MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

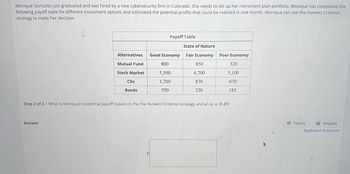

Transcribed Image Text:Monique Gonzales just graduated and was hired by a new cybersecurity firm in Colorado. She needs to set up her retirement plan portfolio. Monique has completed the

following payoff table for different investment options and estimated the potential profits that could be realized in one month. Monique can use the Hurwicz Criterion

strategy to make her decision.

Alternatives

Mutual Fund

Stock Market

Answer

CDs

Bonds

Payoff Table

$

Good Economy

800

5,500

1,700

550

State of Nature

Fair Economy

650

4,700

870

320

Step 2 of 2: What is Monique's potential payoff based on the the Hurwicz Criterion strategy and an a = 0.45?

Poor Economy

320

3,100

670

185

Tables

Keypad

Keyboard Shortcuts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Suppose that you decide to buy a car for $61,000, including taxes and license fees. You saved $10,000 for a down payment. The dealer is offering you a choice between two incentives. 1 Incentive A is $7000 off the price of the car, followed by a five-year loan at 5.53%. Incentive B does not have a cash rebate, but provides free financing (no interest) over five years. What is the difference in monthly payments between the two offers? Which incentive is the better deal? Use PMT= P -nt The difference in monthly payments between the two offers is $. (Round to the nearest cent as needed.) Which incentive is the better deal? Choose the correct answer below. OA. Incentive A is the better deal. OB. Incentive B is the better deal.arrow_forwardA lender requires a minimum down payment of 12% of the value of the home. You have $29,000 cash available to use as a down payment toward a home. Determine the maximum home value that you can finance.arrow_forwardThe Fluffy Laundromat purchased new washing machines and dryers for $62,000. The machines are expected to last 4 years and have a residual value of $10,000. Prepare a depreciation schedule by using the 150% declining-balance method. End ofYear AnnualDepreciation AccumulatedDepreciation BookValue 1 $ $ $ 2 $ $ $ 3 $ $ $ 4 $ $ $10,000arrow_forward

- es There are some excellent free personal finance apps available: Mint.com, GoodBudget, Mvelopes, BillGuard, PocketExpense, HomeBudget, and Expensify. After using Mint.com, you realize you need to pay off one of your high interest loans to reduce your interest expense. You decide to discount a $6,200, 335-day note at 2% to your bank at a discount rate of 3.0% on day 210. What are your proceeds? (Round your final answer to the nearest whole number.) Proceedsarrow_forwardMolly's Mobile Pet Grooming Service recently purchased a cargo van for $27,900. For depreciation purposes, the van is expected to to have a useful life of 10 years and have a trade-in value of $5000. Molly uses the double-declining-balance method to calculate depreciation.What is the book value at the end of the first year?$What is the accumulated depreciation by the end of the second year?$What is the annual depreciation in the third year?$arrow_forwardDecide whether the following statement makes sense (or is clearly true) or does not make sense (or is clearly false). Explain. My financial advisor showed me that I could reach my retirement goal with deposits of $213 per month and an average return of 4 %. But I don't want to deposit that much of my paycheck, so I'm going to reach the same goal by getting an average annual return of 9 % instead.Choose the correct answer below. A.This does not make sense because you cannot choose your own annual rate of return. B.This makes sense because 9 % of $213 is greater than 4 % of $213. C.This does not make sense because $213 is not a lot of money to earn interest off of. D.This makes sense because an average annual return of 9 % is greater than 4%.arrow_forward

- You are tasked with calculating the property tax needed to fund construction and operation of a $22.5 million complex. The facility’s annual operating budget is forecast at $3.6 million, to be covered by revenues from programs offered at the facility. A 30-year general obligation bond with a rate of 5.5% will be issued to pay for the facility’s construction costs. The net assessed value of property in the municipality is $725 million. 3. For an owner of property with a total assessed value of $15,000, by how much will his/her property tax increasearrow_forwardSuppose that you decide to buy a car for $61,000, including taxes and license fees. You saved $13,000 for a down payment. The dealer is offering you a choice between two incentives. Incentive A is $7000 off the price of the car, followed by a four-year loan at 7.89%. Incentive B does not have a cash rebate, but provides free financing (no interest) over four years. What is the difference in monthly payments between the two offers? Which incentive is the better deal? Use PMTarrow_forwardplease solve this on a paperarrow_forward

- draw the cash flow diagram, and write the general formula of the perpetuityarrow_forwardnot use ai pleasearrow_forwardAdams Enterprises noncallable bonds currently sell for $910. They have a 15-year maturity, an annual coupon of $85, and a par value of $1,000. What is their yield to maturity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman