Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer accounting questions

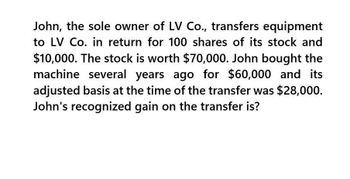

Transcribed Image Text:John, the sole owner of LV Co., transfers equipment

to LV Co. in return for 100 shares of its stock and

$10,000. The stock is worth $70,000. John bought the

machine several years ago for $60,000 and its

adjusted basis at the time of the transfer was $28,000.

John's recognized gain on the transfer is?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sam and Maude (both individuals) form S&M Corporation. Sam contributes cash of $100,000 and Maude contributes property with a basis of $40,000 and a fair market value of $100,000. If Sam and Maude own all of the stock in S&M Corporation immediately after the transfer, what is Maude's recognized gain on the transfer? O a. $0 O b. $50,000 O c. $20,000 O d. $30,000arrow_forwardStephanie owns a machine (adjusted basis of $90,000; the fair market value of $125,000) that she uses in her business. She exchanges it for another machine (worth $100,000) and stock (worth $25,000). a. Stephanie's realized gain is $ ... and recognized gain is $.. b. The basis of the new machine is $. c. The basis in the stock she received is $arrow_forwardGreta had the following transaction in 2021: a. Carl sold a building in 2021 and generated a $3,000 unrecaptured 1250 gain and a $6,000 LT capital gain. b. Carl sold some old postage stamps he had been collecting since he was a kid at a gain of $5,000. c. Stock purchased on 4/15/21 for $4,000 and sold 11/2/21 for $1,000. d. He sold a potato washing machine that he had used in his business for an ordinary loss of $2,000 e. He sold a personal auto for a long-term loss of $1,000. f. He sold bonds that he purchased back in 2018 for a loss of $10,000. What is the net capital gain or loss and its character?arrow_forward

- John transfers a property (A/B $10,000, FMV $50,000) to Brown Corp. in exchange for 100% of the Brown stock, which is worth $50,000. The property is subject to a liability of $20,000, which Brown assumes. The transfer is for business purpose. The $20,000 liability is also for business purpose. What is John’s recognized gain? What is John’s stock basis in the Brown corporation What is Brown’s basis in the property?arrow_forwardAlfonso sells a passive activity in the current year for $800,000. His adjusted basis in the activity is $200,000, and he uses the installment method of reporting the gain. The activity has suspended losses of $44,000. Alfonso receives $400,000 in the year of sale. a. What is his gross profit ratio on the sale? Enter as a percentage. For example, .35 would be entered as "35".% b. His recognized gain for the current year is $. c. Alfonso can currently deduct $of suspended losses.arrow_forwardRussell Corporation sold a parcel of land valued at $400,000. Its basis in the land was $275,000. For the land, Russell received $50,000 in cash in yar 0 and a note providing that Russell will receive $175,000 in year 1 and $175,000 in yar 2 from the buyer. What is Russell’s realized gain on the transaction? What is Russell’s realized gain in year 0, year 1, and year 2?arrow_forward

- Please do answer the question asap.arrow_forwardBob sold 100 shares of ABC stock for $2,100 and 300 shares of XYZ stock for $8,900. He purchased the ABC stock four years ago for $1,200 and the XYZ stock two years ago for $9,100. What is the net effect of these sales on Bob’s income? a. $200 net gain b. $700 net gain c. $900 net gain d. $1,100 net gainarrow_forwardLance contributed investment property worth $500,000, purchased three years ago for $200,000 cash, to Cloud Peak LLC in exchange for an 85 percent profits and capital interest in the LLC. Cloud Peak owes $300,000 to its suppliers but has no other debts.a. What is Lance’s tax basis in his LLC interest? b. What is Lance’s holding period in his interest? c. What is Cloud Peak’s basis in the contributed property? d. What is Cloud Peak’s holding period in the contributed property?arrow_forward

- Henrietta transfers cash of $312,400 and equipment with a fair market value of $93,720 (basis to her as a sole proprietor, $37,488) in exchange for a 40% profit and loss interest worth $406,120. If an amount is zero, enter "0". a. How much are Henrietta's realized and recognized gains?Realized gain: $ ________Recognized gain: $_________ b. What is the amount of Henrietta's basis in her partnership interest?$__________ c. What is the partnership's basis in the contributed equipment? $__________arrow_forwardRafael sold an asset to Jamal. What is Rafael's amount realized on the sale in each of the following alternative scenarios? c. Rafael received $23,500 cash, a parcel of land worth $96,500, and marketable securities of $10,40O. Rafael also paid a commission of $9,000 on the transaction. Amount realizedarrow_forwardArnold and Bobby form Happy Corporation. Arnold transfers equipment that Arnold has an adjusted basis of $30,000 but has a fair market value of $60,000. Arnold receives 50% of the stock. Bobby transfers equipment with an adjusted basis of $70,000 and a faiir market value of $60,000 for the remaining 50% of the stock of Happy Corporation. Does Arnold, Bobbly or Happy have to report any gain or loss on this transaction? Why or why not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT