FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

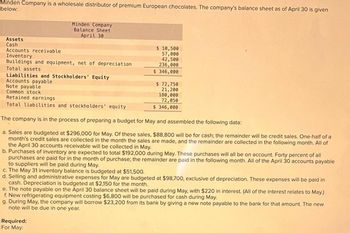

Transcribed Image Text:Minden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April 30 is given

below:

Assets

Cash

Minden Company

Balance Sheet

April 30

Accounts receivable

Inventory

Buildings and equipment, net of depreciation

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Note payable

Common stock

Retained earnings

Total liabilities and stockholders' equity

$ 10,500

57,000

42,500

236,000

$ 346,000

$ 72,750

21,200

180,000

72,050

$ 346,000

The company is in the process of preparing a budget for May and assembled the following data:

a. Sales are budgeted at $296,000 for May. Of these sales, $88,800 will be for cash; the remainder will be credit sales. One-half of a

month's credit sales are collected in the month the sales are made, and the remainder are collected in the following month. All of

the April 30 accounts receivable will be collected in May.

Required:

For May:

b. Purchases of inventory are expected to total $192,000 during May. These purchases will all be on account. Forty percent of all

purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable

to suppliers will be paid during May.

c. The May 31 inventory balance is budgeted at $51,500.

d. Selling and administrative expenses for May are budgeted at $98,700, exclusive of depreciation. These expenses will be paid in

cash. Depreciation is budgeted at $2,150 for the month.

e. The note payable on the April 30 balance sheet will be paid during May, with $220 in interest. (All of the interest relates to May.)

f. New refrigerating equipment costing $6,800 will be purchased for cash during May.

g. During May, the company will borrow $23,200 from its bank by giving a new note payable to the bank for that amount. The new

note will be due in one year.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Cash Accounts receivable Raw materials inventory Finished goods inventory Equipment Less: Accumulated depreciation $ 2,160,000 540,000 $ 144,000 1,239, 840 354,600 1,171,944 1,620,000 Liabilities Liabilities and Equity Accounts payable Loan payable Long-term note payable Equity Common stock Retained earnings $ 723,600 12,000 1,800,000 1,206,000 788,784 $ 2,535,600 1,994,784 $4,530,384 Total assets $4,530,384 Total liabilities and equity To prepare a master budget for April, May, and June, management gathers the following information. a. Sales for March total 73,800 units. Budgeted sales in units follow: April, 73,800; May, 70,200; June, 72,000; and July, 73,800. The product's selling price is $24.00 per unit and its total product cost is $19.85 per unit. b. Raw materials inventory consists solely of direct materials that cost $20 per pound. Company…arrow_forwardThe management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Cash Accounts receivable Raw materials inventory Finished goods inventory Equipment Less: Accumulated depreciation $ 2,160,000 540,000 $ 144,000 1,239, 840 354,600 1,171,944 1,620,000 Liabilities Liabilities and Equity Accounts payable Loan payable Long-term note payable Equity Common stock Retained earnings $ 723,600 12,000 1,800,000 1,206,000 788,784 $ 2,535,600 1,994,784 $4,530,384 Total assets $4,530,384 Total liabilities and equity To prepare a master budget April, May, and June, management gathers the following information. a. Sales for March total 73,800 units. Budgeted sales in units follow: April, 73,800; May, 70,200; June, 72,000; and July, 73,800. The product's selling price is $24.00 per unit and its total product cost is $19.85 per unit. b. Raw materials inventory consists solely of direct materials that cost $20 per pound. Company…arrow_forwardMinden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below: Minden CompanyBalance SheetApril 30 Assets Cash $ 18,700 Accounts receivable 70,250 Inventory 41,250 Buildings and equipment, net of depreciation 230,000 Total assets $ 360,200 Liabilities and Stockholders’ Equity Accounts payable $ 72,250 Note payable 13,700 Common stock 180,000 Retained earnings 94,250 Total liabilities and stockholders’ equity $ 360,200 The company is in the process of preparing a budget for May and has assembled the following data: Sales are budgeted at $214,000 for May. Of these sales, $64,200 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. Purchases of inventory are…arrow_forward

- An excerpt from Ivanhoe Company's accounting records is provided below. Sales revenue $627,000 Cost of goods sold 346,500 Wages expense 123,750 Depreciation expense 15,675 Rent expense 50,325 Interest expense 4,950 Income tax expense 14,850 Retained earnings 36,300 Dividends declared 16,500 Wages payable 12,375 Cash 41,250 Accounts receivable 61,875 Accounts payable 82,500 M σε Ac Q Ac Q Ac Using only the data provided above, record all the required closing entries using proper Journal Entry form. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Q Ac A C M Narrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $189,400; common stock. $87,000, and retained earnings, $29,103.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement For Current Year Ended December 311 $455,600 298,450 157,150 99,000 4,400 53,758 21,653 $ 32,097 Sales Cost of goods sold i Gross profit Operating expenses Interest expense Income before taxes Income tax expense. Net income CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity $10,000 Accounts payable 8,600 Accrued wages payable 30,400 Income taxes payable: 40,150 Long-term note payable, secured by mortgage on plant assets 2,550 Common stock 148,300 Retained earnings $ 240,000 Total liabilities and equity $ 17,500 5,000 3,900…arrow_forwardMinden Company is a wholesale distributor of premium European chocolates. The company balance sheet as of April 30 is given below: Assets Cash Minden Company Balance Sheet April 30 $ 14,600 Accounts receivable Inventory Buildings and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Note payable Common stock Retained earnings Total liabilities and stockholders' equity 55,000 43,500 223,000 $ 336,100 $ 74,500 15,000 180,000 66,600 $ 336,100 The company is in the process of preparing a budget for May and assembled the following data: a. Sales are budgeted at $244,000 for May. Of these sales, $73,200 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder are collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $130,000 during May. These purchases will…arrow_forward

- Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below: Minden CompanyBalance SheetApril 30 Assets Cash $ 10,300 Accounts receivable 70,000 Inventory 43,000 Buildings and equipment, net of depreciation 227,000 Total assets $ 350,300 Liabilities and Stockholders’ Equity Accounts payable $ 86,000 Note payable 23,000 Common stock 180,000 Retained earnings 61,300 Total liabilities and stockholders’ equity $ 350,300 The company is in the process of preparing a budget for May and has assembled the following data: Sales are budgeted at $276,000 for May. Of these sales, $82,800 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. Purchases of inventory are…arrow_forwardOperating activities: Net earnings Non-cash items Add: Depreciation LAURENT COMPANY Statement of Cash Flows For the year 31 December 20X8 Changes to working ital: Add: Decrease in accounts receivable Less: Increase in accounts payable Less: Increase in inventory Investing activities: Decrease in long-term bank loan Purchase of long-term investment Financing activities: Sold long-term investment Paid cash dividend Net change in cash Opening cash Closing cash Chemisie ہےarrow_forwardThe following information comes from the accounting records of Wildhorse Ltd.: Statement of Financial Position Assets Cash Accounts receivable Inventory Capital assets (net) Other assets Liabilities and shareholders' equity Accounts payable Long-term debt Common shares Retained earnings Statement of Income Sales Cost of goods sold Other expenses Income tax Net income (a1) Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover 2022 Days to sell inventory $34,900 101,700 164,000 639,000 345,000 $149,000 300,000 779,000 757,000 402,000 $1,284,600 $1,341,000 $1,556,000 56,600 254,160 2022 21,180 17,000 $4,180 100 % 74 % $1,284,600 $1,341,000 26 % $1,059,000 $1.199,000 783,660 24 % 1.6 % 0.39 % 2022 2023 $32,000 3.2 119,000 9.5 195,000 Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable…arrow_forward

- The comparative statements of Lily Company are presented here. Net sales Lily Company Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income Assets Current assets Cash Debt investments (short-term) Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Lily Company Balance Sheets December 31 Liabilities and Stockholders' Equity Current liabilities Accounts payable Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 282,200 265,700 547,900 $971,800 $1,815,100 1,011,300 2022 803,800 517,400 286,400 2022 267,600 80,016 $ 187,584 $60,100 68,100 18,800 304,000 161,700 465,700 $852,700 116,200 123,100 367,500 604.300 $971,800 $160,300 2021 $64,600 50,200 102,900 114,500 332,200 520,500 $852,700…arrow_forwardMinden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April 30 is given below: Minden Company Balance Sheet April 30 Assets $ 14,600 55,000 43,500 223,000 $ 336,100 Cash Accounts receivable Inventory Buildings and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Note payable $ 74,500 15,000 180,000 Common stock Retained earnings 66,600 $ 336,100 Total liabilities and stockholders' equity The company is in the process of preparing a budget for May and has assembled the following data: a. Sales are budgeted at $244,000 for May. Of these sales, $73,200 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $130,000 during May. These purchases…arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: Beginning balances: Inventory $200,000 Accounts receivable 300,000 Ending balances: Inventory 250,000 Accounts receivable 400,000 Cash 100,000 Marketable securities (short-term) 200,000 Prepaid expenses 50,000 Accounts payable 175,000 Taxes payable 85,000 Wages payable 90,000 Short-term loans payable 50,000 During the year, Arnn had net sales of $2.45 million. The cost of goods sold was $1.3 million. Required: When required, round your answers to two decimal places. Assume 365 days per year. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. times 4. Compute the accounts receivable turnover in days. days 5. Compute the inventory turnover ratio. times 6. Compute the inventory turnover in days. daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education