FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4G H

10:47 O 6 e

4G E

10:13 O O 3

01:57:11 Remaining

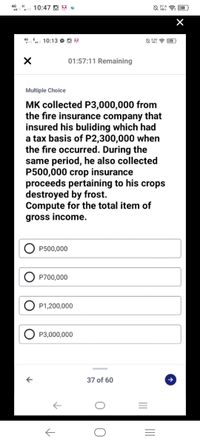

Multiple Choice

MK collected P3,000,000 from

the fire insurance company that

insured his buliding which had

a tax basis of P2,300,000 when

the fire occurred. During the

same period, he also collected

P500,000 crop insurance

proceeds pertaining to his crops

destroyed by frost.

Compute for the total item of

gross income.

P500,000

P700,000

P1,200,000

P3,000,000

37 of 60

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the current year, Eva has net short-term capital losses of $3,000, a net long-term capital loss of $42,000, and taxable income from wages of $36,000. a. Calculate the amount of Estes' deduction for capital losses for the current year. b. Calculate the amount and nature (short-term or long-term) of his capital loss carryforward. c. For how many years may Eva carry the unused loss forward?arrow_forwardMr. Philip collected the P1,000,000 insurance proceeds of Mr. Gerald which he bought from the latter for P400,000. Before the death of Mr. Gerald, Mr. Philip paid total premiums of P200,000. Determine respectively the exclusion in gross income and the inclusion in gross income a. 1,000,000; 0 b. 0; 1,000,000 c. 400,000; 600,000 d. 600,000; 400,000arrow_forwardConnie and Dave Barney are married and file a joint return. They have an Adjusted Gross Income of $120,000 for the year 2022. They incurred the following expenses and losses during the year. Calculate their itemized deductions for the year. Show all calculations for partial credit. Casualty loss in a federally declared disaster area before the $100 floor (no insurance proceeds) 22,800 Home mortgage interest 8,000 Credit card interest 1,000 State and local taxes 2,000 Real estate taxes 5,000 Charitable contributions: Cash of 2,000 and FMV of clothing given to Goodwill of 1,000 (cost of 10,000) ? Medical expenses (before the limitation) 4,000 Union dues 1,000arrow_forward

- Taxpayer is a sole proprietor owner of a merchandising business. He sells an idle lot located in Baguio City at 10% above cost. Records show the cost of P1,000,000. Zonal value per BIR list is P1,200,000 and the value per local assessor's office is P800,000. Compute the capital gains tax: О а. Рб,000 O b. PP60,000 О с. Р72,000 O d. Not subject to capital gains taxarrow_forwardMoose received a Form W-2 for $60,000 which showed his federal income tax withheld amount was $7,000. Suzie has a residential rental property (cost basis $270,000) which was rented for the whole year for $2,000 per month. Property taxes on the residential rental property: $3,700 and property insurance: $1,785. Suzie spent $500 fixing the sprinklings system and $5,000 for a new roof after a hailstorm. Moose got lucky and won $4,000 gambling on a trip to Las Vegas. Suzie sold her old car for $4,000. She had originally paid $8,000 for it. She also sold a parcel of land for $7,500 on March 7, 2022. She purchased it on January 5th of 2000 for $5,000. What is the taxable income?arrow_forwardOn January 2, 2018 Mr. B contracted a 1-year P100,000 loan from Metrobank for the purchase of computers. The equipment which had a depreciable life of eight (8) years were acquired on April 1, 2018. The interest expense for one (1) year amounted P15,000. In the same year, his bank deposit with PNB earned an interest income of P2,000. During the year, he incurred an interest expense on unpaid business tax of P600. The deductible interest expense of Mr. B in 2018 is - a. P14,240 c. P14,760 b. P13,600 d. P14,940arrow_forward

- A self-employed taxpayer purchased a gold mine for $700,000 which is expected to produce 200,000 units of gold. During the current year, the taxpayer mined 140,000 units of gold and sold it for $3,700,000. If the taxpayer's net business income is $1,100,000 and the applicable percentage depletion for gold is 15%, what should the taxpayer take as deletion deducton?arrow_forwardPoly received a TV set from her employer Alfa Mart Company, a business entity engaged in the distribution of home appliances, in exchange for payment of her two-month salary amounting to Php. 50,000.00. The merchandise, with a prevailing market price of Php. 55,000, cost the company Php. 25,000.00. Determine Poly's taxable compensation income.arrow_forwardTPW, a calendar year taxpayer, sold land with a $549,000 tax basis for $845,000 in February. The purchaser paid $84,500 cash at closing and gave TPW an interest-bearing note for the $760,500 remaining price. In August, TPW received a $60,825 payment from the purchaser consisting of a $38,025 principal payment and a $22,800 interest payment. In the first year after the year of sale, TPW received payments totaling $116,650 from the purchaser. The total consisted of $76,050 principal payments and $40,600 interest payments. Required: For the first year after the year of sale, compute the difference between TPW’s book and tax income resulting from the installment sale method. Is this difference favorable or unfavorable? Using a 21 percent tax rate, determine the effect of the difference on the deferred tax asset or liability generated in the year of sale.arrow_forward

- Aiden is married and has salary income of $80,000 and total itemized deductions is $30,000. During the year, he sold two investments resulting in a $5,000 long-term capital gain and a $15,000 short-term capital loss. He calculated his AGI to be $70,000 (80,000 -10,000) and his taxable income to be $40,000 (70,000-30,000). Based on the tax formula and the net capital loss rules, comment on whether or not the adjusted gross income and taxable income are correct. Explain and provide support for your position.arrow_forwardChrist owns a factory building that he has used in his business for many years. On 1/28/20, the factory was totally destroyed in a fire. Christ received $ 5,000,000 from his insurance company for this total loss. At the time of this loss, Christ had an adjusted basis in this factory of $ 2,000,000 ($ 3,000,000 original cost less $ 1,000,000 in accumulated straight-line tax depreciation). Christ replaced the factory at a cost of $ 4,800,000 in November of 2020. Calculate Christ’s 2020 realized gain of loss from the above How much gain or loss will Christ recognize for tax purposes in 2020? How much additional federal tax will Christ incur in 2020 assuming his marginal ordinary income tax rate is 37% and his net capital gain rate is 20%? What is Christ’s tax basis in the replacement factory building?arrow_forwardBill received $100,000 in insurance proceeds to compensate him 3budiness equipment destroyed by a fire. The adjusted basis of the equipment was $80,000. Bill reinvested $95,000 of the insurance proceeds in replacement business equipment within the time allowed. He wants to defer gain to the maximum extent allowed. Bill must recognize how much gain? A. 2,500 B. 5,000 C. 25,000 D. 450,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education