FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

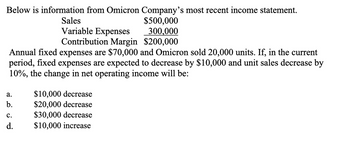

Transcribed Image Text:Below is information from Omicron Company's most recent income statement.

Sales

$500,000

300,000

Variable Expenses

Contribution Margin $200,000

Annual fixed expenses are $70,000 and Omicron sold 20,000 units. If, in the current

period, fixed expenses are expected to decrease by $10,000 and unit sales decrease by

10%, the change in net operating income will be:

a.

b.

C.

d.

$10,000 decrease

$20,000 decrease

$30,000 decrease

$10,000 increase

Expert Solution

arrow_forward

Step 1: Background

Net operating income means the sale price less variable cost which is contribution and then we reduces the fixed cost to arrive at net operating income.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Variable costs as a percentage of sales for Lemon Inc. are 66%, current sales are $534,000, and fixed costs are $188,000. How much will operating income change if sales increase by $49,900? a. $32,934 decrease b. $16,966 decrease c. $32,934 increase d. $16,966 increasearrow_forwardPhilip Inc. has provided the following data: Data Table Accounts Amounts Sales per unit $120 Variable cost per unit $40 Fixed costs $280,000 Units sold 10,000 How much will operating income change if sales increase by $600,000? (Do not round intermediate calculations) Group of answer choices $420,000 increase $420,000 decrease $200,000 increase $400,000 increasearrow_forwardLeete Inc. reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income 14.000.000 9.660.000 4,340,000 3,620,000 720,000 The Company's average operating assets were $8,000,000. It's minimum required return was 8%. 1. What is the company's margin percentage? 2. What is the company's turnover? 3. What is the company's return on investment? 4. What is the company's residual income?arrow_forward

- Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $1,400,000 680,000 720,000 440,000 $ 280,000 $ 875,000 $ 480,000 $ 336,000 The company's minimum required rate of return is 15%. Residual income 80% of sales 13. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year?arrow_forwardRequired information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 1,600,000 700,000 900,000 660,000 Net operating income 24 240,000 Average operating assets $1,000,000 At the beginning of this year, the company has a $325,000 investment opportunity with the fol characteristics: $ 520,000 Sales Contribution margin ratio Fixed expenses 70 % of sales $ 312,000 The company's minimum required rate of return is 15%. 4. What is the margin related to this year's investment opportunity? Margin % ( Prev Ps Ai Pr re to searcharrow_forwardRequired information [The following information applies to the questions displayed below.] The following information relates to a company's operations for last year. $ 1,300,000 Sales Variable expenses Contribution margin 440,000 860,000 600,000 Fixed expenses Net operating income 260,000 Average operating assets 812,500 The company's minimum required rate of return is 15%. 1. Calculate last year's return on investment (ROI). ROIarrow_forward

- Net Income Planning Holland Corporation earned an after-tax net income of $182,000 last year. Fixed costs were $750,000. The selling price per unit of its product was $130, of which $60 was a contribution to fixed cost and net income. The income tax rate was 35%. Round UP answers to the nearest unit, when applicable. a. How many units of product were sold last year? 0 units b. What was the break-even point in units last year? 0 c. The company wishes to increase its after-tax net income by 20% this year. If selling prices and the income tax rate remain unchanged, how many units must be sold? 0 units unitsarrow_forwardVictoria Company reports the following operating results for the month of April. VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2020 Total Sales (10,000 units) Variable costs Contribution margin Fixed expenses Net income $500,000 250,000 250,000 189,900 $60,100 Per Unit $50 25.00 $25.00 Management is considering the following course of action to increase net income: Reduce the selling price by 5%, with no changes to unit variable costs or fixed costs. Management is confident that this change will increase unit sales by 20%. Using the contribution margin technique, compute the break-even point in units and dollars and margin of safety in dollars: (Roundarrow_forward15 ces ! Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income. Average operating assets At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: $ 200,000 60 $ 90,000 The company's minimum required rate of return is 15%. Sales Margin $ 1,000,000 300,000 700,000 500,000 $ 200,000 $ 625,000 Contribution margin ratio Fixed expenses 4. What is the margin related to this year's investment opportunity? % of salesarrow_forward

- provide the answer pls.arrow_forwardRequired information [The following information applies to the questions displayed below.] Henna Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 46,000 units of each product. Sales and costs for each product follow. Product 0 $ 800,400 160,080 640,320 512,320 128,000 44,800 Product T $ 800,400 640,320 Sales Variable costs Contribution margin 160,080 32,080 128,000 44,800 $ 83,200 Fixed costs Income before taxes Income taxes (35% rate) Net income $ 83, 200arrow_forwardRequired information [The following information applies to the questions displayed below] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets ROI At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales $ 1,800,000 435,000 1,365,000 1,005,000 $360,000 $ 1,200,000 $360,000 $ 216,000 The company's minimum required rate of return is 10% Contribution margin ratio Fixed expenses 70 of sales. 6. What is the ROI related to this year's investment opportunity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education