Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

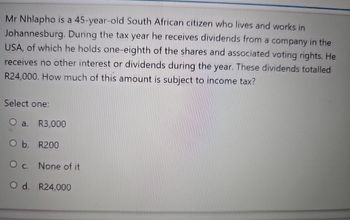

Transcribed Image Text:Mr Nhlapho is a 45-year-old South African citizen who lives and works in

Johannesburg. During the tax year he receives dividends from a company in the

USA, of which he holds one-eighth of the shares and associated voting rights. He

receives no other interest or dividends during the year. These dividends totalled

R24,000. How much of this amount is subject to income tax?

Select one:

O a. R3,000

O b. R200

O c. None of it

O d. R24,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Marc, a single taxpayer, earns $214,000 in taxable income and $6,600 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for year 2022, what is his current marginal tax rate? a. 22.00 percent b. 32.00 percent c. 34.00 percent d. 44.00 percent e. none of the choices are correctarrow_forwardMarc, a single taxpayer, earns $64,800 in taxable income and $5,480 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for 2023, what is his average tax rate? Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 11,000 10% of taxable income $ 11,000 $ 44,725 $1,100 plus 12% of the excess over $11,000 $ 44,725 $ 95,375 $5,147 plus 22% of the excess over $44,725 $ 95,375 $ 182,100 $16,290 plus 24% of the excess over $95,375 $ 182,100 $ 231,250 $37,104 plus 32% of the excess over $182,100 $ 231,250 $ 578,125 $52,832 plus 35% of the excess over $231,250 $ 578,125 — $174,238.25 plus 37% of the excess over $578,125 a)14.76 percent b)12.08 percent c)11.85 percent d)22.00 percent e)None of the choices are correct.arrow_forwardorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly.) Required: If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? What is their marginal rate if, instead, they report an additional $100,000 in deductionsarrow_forward

- Jenna paid foreign income tax of $4,961 on foreign income of $24,806. Her worldwide taxable income was $162,800, and her U.S. tax liability was $40,000. Required: What is the amount of the foreign tax credit (FTC) allowed? What would be the allowed FTC if Jenna had paid foreign income tax of $10,900 instead?arrow_forwardKim is an employee of Azure Corporation. In the current year, she receives a cash salary of $106,200 and also is given 45 shares of Azure stock for services she renders to the corporation. The shares in Azure Corporation are worth $2,500 each. a. How will the transfer of the 45 shares to Kim be handled for tax purposes? Kim's basis in the stock is $fill in the blank 2 ______? b. What is Azure Corporation's total compensation deduction for Kim's services?$fill in the blank 3 _________?arrow_forwardJenna paid foreign income tax of $3,194 on foreign income of $15,968. Her worldwide taxable income was $125,000, and her U.S. tax liability was $31,000. Required: What is the amount of the foreign tax credit (FTC) allowed? What would be the allowed FTC if Jenna had paid foreign income tax of $6,400 instead?arrow_forward

- Subject :- Accountingarrow_forwardSimon is a resident for tax purposes. During the year he derived gross wages of $50,000 from his employer in Sydney, $2,000 interest from Australian investments, and $8,000 of rent from an overseas property. Giving reasons, calculate the taxable income for Simonarrow_forwardJorge and Anita, married taxpayers, earn $158,500 in taxable income and $48,500 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Jorge and Anita earn an additional $108,500 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $108,500 in deductions? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) a. Marginal tax rate b. Marginal tax rate % %arrow_forward

- aa.6 Scot and Vidia, married taxpayers, earn $184,000 in taxable income and $5,000 in interest from an investment in City of Tampa bonds. (Use the U.S. tax rate schedule). a If Scot and Vidia earn an additional $81,250 of taxable income, what is their marginal tax rate on this income? b. How would your answer differ if they, instead, had $81,250 of additional deductions?arrow_forward17) Bamdad plans to become a landlord and purchase a property to use as a rental (he is conducting these activities under a registered business). He plans to take advantage of leveraging his real estate investment to increase his expenses and reduce his income tax. According to the Canadian government, by what percentage is Bamdad allowed to depreciate his property per year under the Declining Balance Method? 1. He is not able to depreciate the property. 2. 30% 3. 20% 4. 5%arrow_forwardaj.3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education