FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

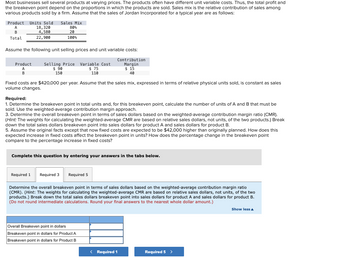

Transcribed Image Text:Most businesses sell several products at varying prices. The products often have different unit variable costs. Thus, the total profit and

the breakeven point depend on the proportions in which the products are sold. Sales mix is the relative contribution of sales among

various products sold by a firm. Assume that the sales of Jordan Incorporated for a typical year are as follows:

Product Units Sold Sales Mix

A

B

Total

18,320

4,580

22,900

80%

20

100%

Assume the following unit selling prices and unit variable costs:

Contribution

Margin

$ 15

40

Product Selling Price Variable Cost

A

B

$90

150

$75

110

Fixed costs are $420,000 per year. Assume that the sales mix, expressed in terms of relative physical units sold, is constant as sales

volume changes.

Required:

1. Determine the breakeven point in total units and, for this breakeven point, calculate the number of units of A and B that must be

sold. Use the weighted-average contribution margin approach.

3. Determine the overall breakeven point in terms of sales dollars based on the weighted-average contribution margin ratio (CMR).

(Hint: The weights for calculating the weighted-average CMR are based on relative sales dollars, not units, of the two products.) Break

down the total sales dollars breakeven point into sales dollars for product A and sales dollars for product B.

5. Assume the original facts except that now fixed costs are expected to be $42,000 higher than originally planned. How does this

expected increase in fixed costs affect the breakeven point in units? How does the percentage change in the breakeven point

compare to the percentage increase in fixed costs?

Complete this question by entering your answers in the tabs below.

Required 1 Required 3

Required 5

Determine the overall breakeven point in terms of sales dollars based on the weighted-average contribution margin ratio

(CMR). (Hint: The weights for calculating the weighted-average CMR are based on relative sales dollars, not units, of the two

products.) Break down the total sales dollars breakeven point into sales dollars for product A and sales dollars for product B.

(Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.)

Overall Breakeven point in dollars

Breakeven point in dollars for Product A

Breakeven point in dollars for Product B

< Required 1

Required 5 >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Similar questions

- Breakeven point-Algebraic and graphical Fine Leather Enterprises sells its single product for $128.88 per unit. The firm's fixed operating costs are $472,200 annually, and its variable operating costs are $86.54 per unit. a. Find the firm's operating breakeven point in units. b. Label the x axis "Sales (units)" and the y axis "Costs/Revenues ($)," and then graph the firm's sales revenue, total operating cost, and fixed operating cost functions on these axes. In addition, label the operating breakeven point and the areas of loss and profit (EBIT). a. The operating breakeven point is units. (Round to the nearest integer.)arrow_forwardCalculate the effect on profit of a proposed change in ‘Sales Mix’ from the following data and also suggest that whether company should change the sales mix or continue with the existing:arrow_forwardTom Company reports the following data: Sales Variable costs Fixed costs Determine Tom Company's operating leverage. Round your answer to one decimal place. $156,332 81,532 30,800arrow_forward

- sarrow_forwardContribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials $50.00 Direct labor 30.00 Factory overhead $350,000 6.00 Selling expenses: Sales salaries and commissions 340,000 4.00 Advertising 116,000 Travel 4,000 Miscellaneous selling expense 2,300 1.00 Administrative expenses: Office and officers' salaries 325,000 Supplies 6,000 4.00 Miscellaneous administrative expense 8,700 1.00 Total $1,152,000 $96.00 It is expected that 12,000 units will be sold at a price…arrow_forwardCurrent Attempt in Progress Some financial information for each of three companies is reflected below in columns A, B, and C. Use your knowledge of CVP relationships to fill in the missing pieces numbered (1) through (9). Consider each company (i.e., column) separately. (Round variable cost per unit and contribution margin ratio to 2 decimal places, e.g. 0.24.) Selling price Total fixed costs Sales volume (units) Variable cost/unit Operating income Tax rate After-tax profit Contribution margin ratio A $6 $13,100 29,000 $40,840 (1) % (2) $28,588 (3) B $800 2,500 $384 25% $684,375 (4) (5) (6) с $389,000 $30.24 $229,240 40% 0.64arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education