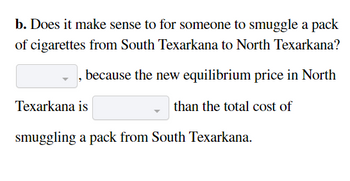

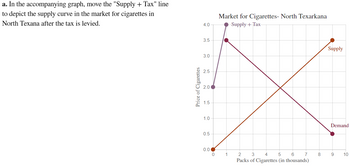

In the United States, each state government can impose its own excise tax on the sale of cigarettes. Suppose that in the state of North Texarkana, the state government imposes a tax of $2.00 per pack sold within the state. In contrast, the neighboring state of South Texarkana imposes no excise tax on cigarettes. Assume that in both states the pre-tax price of a pack of cigarettes is $2.00. Assume that the total cost to a resident of North Texarkana to smuggle a pack of cigarettes from South Texarkana is $3.50 per pack. (This includes the cost of time, gasoline, and so on.) Assume that the tax is levied on the supplier.

Part b. first option (Yes or No), 2nd option (higher or Lower).

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Which of the following is wrong? If the seller is a non-VAT registered seller, the government shall withhold a 3% final percentage tax on the sale before payment. The final withholding system on the sales to the government and GOCC will no longer be applicable starting 2021. VAT treatment on sales to government is the same as VAT treatment on sale to non-government taxpayer except for the mandatory withholding of 5% by the government agency who avail the goods or services offered by the seller. None of the choicesarrow_forwardPhilly Cheesecake Corporation (“Cheesecake") operates food stands in several states and is headquartered in Philadelphia, Pennsylvania. Philly has a Pennsylvania state income tax base of $500,000. Of this amount, $150,000 was nonbusiness income. Philly Cheesesteak's Pennsylvania apportionment factor is 28.52 percent. The nonbusiness income allocated to Pennsylvania was $61,000. Assuming a Pennsylvania corporate tax rate of 7.75 percent, what is Philly Cheesesteak's Pennsylvania state tax liability? а. $19,361 b. $11,051 С. $12,464 d. $4,727arrow_forwardWhich of the following is true? i. The general percentage tax is an explicit tax on consumption. ii. VAT and percentage tax are mutually exclusive. iii. In business taxes, the statutory taxpayer is normally the economic taxpayer. iv. The CREATE Law amended the VAT threshold to P3,000,000 from P1,919,500 (formerly P1,500,000). v. All of the other choices is incorrect.arrow_forward

- A general state sales tax of 8% assessed on all purchases would be an example of a ___________________ income tax.arrow_forwardplease step by step solution.arrow_forwardBen, a resident of Idaho, buys a $100 shirt at a store in State A. The store only does business in State A. State A has a 4% sales tax. He takes the shirt with him back to Idaho and uses it in Idaho. How much use tax does Ben owe Idaho? Ben, a resident of Idaho, buys a $100 shirt at a store in State A. The store only does business in State A. State A has a 4% sales tax. He takes the shirt with him back to Idaho and uses it in Idaho. How much use tax does Ben owe Idaho? A. $6 B. $4 C. $2 D. $0arrow_forward

- Which of the following is wrong?A. If the seller is a non-VAT registered seller, the government shall withhold a 3% finalpercentage tax on the sale before payment.B. The final withholding system on the sales to the government and GOCC will no longerbe applicable starting 2021.C. VAT treatment on sales to government is the same as VAT treatment on sale to non-government taxpayer except for the mandatory withholding of 5% by the government agency who avail the goods or services offered by the sellerD. None of the choices.arrow_forwardDIGITAL TAX IN MALAYSIA Starting 1 January 2020, the government began imposing a digital services tax (DST) of six per cent on foreign digital service providers (FSPs) in Malaysia. Based on the given required to produce the write up on Digital Service Tax (DST) in Malaysia. Below is the content of your write up. Make sure you answer is genuine and not googleable You are required to write up on administration of digital tax of ; - Chargeable person - Taxable period - Threshold - Submission of return - Offence and penaltiesarrow_forwardKashi Corporation is the U.S. distributor of fencing (sword fighting) equipment imported from Europe. It is incorporated in Virginia and headquartered in Arlington, Virginia; it ships goods to all 50 states. Kashi's employees attend regional and national fencing competitions, where they maintain temporary booths to market their goods. Determine whether Kashi has income tax nexus and a filing requirement in the following situations: Required: Kashi is incorporated and headquartered in Virginia. It also has property, employees, salespeople, and intangibles in Virginia. Determine whether Kashi has income tax nexus in Virginia. Kashi has employees who live in Washington, D.C., and Maryland, but they perform all their employment-related activities in Virginia. Does Kashi have income tax nexus in Washington, D.C., and Maryland? Kashi has two customers in North Dakota. It receives their orders over the phone and ships goods to them using FedEx. Determine whether Kashi has income tax nexus…arrow_forward

- QUESTION 1 A) By way of an example , state the difference between an “Exempt supply and a “Zero -rated supply” ? B) A second dealer buys a used fridge from a non-vendor for NAD 600 for resale. He pays the person NAD 400 immediately and the balance of NAD 200 in the next VAT period. Calculate the input tax that the second hand dealer will be entitled to claim ? C) A vendor purchases a VEHICLE for private purposes on 1 March 2020. The VEHICLE costs NAD228 000 including VAT (excludes finance charges and any other charges incurred). The vendor then decides to use the VEHICLE exclusively in his business for delivery of goods to his/her customers with effect from1 March 2020. At the time of introducing the VEHICLE into the business, it had an open market value of NAD205 200. Calculate input VAT to be claimed by the vendor?arrow_forwardProvide an example of how a US taxpayer that manufactures the property which that taxpayer sells could increase its net foreign source income. Next, assume instead the US taxpayer doesn’t manufacture but rather is a reseller of a finished good. Provide an example of how a reseller could increase its net foreign source income. Lastly, why is it generally better for a US taxpayer to increase its net foreign source income if it is subject to US tax on a worldwide basis?arrow_forwardMike Klein lives in a state with an income tax rate of 4.5%. What is the state The state withholding tax for Mr. Klein is $ withholding on a weekly gross income of $454.75? (Round to the nearest cent.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education