Concept explainers

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Preliminary

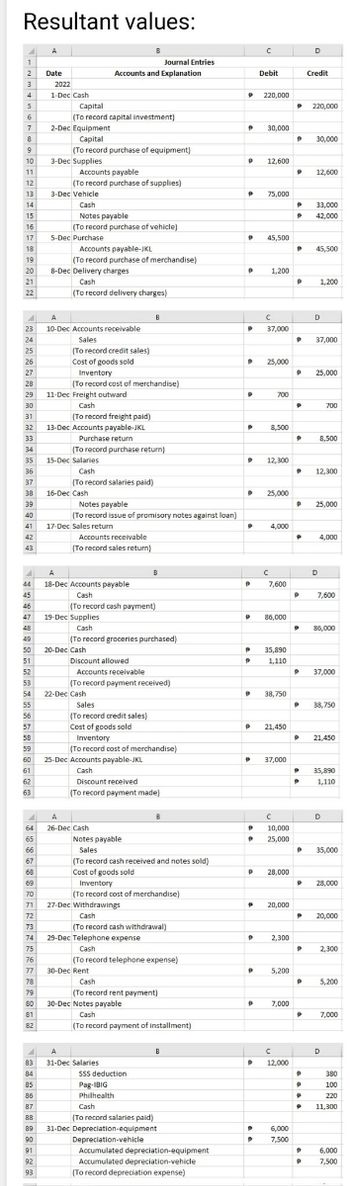

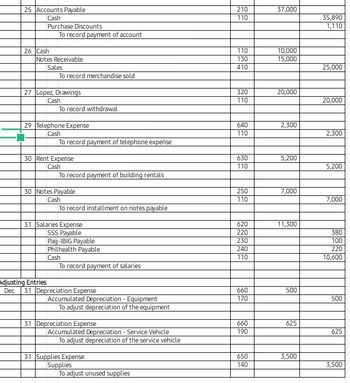

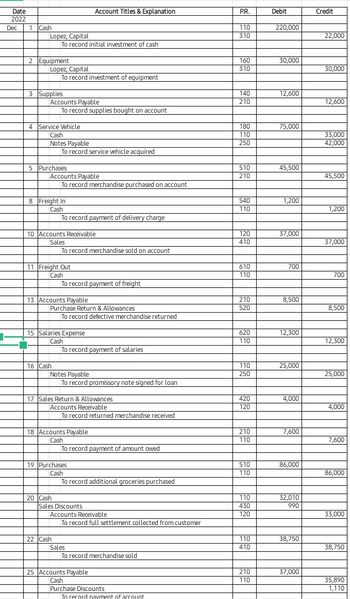

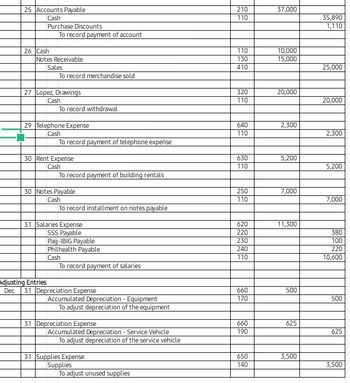

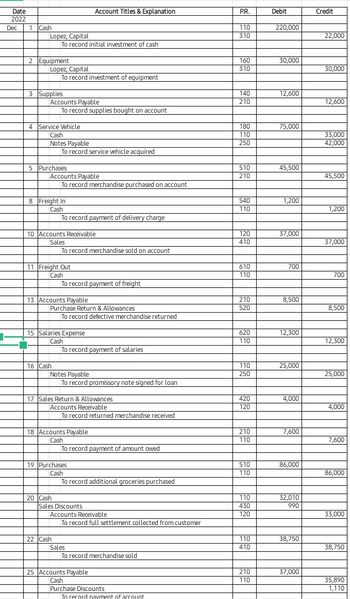

Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of ₱220,000. The following are additional transactions for the month: 2Mr. Lopez invested equipment for the business worth ₱30,000. 3Bought supplies on account for ₱12,600. 4Acquired a service vehicle costing ₱75,000. A payment of ₱33,000 cash was made and a promissory note was given for the remainder, payable for 6 equal monthly installment. 5Purchased merchandise from JKL Enterprises ₱45,500, Term, 3/20, n/30. 8Paid ₱1,200 delivery charge for December 5 purchase. 10Sold merchandise on account ₱37,000, Term, 3/10, n/30. Cost of Merchandise, ₱25,000. 11Paid ₱700 freight for December 10 transaction. 13Returned defective merchandise to JKL Enterprises amounting to ₱8,500. 15Paid salaries, ₱12,300 16Signed a promissory note for ₱25,000 loaned amount from Commonwealth Bank. 17Received returned merchandise from customers on December 10, ₱4,000. 18Paid ₱7,600 of the amount owed from the December 3 transaction. 19Purchase additional groceries from QR Supermarket amounting to ₱86,000. 20Collected full settlement of customer from December 10 sale. 22₱21,450 cost of merchandise was sold for ₱38,750. 25Settled account to JKL Enterprises. 26Cash received, ₱10,000 and a promissory note for ₱25,000 for merchandise sold to a key customer. Cost of merchandise, ₱28,000. 27Mr. Lopez withdrew ₱20,000 cash from the business. 29Paid telephone expense, ₱2,300. 30Paid building rentals for the month, ₱5,200. 30Paid the first installment of the note payable on Service Vehicle. 31Paid Salaries ₱11,300, net of the following deductions: SSS, ₱380; Pag-IBIG, ₱100; Philhealth, ₱220 The Merchandise Inventory at the end of the of the month is ₱48,000. Additional information for year-end adjustments. Ø The useful life of the equipment is 5 years with no salvage value. -The useful life of the service vehicle is 10 years with no salvage value. -Remaining unused supplies worth ₱9,100. Use asset method.

Question:

1. Prepare the General Ledger. Pls use periodic inventory method.

Preliminary

Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of ₱220,000. The following are additional transactions for the month: 2Mr. Lopez invested equipment for the business worth ₱30,000. 3Bought supplies on account for ₱12,600. 4Acquired a service vehicle costing ₱75,000. A payment of ₱33,000 cash was made and a promissory note was given for the remainder, payable for 6 equal monthly installment. 5Purchased merchandise from JKL Enterprises ₱45,500, Term, 3/20, n/30. 8Paid ₱1,200 delivery charge for December 5 purchase. 10Sold merchandise on account ₱37,000, Term, 3/10, n/30. Cost of Merchandise, ₱25,000. 11Paid ₱700 freight for December 10 transaction. 13Returned defective merchandise to JKL Enterprises amounting to ₱8,500. 15Paid salaries, ₱12,300 16Signed a promissory note for ₱25,000 loaned amount from Commonwealth Bank. 17Received returned merchandise from customers on December 10, ₱4,000. 18Paid ₱7,600 of the amount owed from the December 3 transaction. 19Purchase additional groceries from QR Supermarket amounting to ₱86,000. 20Collected full settlement of customer from December 10 sale. 22₱21,450 cost of merchandise was sold for ₱38,750. 25Settled account to JKL Enterprises. 26Cash received, ₱10,000 and a promissory note for ₱25,000 for merchandise sold to a key customer. Cost of merchandise, ₱28,000. 27Mr. Lopez withdrew ₱20,000 cash from the business. 29Paid telephone expense, ₱2,300. 30Paid building rentals for the month, ₱5,200. 30Paid the first installment of the note payable on Service Vehicle. 31Paid Salaries ₱11,300, net of the following deductions: SSS, ₱380; Pag-IBIG, ₱100; Philhealth, ₱220 The Merchandise Inventory at the end of the of the month is ₱48,000. Additional information for year-end adjustments. Ø The useful life of the equipment is 5 years with no salvage value. -The useful life of the service vehicle is 10 years with no salvage value. -Remaining unused supplies worth ₱9,100. Use asset method.

Question:

1. Prepare the General Ledger. Pls use periodic inventory method.

- On May 1, Year 1, Benz's Sandwich Shop loaned $12,000 to Mark Henry for one year at 9 percent interest. Required: a. What is Benz's interest income for Year 1? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry? Note: For all requirements, round your answers to the nearest dollar amount. a. b. ذان C. e f. f. g. × Answer is not complete. Interest income Receivables Cash used in investing activities Interest income Cash Cash provided by operating activities Cash provided by investing activities Interest earned P ✔ >>arrow_forwardOn May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $478,700. The interest rate charged by the bank was 6.75%. The bank made the loan on a discount basis. Exercise 7-7 (Algo) Part a - Journal entry a-3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on May 15, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardDiana Rene’s deposited an inheritance of 13,050 in a bank account and earned 435 in Simple bankers interest at a rate of 10.5% find the length of time the money was on depositarrow_forward

- Mr. Nailor invests $21,000 in a money market account at his local bank. He receives annual interest of 7% for 6 years. How much return will his investment earn during this time period? Use Appendix A. (Round "FV Factor" to 3 decimal places.) $10,521 $29,205 $31,521 $13,986arrow_forwardOliver Lopez deposits $12,000 in a bank account that pays 7% annual interest. Calculate the balance of the account after 5 years.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education