FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

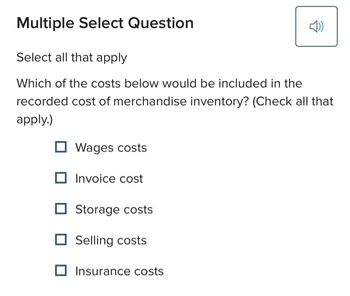

Transcribed Image Text:Multiple Select Question

Select all that apply

Which of the costs below would be included in the

recorded cost of merchandise inventory? (Check all that

apply.)

Wages costs

Invoice cost

Storage costs

Selling costs

Insurance costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I calculate cost of goods sold What numbers do I use to get finished goods inventoryarrow_forwardPART 1: Raw Materials Inventory Turnover A. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover. Days' Sales in Raw Materials Inventory B. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventoryarrow_forwardScrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Units Unit Cost $30 Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($46 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($46 each) 200 300 32 (350) 250 36 (50) TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred. Required: 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Last-in, first-out. LIFO…arrow_forward

- How do you use FIFO and LIFO to calculate the cost of inventory?arrow_forwardAccounting for Merchandising Businesses and Inventory and Assets Define the following: Cost of goods sold Credit memo Credit terms Debit memo FIFO FOB Gross profit Invoice LIFO Net sales Periodic inventory Perpetual inventory Sales Selling expense Subsidiary ledger Trade discount Weighted averagearrow_forwardOn a cost-volume-profit graph, the revenue line will be shown below the total expense line for any activity level above the break-even point. FALSE O TRUEarrow_forward

- Compute cost of goods sold using the following information. Merchandise inventory, beginning Cost of merchandise purchased Merchandise inventory, ending $12,200 45.200 18,200 Cost of Goods Sold is Computed an Cost of goods sold $ Heip have t Subitarrow_forwardExplain how to estimate the average cost of inventory when using the retail inventory method.arrow_forwardCalculate the value of ending inventory and cost of goods soldarrow_forward

- How do i calculate ending inventory and cost of goods sold using LIFO?arrow_forwardSelect all that apply Determine which of the following statements are correct regarding the difference between physical flow and the cost flow of inventory Check all that apply) A business may adopt any cost flow assumption when accounting for perishable sems Perishable-items Usually have an actual physical flow of FIFO Penshable items neve an actual physical flow of LIFO Cost flow in an assumption about which goods/items are sold Physical flow refers to the actual movement of goodsarrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education