FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

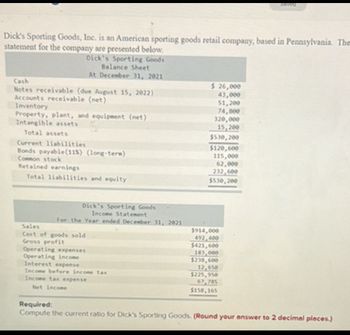

Transcribed Image Text:Dick's Sporting Goods, Inc. is an American sporting goods retail company, based in Pennsylvania. The

statement for the company are presented below.

Dick's Sporting Goods

Balance Sheet

At December 31, 2021

Cash

$ 26,000

Notes receivable (due August 15, 2022)

43,000

Inventory

Accounts receivable (net)

Property, plant, and equipment (net)

Intangible assets

Total assets

Current liabilities

Bonds payable(11%) (long-term)

Common stock

51,200

74,800

320,000

15,200

$530,200

$120,600

Retained earnings

Total liabilities and equity

115,000

62,000

232,600

$530,200

Dick's Sporting Goods

Income Statement

For the Year ended December 31, 2021

Sales

Cost of goods sold

Gross profit

Operating expenses

Operating income

Interest expense

Income before income tax

Income tax expense

Net income

Required:

$914,000

492,400

$421,600

183,000

$238,600

12,650

$225,950

67,785

$158,165

Compute the current ratio for Dick's Sporting Goods. (Round your answer to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Madigan Pets Supply Inc. has the following account balances at December 31, 2022 and 2023: December 31, 2023 December 31, 2022 Cash $1,200,000 $1,050,000 Notes Receivable $300,000 $100,000 Plant Asset (net) 300,000 100,000 Long Term Security Investments $150,000 250,000 Bonds Payable $550,000 $350,000 Common Stock 300,000 120,000 Additional Paid-in Capital 50,000 20,000 Retained Earnings 200,000 150,000 Dividends Declared and Paid 24,000 18,000 Depreciation Expense (annual) 50,000 50,000 Long-term Intangible Assets(net) $8,000 $12,000 Amortization Expense (annual) $6,000 $8,000 Additional information:2023 plant asset acquisitions were paid in cash.No plant assets were sold during 2023.$30,000 of the notes receivable were collected during 2023.No common stock was retired during 2023.$50,000 in bonds were retired in 2023. All bonds were issued at par value. Using the indirect…arrow_forwardSuppose the following items were taken from the 2022 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock Prepaid rent Equipment Stock investments (long-term) Debt Investments (short-term) Income taxes payable Cash $2.826 164 6,705 637 1,743 128 1,182 Accumulated depreciation-equipment Accounts payable Patents Notes payable (long-term) Retained earnings Accounts receivable V Inventory TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assets $3.547 1,459 2,210 Prepare a classified balance sheet in good form as of December 31, 2022. (List Current Assets in order of liquidity) $ 810 6,896 1,823 1,202 Liabilities and Stockholders' Equity $ $ $ $arrow_forwardPLEASE HELP MEarrow_forward

- Windsor Inc., a greeting card company, had the following statements prepared as of December 31, 2020. WINDSOR INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 62,400 51,000 Short-term debt investments (available-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepaid rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreciation—equipment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salaries and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000 Contributed…arrow_forwardYour answer is partially correct. Presented below are a number of balance sheet items for Pearl, Inc. for the current year, 2025. Goodwill Payroll taxes payable Bonds payable Discount on bonds payable Cash Land Notes receivable Notes payable (to banks) Accounts payable Retained earnings Income taxes receivable Notes payable (long-term) $ 128,520 Accumulated depreciation-equipment 181,111 Inventory Rent payable (short-term) Income taxes payable Rent payable (long-term) Common stock, $1 par value Preferred stock, $10 par value Prepaid expenses Equipment 303.520 15,180 363,520 483,520 449,220 268,520 493,520 ? Debt investments (trading) Accumulated depreciation-buildings 101,150 1,603,520 Buildings $ 292,180 243,320 48.520 101,882 483,520 203,520 153,520 91,440 1,473,520 124.520 270,380 1.643.520 Current Llabilitles Accounts Payable Notes Payable Rent Payable Payroll Taxes Payable Income Taxes Payable Total Current Llabilitles Long-term Llabilitles Discount on Bonds Payable Bonds Payable…arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners’ Equity 2020 2021 Current assets Current liabilities Cash $ 7,800 $ 12,250 Accounts payable $ 46,400 $ 52,750 Accounts receivable 15,800 31,000 Notes payable 20,600 26,500 Inventory 53,400 64,250 Total $ 77,000 $ 107,500 Total $ 67,000 $ 79,250 Long-term debt $ 46,000 $ 40,000 Owners’ equity Common stock and paid-in surplus $ 50,000 $ 50,000 Retained earnings 237,000 330,750 Net plant and equipment $ 323,000 $ 392,500 Total $ 287,000 $ 380,750 Total assets $ 400,000 $ 500,000 Total liabilities and owners’ equity $ 400,000 $ 500,000 For each account on this company’s balance sheet, show the change in the account during 2021 and note whether…arrow_forward

- subject : Accountingarrow_forwardA comparative balance sheet for Stokely, Inc., on December 31, 2022 and 2021, follows. Additional information about the firm’s financial activities during 2022 is also given below. STOKELY, INC.Comparative Balance SheetDecember 31, 2022 and 2021 Assets 2022 2021 Cash $ 149,900 $ 73,500 Accounts Receivable (Net) 130,600 80,600 Merchandise Inventory 47,600 44,000 Property, Plant, and Equipment 250,000 200,000 Less: Accumulated Depreciation (40,000 ) (20,000 ) Total Assets $ 538,100 $ 378,100 Liabilities and Stockholders' Equity Liabilities Accounts Payable 57,000 77,000 Bonds Payable 160,000 110,000 Total Liabilities $ 217,000 $ 187,000 Stockholders' Equity Common Stock ($1 par, 100,000 shares authorized, 60,000 shares issued in 2021 and 30,000 shares issued in 2022) 90,000 60,000 Retained Earnings…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education