FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

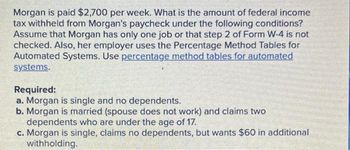

Transcribed Image Text:Morgan is paid $2,700 per week. What is the amount of federal income

tax withheld from Morgan's paycheck under the following conditions?

Assume that Morgan has only one job or that step 2 of Form W-4 is not

checked. Also, her employer uses the Percentage Method Tables for

Automated Systems. Use percentage method tables for automated

systems.

Required:

a. Morgan is single and no dependents.

b. Morgan is married (spouse does not work) and claims two

dependents who are under the age of 17.

c. Morgan is single, claims no dependents, but wants $60 in additional

withholding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the penalty described for the following taxpayers. If an amount is zero, enter "0". If required, round your answers to two decimal places. Question Content Area a. Wilson filed his individual tax return on the original due date, but failed to pay $2,310 in taxes that were due with the return. If Wilson pays the taxes exactly 3 months late (not over 60 days), calculate the amount of his failure-to-pay penalty.$fill in the blank b. Joan filed her individual income tax return 5 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $725, which was the balance of the taxes she owed with her return. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent.$fill in the blankarrow_forwardValentina is single and claims no dependents. Assume that Valentina has only one job or that step 2 of Form W-4 is not checked. Use the Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 from 2020 or Later available online in Publication 15, Publication 15-T. "Federal Income Tax Withholding Methods." Use the appropriate wage bracket tables for a manual payroll systems Required: a. If Valentina is paid weekly and her annual wages are $82,680, what is the amount of withholding per paycheck? b. If Valentina is paid monthly with annual wages of $68,640, what is the amount of withholding per paycheck? c. If Valentina is paid biweekly with annual wages of $63,960, what is the amount of withholding per paycheck? d. If Valentina is paid semimonthly with annual wages of $77,160, what is the amount of withholding per paycheck? Amount a Withholdings per paycheck (b Withholdings per paycheck e Withholdings par paycheck d. Withholdings pet paygarrow_forwardMahmet earned wages of $148,800 during 2022. Mahmet qualifies to file as head of household and claims two dependents under the age of 17. How much FICA tax is Mahmet's employer responsible to remit in 2022?arrow_forward

- T uses frequent flyer miles to take his family on a vacation. T received the miles duringbusiness travel paid for by his employer. The normal airfare for his vacation wouldhave cost $7,000.a. T must realize and recognize $7,000 as income.b. Although T has realized income, he will not be required to recognize it becausethe IRS has chosen, as a matter of administrative convenience, not to requiretaxpayers to recognize the value of frequent flyer tickets earned duringemployer-paid travel.c. Had T earned the frequent flyer miles during travel he had paid for himself, theissue of income realization and recognition would not arise.d. Both (a) and (c) are correct.e. Both (b) and (c) are correct. T buys a parcel of real estate for $100,000, which he finances by giving the seller a nonrecoursemortgage for the full purchase price. The debt is due in one balloon payment inYear 5. When the debt becomes due in Year 5, T decides to give the property back to theseller in satisfaction of the debt…arrow_forwardEkiya, who is single, has been offered a position as a city landscape consultant. The position pays $150,200 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)? Solve for sub-questions 2, 4, and 6.arrow_forwardKaren most had a federal tax levy of 2100.50 against her. If Most is single with two personal exemptions and had take home pay of 499 this week, how much would her employer take from her pay to satisfy part of the tax levy?arrow_forward

- A taxpayer works for a single employer during the year (TY2018) and discovers that they withheld a total of $1,356 in VPDI. What is the amount of the credit that they can claim for this excess on their State return? (Look at the explanation as much as the answer) $0 - They only had a single employer. $0 - That is below the maximum amount and there is no excess. $0 - VPDI has no upper limit, unlike SDI. $206.33 - This is the excess over the $1,149.67 maximum.arrow_forwardKaren Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal exemptions and had a take-home pay of $499.00 this week, how much would her employer take from her to satisfy part of the tax levy?arrow_forwardb. Joan filed her individual income tax return 4(1)/(2) months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $750, which was the balance of the taxes she owed with her return. Disregarding interest, calculate the total penalty that Joan will be required to pay, assuming the failure to file was not fraudulent.arrow_forward

- 1. Deductible transportation expenses: a.Do not include the normal costs of commuting. b.Do not include daily expenses for transportation between the taxpayer's home and temporary work locations if the taxpayer has a regular place of business. c.Include only costs incurred while away from home. d.Include meals and lodging. 2. Barry is a self-employed attorney who travels to New York on a business trip during 2021. Barry's expenses were as follows: Airfare $550 Taxis 40 Restaurant meals 150 Lodging 350 How much may Barry deduct as travel expenses for the trip? a.$0 b.$1,015 c.$940 d.$1,090 e.None of these choices are correct. 3. Which of the following is deductible as dues, subscriptions, or publications? a.Subscription to the "Journal of Taxation" for a tax attorney b.Dues to a health club for a doctor c.Dues to the drama club for a student d.Subscription to "Vogue" magazine for a corporate president e.None of these choices are correct.arrow_forwardAs a tax return preparer for The Fernando Rodriguez Tax & Accounting Service, you have been asked to calculate the missing information for one of the firm's tax clients. The following table gives the standard deduction for various filing statuses. Standard Deductions Single or married filing separately $12,000 Married filing jointly or surviving spouse $24,000 Head of household $18,000 65 or older and/or blindand/or someone else canclaim you (or your spouseif filing jointly) as a dependent: Varies(See www.irs.gov for information.) Using the standard deduction table above, complete the following table (in $). Name Filing Status Income Adjustments toIncome Adjusted GrossIncome StandardDeduction ItemizedDeductions TaxableIncome Campbell Married filingjointly $58,320 $1,560 $ $ $5,910 $ When finding your client's taxable income, which deduction did you use?arrow_forwardArno and Bridgette are married and have combined W-2 income of $89,361. They received a refund of $128 when they filed their taxes. How much income tax did their employers withhold during the year? $9,582. $9,326. $9,454. The answer cannot be determined with the information provided.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education