods. 7. Taxable income is expected in all future years.arrow_forwardYour answer is partially correct. The pretax financial income (or loss) figures for Marin Company are as follows. 2022 $72,000 2023 (37,000) 2024 (32,000) 2025 110,000 2026 93,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 20% tax rate for all years. Prepare the journal entries for the years 2022 to 2026 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)arrow_forwardDetermine from the tax table provided the amount of the income tax (before any credits) for each of the following taxpayers for 2021: Тахраyer(s) Filing Status Taxable Income Income Taх Allen Single $21,000 Boyd MFS 24,545 Caldwell MFJ 35,784 Dell H of H 27,450 Evans Single 44,999arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education