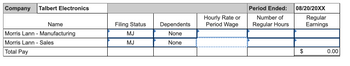

Morris Lann works for Talbert Electronics. He is a shared employee; he works in the manufacturing department and has been trained to work the sales counter when needed. He was asked to work the sales counter for two days, five hours each day during other employees' vacations. When he works in the manufacturing department, he earns $16.50 per hour. Morris earns a $2.50 pay differential for working the sales counter. He worked a total of 39 hours and 30 minutes during the week. Morris is married filing joint with no dependents.

Compute Morris’s pay for the week ending August 20 using the hundredth-hour system. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Jason Rogers works full-time for UPS and runs a lawn-mowing service part-time after work during the warm months of April through October. Jason has three men working with him, each of whom is paid $6.00 per lawn mowing. Jason has 27 residential customers who contract with him for once-weekly lawn mowing during the months of May through September, and twice-per-month mowings during April and October. On average, Jason charges $48 per lawn mowed. Recently, LStar Property Management Services asked Jason to mow the lawn at each of its 30 rental houses every two weeks during the months of May through September. LStar has offered to pay $30 per lawn mowing, and would forego the lawn edging that normally takes Jason’s team about half of its regular mowing time. If Jason accepts the job, he can assign a two-man team to mow the rental house yards, and will have to buy an additional power lawn mower for about $360 used. Fuel to run the additional mower will be about $0.40 per yard. 1. If Jason…arrow_forwardJuan works on a holiday for which he receives 8 hours' regular pay and 8 hours' holiday pay. During the rest of the workweek he works 32 hours. If his normal pay rate is $8 per hour, how much pay must he receive under federal law? a. 416.00 b. 320.00 c. 448.00 d. 384.00arrow_forwardRhea Xu is a self-employed professional singer. She resides in a rented apartment and uses one room exclusively as a business office. This room includes 405 of the 2,700 square feet of living space in the apartment. Ms. Xu performs in recording studios and concert halls, but she conducts all of the administrative duties with respect to the business in her home office. This year, Ms. Xu's apartment rent was $60,000. She paid $6,400 to a housekeeping service that cleaned the entire apartment once a week and $3,200 for renter's insurance on the apartment furnishings. Required: a. Compute Ms. Xu's home office deduction assuming that her net profit before the deduction was $420,000. b. Compute Ms. Xu's home office deduction assuming that her net profit before the deduction was $5,200. Complete this question by entering your answers in the tabs below. Required A Required B Compute Ms. Xu's home office deduction assuming that her net profit before the deduction was $420,000. Home office…arrow_forward

- 4arrow_forwardJarvie loves to bike. In fact, he has always turned down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie's current shop, Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Description Retail Price Cost Employee Price Specialized road bike $ 7,200 $ 4,900 $ 5,040 Rocky Mountain mountain bike 5,200 3,750 4,160 Trek road bike 3,300 2,760 2,310 Yeti mountain bike 3,300 2,900 2,640 Required: What amount is Jarvie required to include in taxable income from these purchases? What amount of deductions is Bad Dog allowed to claim from these transactions?arrow_forwardManuel is paid $185 each day he guides tourists on camping trips in the Grand Canyon. what amount did he earn last month if he worked 34 days?arrow_forward

- Ron Valdez worked for two different employers. Until May, he worked for Rowland Construction Company in Ames, Iowa, and earned $22,940. The state unemployment rate for Rowland is 4.6%. He then changed jobs and worked for Ford Improvement Company in Topeka, Kansas, and earned $30,360 for the rest of the year. The state unemployment rate for Ford is 5.1%. Determine the unemployment taxes (FUTA and SUTA) that would be paid by each company. Round your answers to the nearest cent. Use Figure 5.1 to determine SUTA caps in Iowa and Kansas. a. Rowland Construction Company $fill in the blank 1 b. Ford Improvement Company $fill in the blank 2arrow_forwardJustin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forwardDelta pays Pete Rose $150 per day to work in the maintenance department at the airport. Pete became ill on Monday and went home after 1/6 of a day. What did he earn on Monday? Assume no work, no pay.arrow_forward

- Park Mischner owns Old Times Buttons, which employs twenty-four people. Park wants to perform a benefits analysis report for one of the employees, Arnold Bower, for the year. Arnold's benefits package is as follows: Annual salary: $58,000 401(k) contribution: 6 percent of annual salary. The company match is 75 percent of employee contribution up to 4 percent employee annual salary. Medical insurance deduction: $230 per month Dental insurance: $15 per month Required: Complete the following Benefits Analysis Report for Arnold Bower for the year. Do not include FUTA and SUTA taxes. (Round your answers to 2 decimal places. Enter all amounts as positive values.) Yearly Benefit Costs Company Cost Arnold's Cost Medical insurance 2$ 34,020.00 Dental insurance $ 2,110.00 Life insurance $ 710.00 $ 0.00 AD&D 2$ 169.00 $ 0.00 Short-term disability $ 1,690.00 $ 0.00 Long-term disability 401(k) 2$ 845.00 2$ 0.00 Social Security Medicare Tuition reimbursement 2$ 2,320.00 $ 0.00 Total yearly benefit…arrow_forwardKate is an executive for the Cozy Furniture Manufacturing Company. She purchased furniture from the company for $9,500, the price Cozy ordinarily would charge a wholesaler for the same items. The retail price of the furniture was $12,500, and Cozy’s cost was $9,000. The company also paid for Kate’s parking space in a garage near the office. The parking fee was $600 for the year. All employees are allowed to buy furniture at a discounted price comparable to that charged to Kate. However, the company does not pay other employees’ parking fees. Kate’s gross income from the above is: answer choices: $3,500. $4,100. $-0-. $900 $600.arrow_forwardPaul's Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul's busiest months: ⚫ June 1 cash balance $16,000. ⚫ June 1 supplies on hand $4,400. ⚫ June 1 accounts receivable $9,100. • June 1 accounts payable $4,300. • Estimated sales for June, July, and August are $27,300, $41,000, and $43,900,…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education