Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

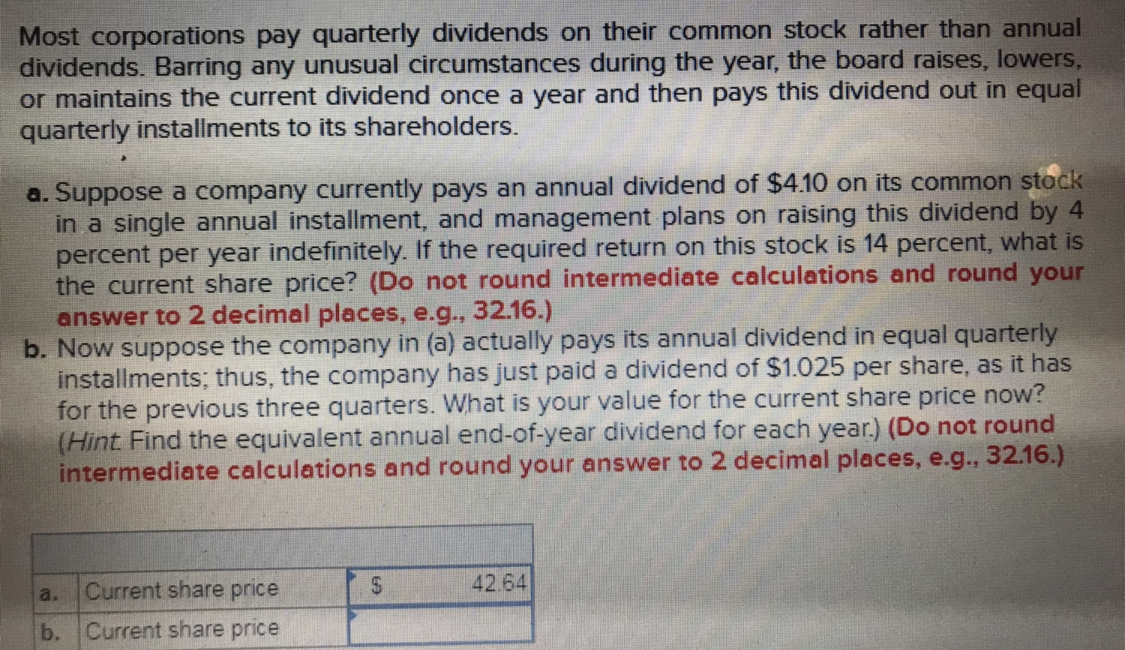

Transcribed Image Text:Most corporations pay quarterly dividends on their common stock rather than annual

dividends. Barring any unusual circumstances during the year, the board raises, lowers,

or maintains the current dividend once a year and then pays this dividend out in equal

quarterly installments to its shareholders.

a. Suppose a company currently pays an annual dividend of $410 on its common stock

in a single annual installment, and management plans on raising this dividend by 4

percent per year indefinitely. If the required return on this stock is 14 percent, what is

the current share price? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

b. Now suppose the company in (a) actually pays its annual dividend in equal quarterly

installments; thus, the company has just paid a dividend of $1.025 per share, as it has

for the previous three quarters. What is your value for the current share price now?

(Hint Find the equivalent annual end-of-year dividend for each year.) (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a. Current share price

b. Current share price

42.64

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.20, all of which was reinvested in the company. The firm's expected ROE for the next four years is 19% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 18% per year. GG's market capitalization rate is 18% per year. Required: a. What is your estimate of GG's intrinsic value per share? Note: Round your answer to 2 decimal places. b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? Complete this question by entering your answers in the tabs below. Required A Required B What is your estimate of GG's intrinsic value per share? Note: Round your answer to 2 decimal places. GG's intrinsic valuearrow_forwardLohn Corporation is expected to pay the following dividends over the next four years: $14, $10, $9, and $3.50. Afterward, the company pledges to maintain a constant 6 percent growth rate in dividends forever. If the required return on the stock is 10 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardMitsui Ltd has 1 million issued shares and expects unlevered after-tax cash flows of $300,000 every year, forever. The company is all-equity financed, and its cost of capital is 12% p.a. The company's tax rate is 30%. The company has just announced its intention to borrow an additional $1,400,000 of perpetual debt (at a 7% p.a. interest rate) and use the proceeds to repurchase shares? a) Calculate the price per share of Mitsui Ltd immediately before the repurchase announcement. b) Calculate the price of a share in Mitsui Ltd immediately after the repurchase announcement but before the new borrowings occur (assuming that the market expects repurchase to occur with certainty and that there are no other information effects). c) Calculate the cost of equity capital for Mitsui Ltd after the share repurchase (ignoring other information effects).arrow_forward

- Sooner-than-Later (STL) Inc. announces that it will pay a $75 per dividend next year, followed by a final dividend of $30 per share in the year after. Mrs. Donna Holder has 50 shares in STL Inc. She wishes to limit her income from investments limited to $35 in the first year. Demonstrate through relevant computations, how she can achieve this goal through homemade dividends if the required return on STL Inc’s shares is 9%. What will be Mrs. Holder’s earning in the second year?arrow_forwardChamberlain Corporation is expected to pay the following dividends over the next four years: $13.20, $9.20, $8.20, and $3.70. Afterward, the company pledges to maintain a constant 4% growth rate in dividends forever. If the required return on the stock is 12%, what is the current share price? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.)arrow_forwardHouse of Haddock has 5,060 shares outstanding and the stock price is $146. The company is expected to pay a dividend of $26 per share next year and thereafter the dividend is expected to grow indefinitely by 3% a year. The president, George Mullet, now makes a surprise announcement: He says that the company will henceforth distribute half the cash in the form of dividends and the remainder will be used to repurchase stock. The repurchased stock will not be entitled to the dividend. a-1. What is the total value of the company before the announcement? a-2. What is the total value of the company after the announcement? a-3. What is the value of one share? b. What is the expected stream of dividends per share for an investor who plans to retain his shares rather than sell them back to the company? Check your estimate of share value by discounting this stream of dividends per share. Complete this question by entering your answers in the tabs below. Req A1 to A3 Req B a-1. What is the total…arrow_forward

- Assume that your company is an all-equity firm with 250,000 shares outstanding. The company's EBIT is $2,500,000, and EBIT is expected to remain constant over time. The company pays out all of its earnings each year, so its earnings per share are equal to its dividends per share and this is currently $6.00 per share. The company's tax rate is 40 percent, its current cost of stock, Ks, is 8 percent, and its current stock price is $75 per share. Now assume that the company is considering issuing $3.75 million worth of bonds (at par) and using the proceeds for a stock repurchase. If issued, the bonds would have an estimated yield to maturity of 5 percent or interest of $187,500. The risk-free rate in the economy is 4 percent, and the market risk premium is 5 percent. The company's beta is currently 0.8, but its investment bankers estimate that the company's beta would rise to 0.9 if it proceeds with the recapitalization. Assume that the shares are repurchased at the equilibrium price that…arrow_forwardMetal Inc. has not issued a dividend. It is management's intention to do so beginning three years from today. The initial annual dividend is expected to be $3.00. Over the subsequent three years the annual dividends are expected to grow by 15% per year and then 10% per year for 4 years before slowing to a permanent growth rate of 3.5% per year. Determine the dollar value of the 2nd dividend.arrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $17.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 15% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 10%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 26% per year. Required: a. What is your estimate of DEQS's intrinsic value per share? b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? c. What do you expect to happen to price in the following year? d. What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 15% of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education