FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

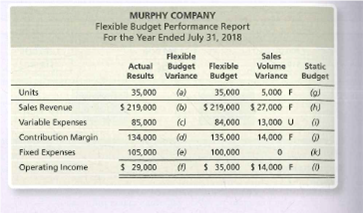

Preparing a flexible budget performance report

Murphy Company managers received the following incomplete performance report:

Complete the performance report. Identify the employee group that may deserve praise and the group that may be subject to criticism. Give your reasoning.

Transcribed Image Text:MURPHY COMPANY

Flexible Budget Performance Report

For the Year Ended July 31, 2018

Flexible

Sales

Actual Budget Flexible

Results Variance Budget

Volume

Static

Variance

Budget

Units

35,000

(a)

35,000

5,000 F

(a)

Sales Revenue

$ 219,000

(b)

$ 219,000 $ 27,000 F

(A)

Variable Expenses

85,000

84,000

13,000 U

Contribution Margin

134,000

(d)

135,000

14,000 F

Fixed Expenses

105,000

(e)

100,000

Operating Income

$ 29,000

$ 35,000 $ 14,000 F

(0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Budgets need to be fair and attainable for employees to consider the budget important in their normal daily activities. Which of the following situations will likely lead to human behavior problems? a. allowing employees the opportunity to be a part of the budget process b. setting goals too loosely, creating a budgetary slack c. setting goals that are consistent across the firm d. setting goals that are reasonable and attainablearrow_forwardConsidering what you have learned in this module, describe the basic flow of the various operating budgets within the master budget for a manufacturing firm. This should include a discussion of which budget is prepared first, and how that budget is used to prepare the next budget(s). You do not need to go into detail about the calculations for every budget. Discuss how a budget for a manufacturing firm would differ from a merchandising firm. Discuss why a company may have desired ending inventory requirements, which two budgets this may impact, and how it impacts them. Provide an example of how an error in one budget could impact other budgets that come later.arrow_forwardA variety of quantitative measures are used to evaluate employee performance, including standard costs, financial ratios, human resource forecasts, and operating budgets.a. Discuss the following aspects of a standard cost system.1. Discuss the characteristics that should be present to encourage positive employee motivation.2. Discuss how the system should be implemented to positively motivate employees.b. The use of variance analysis often results in management by exception.1. Explain the meaning of management by exception.2. Discuss the behavioral implications of management by exception.c. Explain how employee behavior could be adversely affected when actual-to-budget comparisons are used as the basis for performance evaluation.arrow_forward

- Financial Accounting and Cost Management Classify each of the following actions as either being associated with the financial accounting information system (FS) or the cost management information system (CMS): a. Determining the total compensation of the CEO of a public company b. Issuing a quarterly earnings report c. Determining the unit product cost using TDABC d. Calculating the number of units that must be sold to break even e. Preparing a required report for the SEC f. Preparing a sales budget g. Using cost and revenue information to decide whether to keep, or drop, a product line h. Preparing an annual statement of financial position that conforms to generally accepted accounting principles (GAAP) i. Using cost and revenue information to decide whether to invest in a new production system or not j. Reducing costs by improving the overall quality of a product k. Using a debt-equity ratio and liquidity ratios from a balance sheet to assess the likelihood of bankruptcy l. Using a…arrow_forwardA good performance measurement system should have the following characteristics: It should be based on activities over which managers have control or influence. It should be measurable. It should be timely. It should be consistent in its application. When appropriate, the actual results should be compared with the budgeted results, standards, or past performance. The measurements must not favor the manager over the goals of the entire organization. Often, managers have the ability to make decisions that favor their individual units but that may be detrimental to the overall performance of the organization. True / Falsearrow_forwardAn external party receives information about past performance from Question 7 options: planning reports. financial statements. budget reports. internal managerial accounting reports.arrow_forward

- When a company develops and implements a master budget, there is a tendency to incentivize adherence to the goal with bonuses or by tying the employee compensation plans to the achievement of the budget goals. What are some opportunities and risks of these financial incentive programs?arrow_forwardResponsibility accounting means that a manager should be held responsible for those items in the budget which 1. He absorbed as a result of allocation 2. He can actually control to a significant extent 3. His unit incurred as a committed cost 4. All of the above O 1 O 2 O 4 3.arrow_forwardIdentify if the following statements are TRUE or FALSE. 1. Operating budgets and financial budgets are prepared after the master budget. 2. In setting profit objectives, management must consider sales volume required to meet all costs, dividends, and retained earnings requirements 3. Zero-based budgeting includes variable costs only.arrow_forward

- The costs referred to as “controllable costs” are a. Costs which management decides to incur in the current period to enable the company to achieve objectives other than the filling of orders placed by customers. b. Costs which are likely to respond to the amount of attention devoted to them by a specified manager. c. Costs which are governed mainly by past decisions that established the present levels of operating and organizational capacity and which only change slowly in response to small changes in capacity. d. Costs which fluctuate in total in response to small changes in the rate of utilization of capacity.arrow_forwardWhich of the following would the auditor be most concerned about regarding a heightened risk of intentional misstatement? * Senior management emphasizes that O job evaluations are based on performance Senior management emphasizes that budgeted amounts for expenses are to be achieved for each reporting period or explained in the variance analysis report Senior management emphasizes that O job rotation is a worthwhile corporate objective Senior management emphasizes that it is very important to beat analyst estimates of earnings every reporting periodarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education