FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

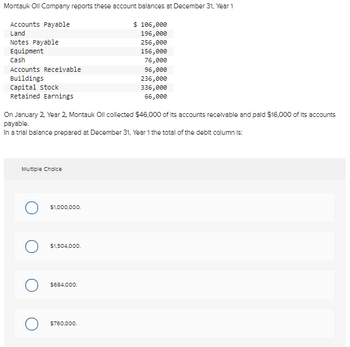

Transcribed Image Text:Montauk Oil Company reports these account balances at December 31, Year 1

Accounts Payable

Land

Notes Payable

Equipment

Cash

Accounts Receivable

Buildings

Capital Stock

Retained Earnings

Multiple Choice

On January 2, Year 2, Montauk Oll collected $46,000 of its accounts receivable and paid $16,000 of its accounts

payable.

In a trial balance prepared at December 31, Year 1 the total of the debit column is:

$1,000,000.

O $1,504,000.

O

$684,000.

$ 106,000

196,000

256,000

156,000

$760,000.

76,000

96,000

236,000

336,000

66,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forwardAccarrow_forward12) ABSD INC.'s B.O.D's approved issuance of 5,000,000 share of $50 par value common stock. Currently 4,200,000 shares are outstanding. Current stock price is $60 A 4% stock dividend is declared on March 1, 2020 and paid two months later. Show journal entries required to record declaration and payment of distribution.arrow_forward

- On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardSubject: accountingarrow_forwardSagararrow_forward

- Record the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardPrepaid rent Accounts receivable Cash Comon stock Retained earnings Current assets Prepare a classified balance sheet. Note: Allowance for doubtful accounts is subtracted from accounts receivable on the company's balance sheet. Total assets otal current assets Long-term Investments Current labies BENNETT COMPANY Balance Sheet Long term is Total abilities December 31 Assets Liabilities $ 2,700 Accounts payable 18,500 Allowance for doubtful accounts 29,098 Notes payable (due in 10 years) 13,500 Notes receivable (due in 4 years) 24,200 Equity Total quity Total abilities and equity 5 S 0 0 $ 4,200 1,000 11,400 0arrow_forward[The following information applies to the questions displayed below.] On January 1, Year 1, the general ledger of a company includes the following account balances: Debit Credit Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts $ 25,600 47,200 $ 4,700 Inventory Land 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock 2,000 29,000 55,000 40,000 31,100 $161,800 Retained Earnings Totals $161,800 During January Year 1, the following transactions occur: 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. 6 Purchase additional inventory on account, $152,000. January January January 15 The comapany sales for the first half the onth total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on…arrow_forward

- On January 1, 2021, Displays Incorporated had the following account balances: Debit 41,000 38,000 44,000 77,000 246,000 Accounts Cash Accounts receivable Supplies Inventory Land Accounts payable Notes payable (5%, due next year) Common stock Retained earnings Totals $ Credit $ 56,000 39,000 205,000 146,000 $ 446,000 $ 446,000 From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $349,000. b. Sold inventory on account for $665,000. The cost of the inventory sold was $329,000. c. Received $594,000 from customers on accounts receivable. d. Paid freight on inventory received, $43,000. e. Paid $339,000 to inventory suppliers on accounts payable of $347,000. The difference reflects purchase discounts of $8,000. f. Paid rent for the current year, $61,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $169,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on…arrow_forwardOn January 1, 2025, the ledger of Wildhorse Co. contained these liability accounts. Accounts Payable $44,700 Sales Taxes Payable 8,800 Unearned Service Revenue 21,200 During January, the following selected transactions occurred. Jan. 1 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. 5 Sold merchandise for cash totaling $5,512, which includes 6% sales taxes. 12 14 20 20 Performed services for customers who had made advance payments of $13,000. (Credit Service Revenue.) Paid state treasurer's department for sales taxes collected in December 2024, $8,800. Sold 720 units of a new product on credit at $49 per unit, plus 5% sales tax. During January, the company's employees earned wages of $58,000. Withholdings related to these wages were $4,437 for FICA, $4,200 for federal income tax, and $1,614 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during…arrow_forwardWilson Trucking, Incorporated reports these account balances at January 1, Year 2 (shown in alphabetical order): Accounts Payable $ 214,000 Accounts Receivable 194,000 Buildings 474,000 Capital Stock 674,000 Cash 154,000 314,000 394, 000 514,000 128,000 Equipment Land Notes Payable Retained Earnings ■ On January 5, Year 2, Wilson Trucking collected $169,000 of its accounts receivable, paid $144,000 on its accounts payable, and paid $27,000 on its note payable. In a trial balance prepared for Wilson Trucking on January 1, Year 2, the total of the credit column is: Multiple Choice ● A $1,530,000. B $1,556,000. C $3,060,000. D$1,596,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education