ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

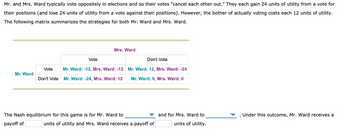

Transcribed Image Text:Mr. and Mrs. Ward typically vote oppositely in elections and so their votes "cancel each other out." They each gain 24 units of utility from a vote for

their positions (and lose 24 units of utility from a vote against their positions). However, the bother of actually voting costs each 12 units of utility.

The following matrix summarizes the strategies for both Mr. Ward and Mrs. Ward.

Mr. Ward

Vote

Vote

Mrs. Ward

Mr. Ward: -12, Mrs. Ward: -12

Don't Vote Mr. Ward: -24, Mrs. Ward: 12

The Nash equilibrium for this game is for Mr. Ward to

payoff of

Don't Vote

Mr. Ward: 12, Mrs. Ward: -24

Mr. Ward: 0, Mrs. Ward: 0

units of utility and Mrs. Ward receives a payoff of

and for Mrs. Ward to

units of utility.

Under this outcome, Mr. Ward receives a

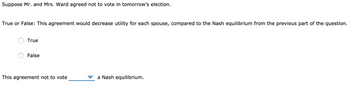

Transcribed Image Text:Suppose Mr. and Mrs. Ward agreed not to vote in tomorrow's election.

True or False: This agreement would decrease utility for each spouse, compared to the Nash equilibrium from the previous part of the question.

True

False

This agreement not to vote

a Nash equilibrium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- When a famous painting becomes available for sale, it is often known which museum or collector will be the likely winner. Yet, the auctioneer actively woos representatives of other museums that have no chance of winning to attend anyway. Suppose a piece of art has recently become available for sale and will be auctioned off to the highest bidder, with the winner paying an amount equal to the second highest bid. Assume that most collectors know that Valerie places a value of $15,000 on the art piece and that she values this art piece more than any other collector. Suppose that if no one else shows up, Valerie simply bids $15,000/2=$7,500 and wins the piece of art. The expected price paid by Valerie, with no other bidders present, is $________.. Suppose the owner of the artwork manages to recruit another bidder, Antonio, to the auction. Antonio is known to value the art piece at $12,000. The expected price paid by Valerie, given the presence of the second bidder Antonio, is $_______. .arrow_forwardSuppose that Lionel Messi is negotiating a contract with FC Barcelona. Messi has an offer from Real Madrid for $20 million a year. If he signs with FC Barcelona, they will earn $90 million in revenue from the signing. FC Barcelona's next best option is to sign Cristiano Ronaldo. They would earn $70 million from signing Ronaldo and would pay him a contract of $10 million. Messi's bargaining power is w = 1/2. a) What is the negotiated salary between Messi and FC Barcelona under Nash Bargaining? What is Messi's surplus and what is FC Barcelona's surplus? b) Due to an injury, FC Barcelona would only earn $50 million from signing Ronaldo but everything else remains the same. What is the negotiated salary between Messi and FC Barcelona under Nash Bargaining? What is Messi's surplus and what is FC Barcelona's surplus?arrow_forwardThe count is three balls and two strikes, and the bases are empty. The batter wants to maximize the probability of getting a hit or a walk, while the pitcher wants to minimize this probability. The pitcher has to decide whether to throw a fast ball or a curve ball, while the batter has to decide whether to prepare for a fast ball or a curve ball. The strategic form of this game is shown here. Find all Nash equilibria in mixed strategies.arrow_forward

- Mr. and Mrs. Ward typically vote oppositely in elections and so their votes “cancel each other out.” They each gain two units of utility from a vote for their positions (and lose two units of utility from a vote against their positions). However, the bother of actually voting costs each one unit of utility. Diagram a game in which they choose whether to vote or not to vote.arrow_forwardJohn and Jane usually vote against each other’s party in the SSC elections resulting to negating or offsetting their votes. If they vote for their party of choice, each of them gains four units of utility (and lose four units of utility from a vote against their party of choice). However, it costs each of them two units of utility for the hassle of actually voting during the SSC elections. A. Diagram a game in which John and Jane choose whether to vote or not to vote.arrow_forward7arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education