Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

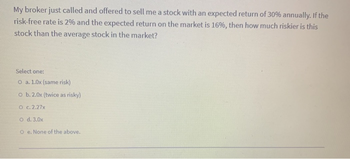

Transcribed Image Text:My broker just called and offered to sell me a stock with an expected return of 30% annually. If the

risk-free rate is 2% and the expected return on the market is 16%, then how much riskier is this

stock than the average stock in the market?

Select one:

O a. 1.0x (same risk)

O b. 2.0x (twice as risky)

O c. 2.27x

O d. 3.0x

Oe. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q6arrow_forwardSuppose you observe the following situation: Security Pete Corporation Repete Company Beta 1.25 .87 Expected Return 1080 .0820 a. Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the risk-free rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Expected return on market using Pete Corporation a. Expected return on market using Repete Company b. Risk-free rate de de % % %arrow_forwardAssume the Black-Scholes framework. You are given: i. S(t) is the stock price at time t. ii. The stock's volatility is 25%. iii. The continuously compounded expected rate of return is 8%. iv. The stock pays dividends continuously at a rate of 3% proportional to its price. v. The continuously compounded risk-free interest rate is 4%. vi. The current stock price is S (0) 125. Calculate Pr (S (4) > 150 S (2) - 120). Possible Answers A. 0.30 0.40 C 0.65 D. 0.70 0.85arrow_forward

- Fiske Roofing Supplies' stock has a beta of 1.23, its required return is 10.00%, and the risk-free rate is 4.30%. What is the required rate of return on the market? (Hint: First find the market risk premium.) Select the correct answer. a. 8.93% b. 8.69% c. 8.77% d. 8.85% e. 9.01%arrow_forwardAssume the Black-Scholes framework for a stock. You are given: i) The current stock price is 40 ii) The stock pays no dividends iii) The expected rate of appreciation is 16% iv) The stock's volatility is 30% v) The Black-Scholes price of a 6-month 42-strike European call on the stock is 3.22 vi) The continuously compounded risk-free rate is 8% You just bought a 6-month straddle which pays the absolute difference between the stock price after 6 months and 42. Calculate the probability of having a positive profit after 6 months.arrow_forwardThe market excess return is 12% and the risk-free rate is 3%. Assume CAPM is a good description of stock price returns. New information has led to the expected returns shown in the table, which stocks present an opportunity for Mary to buy and which should she choose to sell? Expected Return Beta 1.666 Required Return Stock A 25% Stock B 19% 20% Stock C 16% 1.083 Stock D 14% 13% Stock E 16% 1.166 Sell Stocks B and E, Buy Stocks A and D Sell Stocks B and E, Buy Stocks A, C and D OSell Stocks A and D, Buy Stocks B and E OSell Stocks A and D, Buy Stocks B, C and Earrow_forward

- Imagine that you are an investor who is contemplating whether to purchase a stock which is valued at $100 per share to today that pays a 3.5% annual dividend. The stock has a beta compared with the market of 0.3, which indicates that it is riskier than a market portfolio. Keep in mind also that the risk free rate is 5% and that you would expected the market to rise in value by 9% per year. What is the expected return of the stock using the CAPM formulaarrow_forwardAt time t=0 Mr. Anderson sets up a riskless portfolio by taking a position in an option and in the underlying asset. Explain what Mr. Anderson needs to do at time t=1 to keep his portfolio risk neutral and why. A stock price is currently $100 and at the end of four months it will be ST . A derivative written on this stock pays off expST1/3 in four months. Given that u = 1.15, d = 0.87, and that the risk-free interest rate is 10% p.a. (continuously compounded), answer the following questions using a one-period binomial model (show all the details of your calculations and display the results with four decimal places): Calculate the value of ∆ Calculate the current value of the derivative.arrow_forwardSuppose you observe the following situation: Security Ruby Pearl Expected Return 14.9% 21.0% Beta 0.70 2.13 A). If these two securities are correctly priced, calculate the risk-free rate. Round your answer to 4 decimal points. B). If these two securities are correctly priced, find the market risk premium (using the findings of Requirement-A). Round your answer to 4 decimal points. C). If the current market data shows that the risk-free rate is 3.52 percent, are these securities fairly priced? Comment on your answer. Round your answers to 4 decimal points. D). Calculate the expected return and beta of an equally weighted portfolio of these two securities. Round your answers to 3 decimal points.arrow_forward

- Suppose that call options on XYZ stock with time to expiration 3 months and strike price $90 are selling at an implied volatility of 30% ExxonMobil stock price is $90 per share, and the risk free rate is 4%. Required: a1 If you believe the true volatility of the stock is 32%, would you want to buy or sell call options? a2-Now you want to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold?arrow_forward16. Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security A B C .673 Beta If you have a portfolio with $30,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 5%, what would you expect the return of your portfolio to be if the market earned 20.8% next year? Declined 19.6%? The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 20.8% is If the market earned 20.8%, the value of your portfolio is $ The return of your portfolio to be if the market declined 19.6% is If the market declined 19.6%, the value of your portfolio is $ 1.62 0.63 - 0.23 (Round to the nearest dollar.) %. (Round to two decimal places and enter as a negative number if the return decreased.) %. (Round to two decimal places and enter…arrow_forwardYour broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Expected Return 10.5% Delta Vanlines 1.25 13.0 % 1.60 16.0% Firm Beta Anderson, Inc. 0.90 Nathan's Bakeries Z-man Electronics O Delta Vanlines 1.90 19.0% All of the stocks, Anderson, Inc. O Nathan's Bakeries OZ-man Electronicsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education