FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help on three and four with full work

Transcribed Image Text:A company plans to make four annual deposits of $3,750 each to a special building fund. The fund's assets will be invested in

mortgage instruments expected to pay interest at 12% on the fund's balance.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Determine how much will be accumulated in the fund after four years under each of the following situations:

1. The $3,750 annual deposit are made at the end of each of the four years and interest is compounded annually.

2. The $3,750 annual deposit are made at the beginning of each of the four years and interest is compounded annually.

3. The $3,750 annual deposit are made at the beginning of each of the four years and interest is compounded quarterly.

4. The $3,750 annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest

earned is withdrawn at the end of each year.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3 Required 4

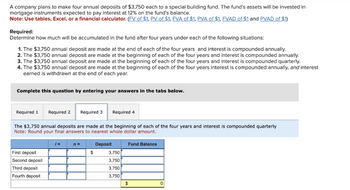

The $3,750 annual deposits are made at the beginning of each of the four years and interest is compounded quarterly

Note: Round your final answers to nearest whole dollar amount.

Deposit

First deposit

Second deposit

Third deposit

Fourth deposit

=

n=

$

3,750

3,750

3,750

3,750

Fund Balance

$

0

Transcribed Image Text:A company plans to make four annual deposits of $3,750 each to a special building fund. The fund's assets will be invested in

mortgage instruments expected to pay interest at 12% on the fund's balance.

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1)

Required:

Determine how much will be accumulated in the fund after four years under each of the following situations:

1. The $3,750 annual deposit are made at the end of each of the four years and interest is compounded annually.

2. The $3,750 annual deposit are made at the beginning of each of the four years and interest is compounded annually.

3. The $3,750 annual deposit are made at the beginning of each of the four years and interest is compounded quarterly.

4. The $3,750 annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest

earned is withdrawn at the end of each year.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

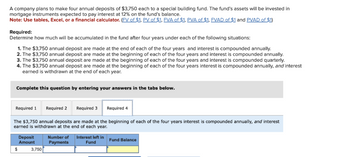

The $3,750 annual deposits are made at the beginning of each of the four years interest is compounded annually, and interest

earned is withdrawn at the end of each year.

$

Deposit

Amount

3,750

Number of

Payments

Required 4

Interest left in

Fund

Fund Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3. Prepare journal entries for the month of April to record the above transactions. View transaction list View journal entry worksheet No 2 3 4 5 6 7 Transaction b. C. d. e. 1. 9. Direct materials used Direct labor used Cash Indirect labor Indirect labor Cash Factory overhead Overapplied overhead Underapplied overhead Factory building Cash Utilities expense Utilities payable General Journal Debit Creditarrow_forwardExercise 8 (Dropping or Retaining a Segment) Paragon Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Pasig Three services are provided for seniors – home nursing, meals on area. wheels, and housekeeping. In the home nursing program, nurses visit seniors on a regular basis to check on their general health and to perform tests ordered by their physicians. The meals on wheels program delivers a hot meal once a day to each senior enrolled in the program: The housekeeping service provides weekly housecleaning and maintenance services. Data on revenue and expenses for the past year follow: Meals on Wheels P400,000 210,000 190,000 Home House- Nursing P260,000 120,000 140,000 keeping P240,000 160,000 80,000 Total P900,000 490,000 410,000 Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* Total fixed…arrow_forwardQuestion 6, part 1arrow_forward

- Problem 7-41 (Algo) Departmental Cost Allocation; Service Company [LO 7-3, 7-5] Comprehensive Insurance Company has two product lines: health insurance and auto insurance. The two product lines are served by three operating departments, which are necessary for providing the two types of products: claims processing, administration, and sales. These three operating departments are supported by two departments: information technology and operations. The support provided by information technology and operations to the other departments is shown below. Operating Departments Information technology Operations The total costs incurred in the five departments are: Information technology Operations Claims processing Administration Sales Total costs Support Departments Information Technology Operations 20% 10% a. Direct Method b. Step Method (Info Tech First) Step Method (Operations First) c. Reciprocal Method $ 589,000 1,660,000 310,000 625,000 630,000 $ 3,814,000 Required: Determine the total…arrow_forwardkk.2arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- QUESTION 2 Five jobs are to be processed through a single machine. The processing times and due dates are given here. Job 3 4 Processing 3 4. 2 Time Due Date 4. 8 12 21 15 Assume that the following precedence relationships must be satisfied: 1→4 and 2 3. Determine the sequence in which these jobs should be done in order to minimize the maximum lateness subject to the precedence restrictions. Job sequence: 1arrow_forwardCan you please show me how to workout this problemarrow_forwardCombat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000 + 10,200)]. Estimated annual manufacturing overhead is $1,588,566. Thus, the predetermined overhead rate is $16.50 or ($1,588,566 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost…arrow_forward

- C3arrow_forwardSpecial-Order Decision, Services, Qualitative Aspects Jason Rogers works full-time for UPS and runs a lawn-mowing service part-time after work during the warm months of April through October. Jason has two men working with him, each of whom is paid $6.00 per lawn mowing. Jason has 25 residential customers who contract with him for once-weekly lawn mowing during the months of May through September, and twice-per-month mowings during April and October. On average, Jason charges $42 per lawn mowed. Recently, LStar Property Management Services asked Jason to mow the lawn at each of its 29 rental houses every two weeks during the months of May through September. LStar has offered to pay $29 per lawn mowing, and would forego the lawn edging that normally takes Jason’s team about half of its regular mowing time. If Jason accepts the job, he can assign a one-man team to mow the rental house yards, and will have to buy an additional power lawn mower for about $370 used. Fuel to run the…arrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education